Is It Time to Time?

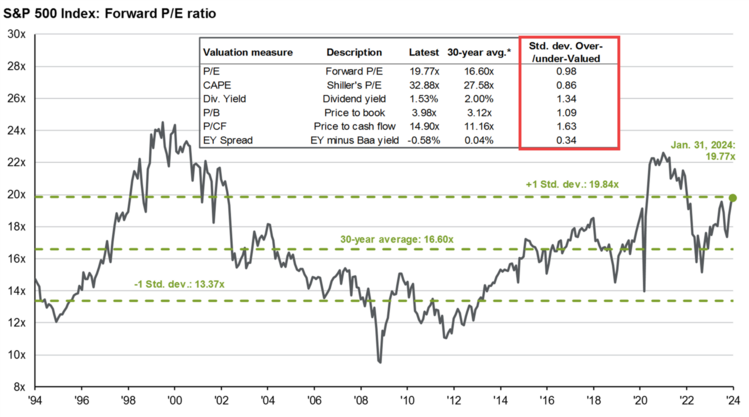

The S&P 500 hit a historic high, crossing over the 5,000 level, last week. It begs the question; are valuations overextended in U.S. Large Cap equities? By most measures, the answer is a resounding yes. It’s an answer most in asset management dread as it requires some tough decision-making. 1

Do you try and time markets by rotating out of one asset class and into another asset class? I’ll save that answer for the end of this post.

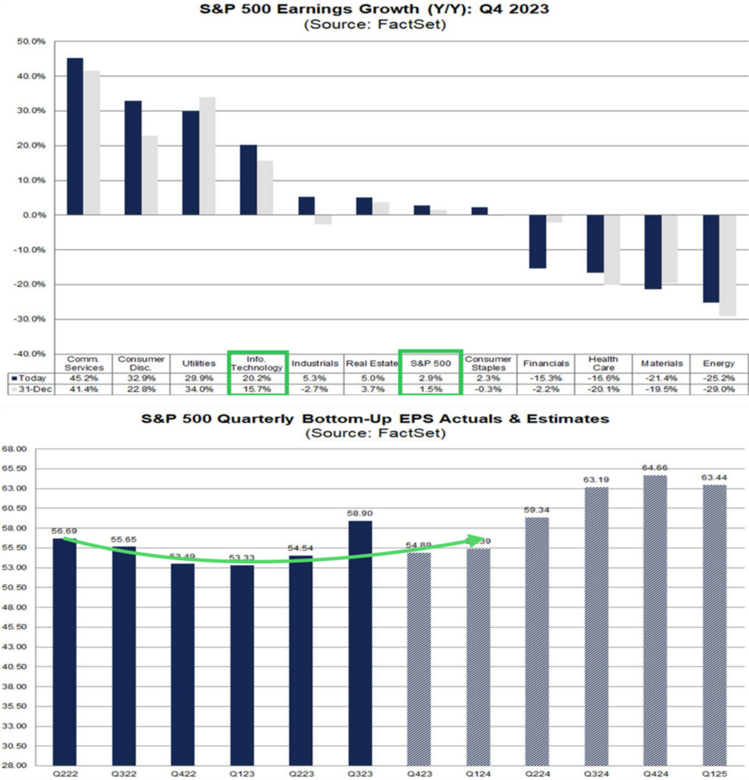

First, let’s realize that S&P 500 earnings are coming in better than expected and are rebounding from a drought that started in 2022. In particular, Technology earnings are crushing expectations. 2

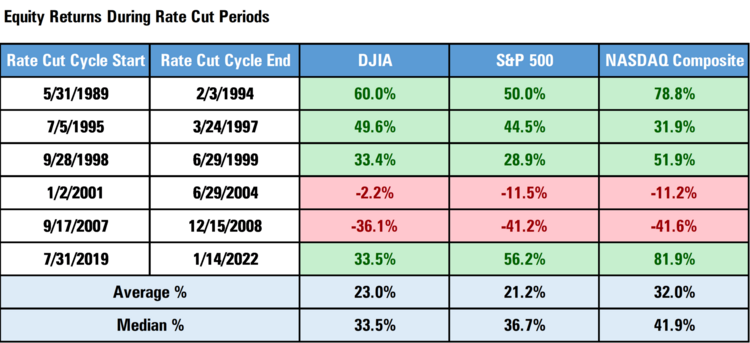

Second, let’s also realize equity markets tend to rally during rate cut periods. We all know we are slow walking towards rate cuts. Returns on the S&P 500 and the tech-heavy NASDAQ, on average, rally by 20%+ during rate cut periods. 3

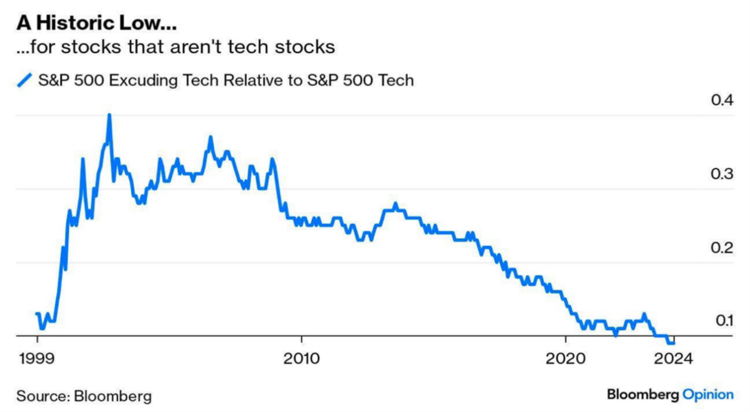

Finally, the S&P 500, excluding Technology, is trading at historic lows. 4

However, it’s also a fact that while rate cut periods are good for equity returns, the road to the returns also lies in a valley of pain.

