Is Optimism Rational?

The world is grappling with a series of challenges: Escalating wars in the Middle East and Ukraine, a cataclysmic hurricane in the Southeast, and the uncertainty surrounding the upcoming Presidential election. For investors, it feels like scaling a wall of worry.

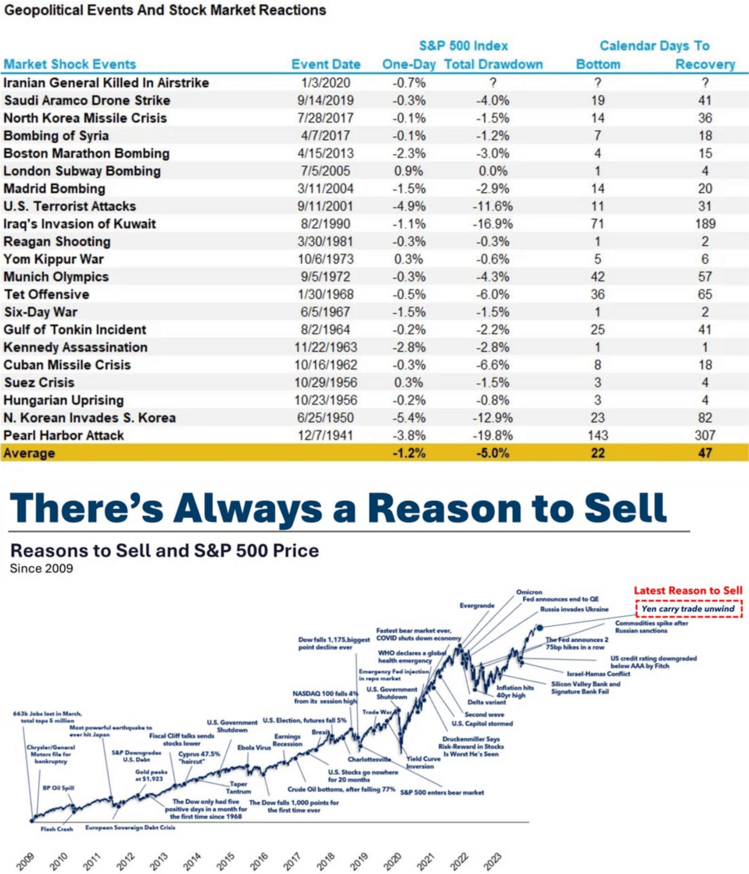

While pessimism currently dominates public sentiment, a logical long-term perspective suggests optimism is warranted. The U.S. economy and markets have consistently overcome significant adversities. Historically, even major events tend to cause only typical drawdowns in the S&P 500, indicating that extreme negativity may be overblown. 1 2

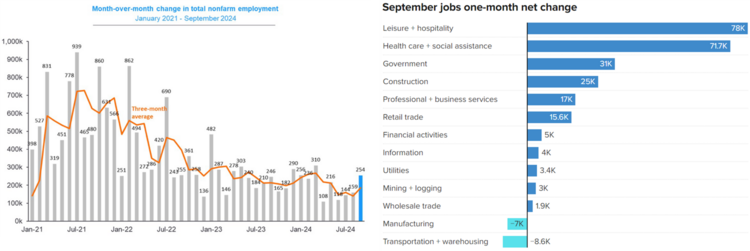

However, the U.S. economy is amid the so called “soft landing” the Federal Reserve is trying to orchestrate. The most recent jobs report for September offers encouraging signs that we’re far from a recession. With 254,000 jobs added – including 78,000 in leisure/hospitality and 71,700 in health care – the economy shows signs of continued growth. 3 4

While it’s premature to declare victory over a potential recession, these job numbers represent a significant step in the right direction.

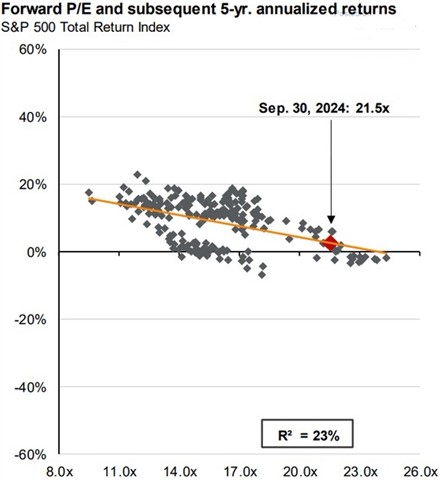

Certainly, the recent rise in equity valuations (as measured by forward P/E ratios) may create some headwinds for future valuations. 5

However, these are challenging to forecast over a five-year horizon.

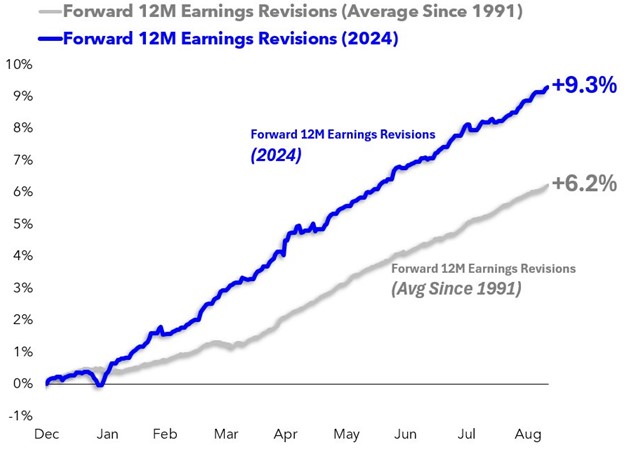

Additionally, it’s worth noting that the Federal Reserve rarely cuts interest rates during periods of earnings growth recovery. 6 7

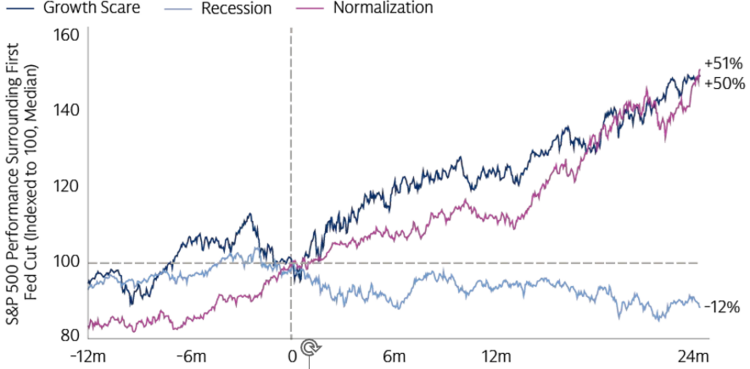

Despite these challenges, there’s reason for measured optimism. Soft landings can produce strong returns in the short run. Historical data shows that when monetary policy easing results from normalization rather than recession, equity returns have typically been positive. 8

In conclusion, while the case for pessimism may be seductive, the case for optimism is rational. The U.S. economy and markets have a track record of resilience and growth, even in the face of significant challenges.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.lpl.com/research/blog/middle-east-conflict-how-stocks-react-to-geopolitical-shock.html

- https://www.theirrelevantinvestor.com/p/thoughts-selloff

- https://x.com/GregDaco/status/1842186252377878753

- https://www.cnbc.com/2024/10/04/heres-where-the-jobs-are-for-september-2024-in-one-chart.html

- https://x.com/dailychartbook/status/1833807709172305951

- https://www.dailychartbook.com/p/dc-lite-208

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=equities/gtm-peratio

- https://publishing.gs.com/content/research/en/reports/2024/09/12/a6a2e3c4-8531-4112-a556-60e06b7644ce.html

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.