Investor Road Map - Time Shapes Risk

On the eve of the first interest rate increase in nearly a decade, markets have naturally become quite jittery. When you consider the number of issues investors are digesting, an increase in volatility is not a surprise.

First, the U.S. Federal Reserve may tighten monetary policy by raising interest rates, while other Central Banks continue easing their monetary policies by keeping their interest rates low. In this financial climate, the dollar is anticipated to become even stronger compared to other currencies. The strong dollar can continue to create significant headwinds for American companies doing business overseas, such as S&P 500 companies. [i]

Second, we just experienced a significant sell off in high-yield debt/junk bonds. It would appear jittery investors are selling risky assets like low-rated debt as a rate increase is almost a forgone conclusion. In fact, yields are now back to levels not seen since the 2007-2009 financial crisis. [ii]

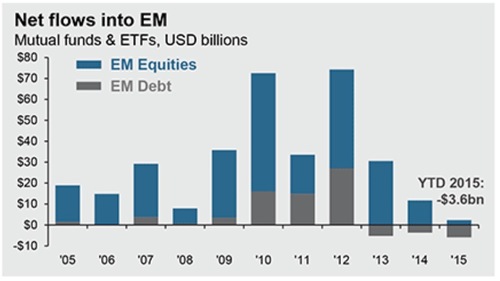

Third, the strong dollar mentioned above and impending rate increase may create headwinds for emerging markets like China, India and Brazil. Although these export driven economies benefit from a strong U.S. Dollar, investors tend to withdraw capital during rising U.S. interest rates. [iii]

That's the bad news.

The good news is, we believe we are at the end of the current earnings recession and don't consider an economic recession a likely event in the near term.

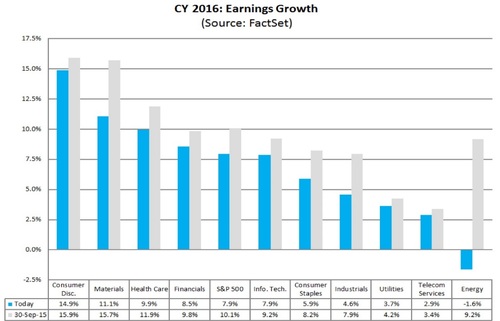

We are approaching a period of time, in this current economic cycle, when corporate earnings expectations are getting much easier to beat. When you look at year-over-year earnings comparisons you can see our point. Q1 2015 earnings per share grew at a paltry 0.1% and we expect corporate earnings growth in Q1 2016 of 3.6%. In fact, when you look at 2016 in total we see a return to normal corporate earnings growth. [iv]

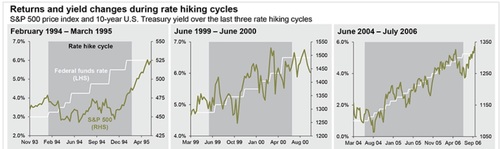

Second, during past periods of increasing interest rates, equities did quite well but you had to deal with significant volatility. Investors, are going to need to strengthen their long term perspective as increased volatility could create significant challenges. You can see from the data below how equity markets did compared to rising rates. While not a straight line up, the S&P 500 was higher. [v]

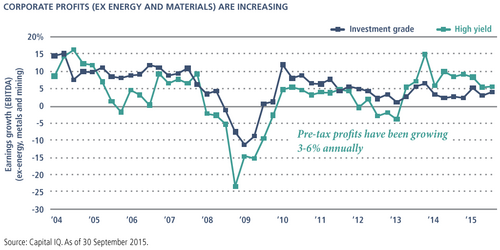

Third, when you factor out the energy and materials sectors, corporate profits are doing fairly well. [vi]

You can see from the chart above that corporate profits for both high yield and investment grade companies are still positive.

So here's our roadmap for investors:

1) We are going to have to wait out one more earnings reporting season (Q4 2015) which is anticipated to have negative year-over-year earnings growth. However, investors may begin discounting this negativity and buy in anticipation of Q1 2016 earnings (earnings will be reported starting in April 2016).

2) We have already tilted away from energy, materials and value. We have reallocated with a bias towards growth sectors.

3) We have already shortened our fixed income duration, relative to the benchmark, which should mute some of the impact when rates rise.

4) We will carefully monitor things like wages, retail sales, auto sales, and home sales as indicators the earnings recession is not pushing us into an economic recession.

Finally, and most importantly, be patient as the economy and earnings work through this natural cycle. If patience is not your strong suit, consider reaffirming or adjusting your plan.

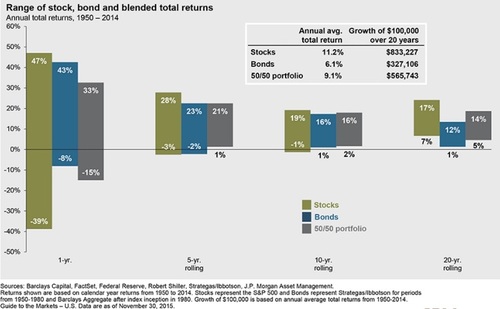

Time Shapes Risk. [vii]

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] https://research.stlouisfed.org/fred2/series/TWEXBPA

[ii] http://www.marketwatch.com/story/5-things-that-show-the-junk-bond-market-is-in-big-trouble-2015-12-11

[iii] https://www.jpmorganfunds.com/blobcontent/337/436/1323431506627_MI-MB_FedEM_3Q15.pdf

[iv] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_12.11.15

[v] https://am.jpmorgan.com/blobcontent/1383215521297/83456/Quarterly-Perspectives-2Q15.pdf

[vi] http://www.spcapitaliq.com/?gclid=Cj0KEQiA7rmzBRDezri2r6bz1qYBEiQAg-YEtkhdgvaPSb6nHqaIplFJJmvSMZepwtO89snRmCFMk9AaAhPP8P8HAQ

[vii] https://am.jpmorgan.com/blobcontent/1383215521297/83456/Quarterly-Perspectives-2Q15.pdf