While the average return for the S&P 500 during rate cut periods is 20%+; there is historically a pain point along the path. The average pullback on the S&P 500 is -23.5%. 5

Again, I caution against the use of averages in any of these representations. On average, a 6-foot person can drown in a 5-foot average stream. It’s always the hole in the stream or drawdown in equities that can kill you if you let it.

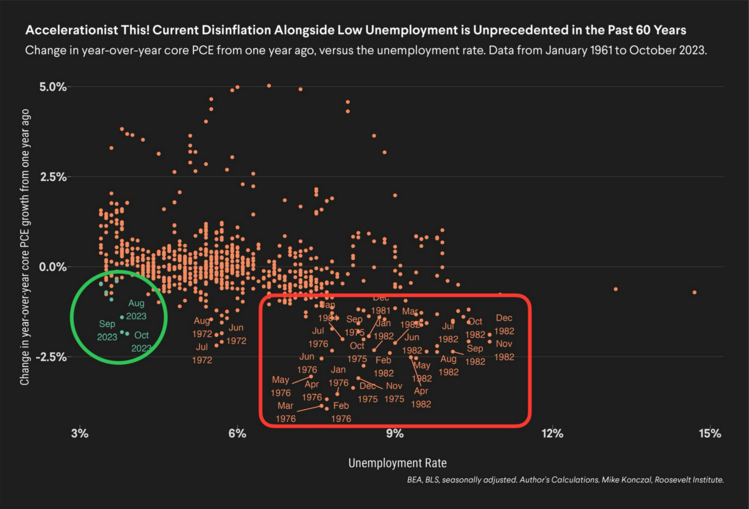

Historically during rate cut cycles, the macro economy goes through a period of adjustment resulting in increasing unemployment. I know I sound like a broken record, but the current expected rate cut cycle is coming during a period of amazing employment growth (green circle) compared to the past (red box). 6

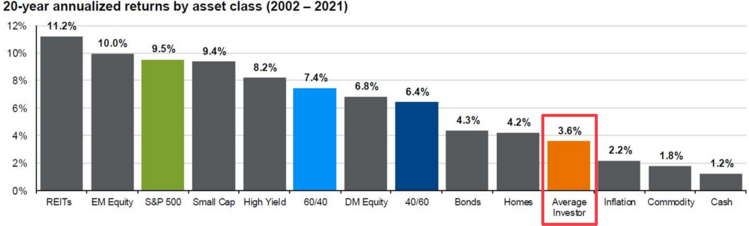

Here’s the rub to timing: investors who try and time the markets invariably take all the advantages from equity investing out of their portfolios. The returns look awful. 7

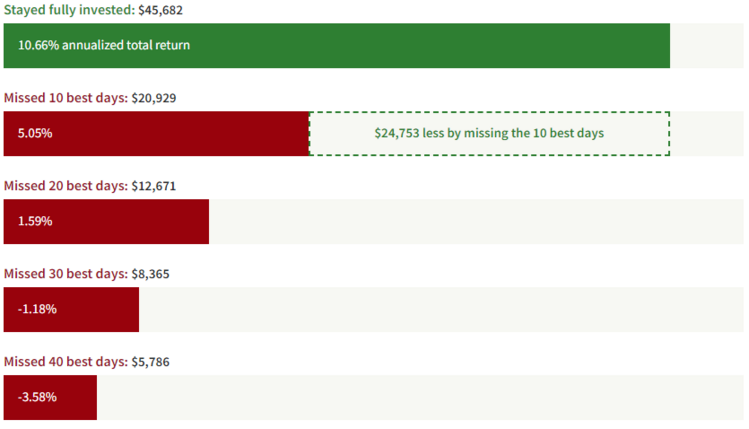

Further, it’s not just the act of timing, it’s the odds of doing it properly. If you miss just a few days of equity returns you get punished and punished badly. 8

So, is it time to time? I’m going to rely on over 30 years of experience and remind our clients and friends it’s simply too painful to miss out on equity returns. However, we should rebalance often during these periods of time. Perhaps we trim U.S. Large Cap Growth and tilt to Core or Value? Perhaps we trim Large Cap and buy Small Cap? Perhaps we even go as far as trimming Large Cap Technology and buying China? That might be hard to do.

It certainly might never be time to time, but it might be time to trim.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?slideId=equities/gtm-forwardpe

- https://insight.factset.com/topic/earnings

- Bloomberg

- https://www.bloomberg.com/opinion/articles/2024-02-09/magnificent-or-marxist-passive-investing-is-back-on-trial

- https://www.barchart.com/

- https://mikekonczal.substack.com/

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets

- https://www.putnam.com/individual/infographics/time-not-timing/