Is the Price of Bananas Going Up?

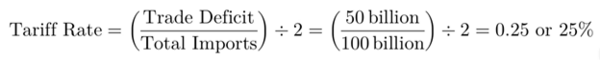

It certainly looks like that will be the case with the current Trump tariffs. The formula used was an oddity and caught many off guard.

The division by two is driven by the Administration wanting to be “reasonable” according to President Trump.

In any case, this formula was much more about past trade injustices (using total imports from other countries) and was much higher than anyone had anticipated. Furthermore, applying a 10% tariff on the entire world, regardless of trade deficit, is far from reciprocal. It can create a U.S. vs. the rest of the world realignment.

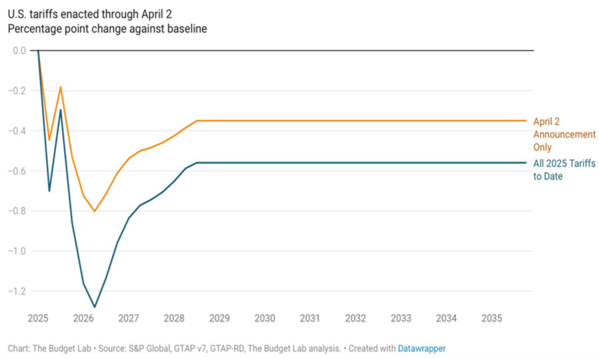

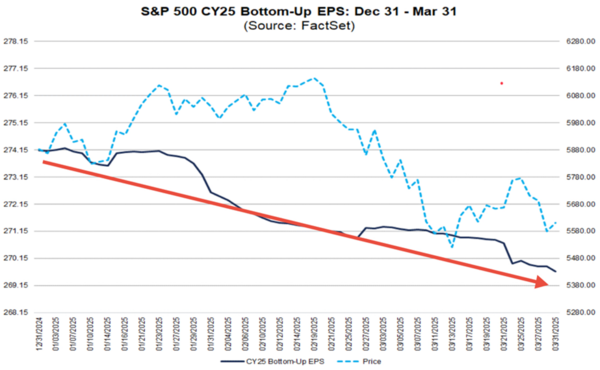

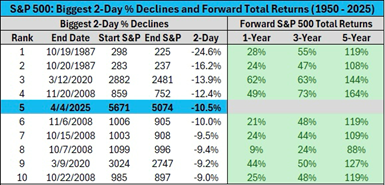

Equity prices have adjusted primarily due to revised expectations of slower macroeconomic growth as a result of tariffs. A 10% drop in the S&P 500 over just two days is unusual (as shown in the last chart of the blog) and reflects concerns about a potential slowdown or recession, both in the U.S. and globally.1

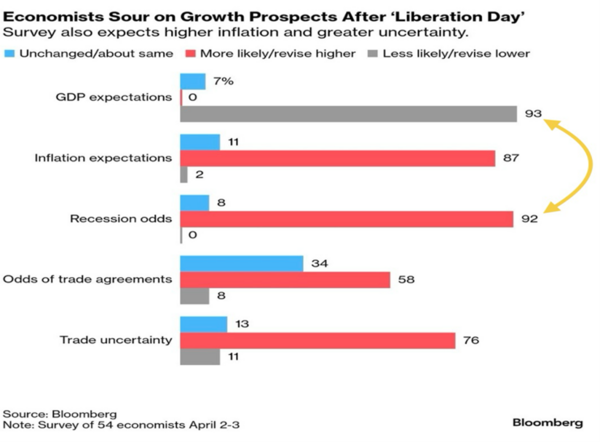

Economists surveyed by Bloomberg believe we are going to have slower GDP growth and an almost equal number felt like we were heading for a recession. Not to mention they expect no relief from trade uncertainty.2

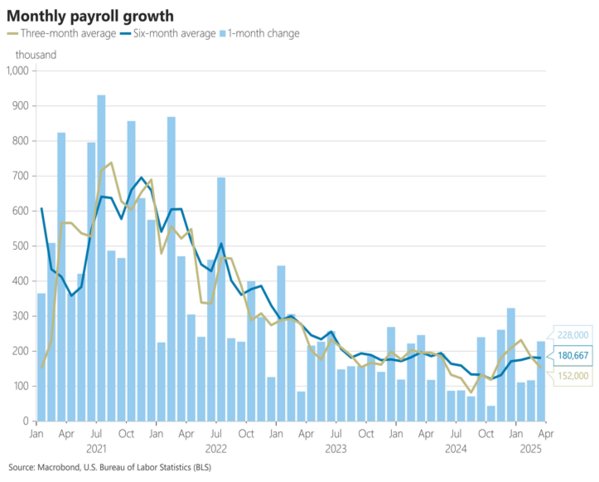

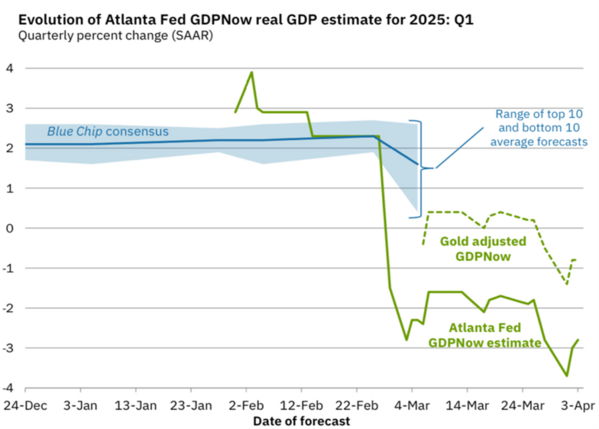

With the recent jobs report it’s hard to imagine the US economy contracting in Q1, as the economy added 228k jobs in March. On a 6-month basis we added more jobs than job entrants. Yet the Atlanta Fed is suggesting the US economy contracted in Q1.3 4

Certainly this adjustment to expectations is a leading factor for the massive equity correction, not to mention the revisions to corporate earnings growth post the Trump tariff announcement. Earnings growth still matters to the equity investor.5

As our frequent readers know, we keep a keen eye on the consumer, as they make up the vast majority (70%) of economic output in America. Here’s the problem:

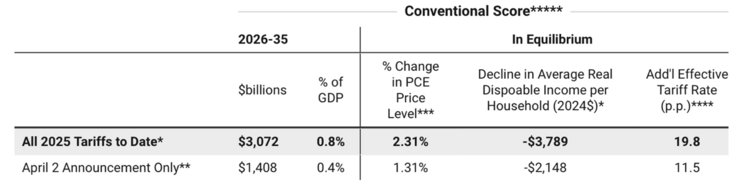

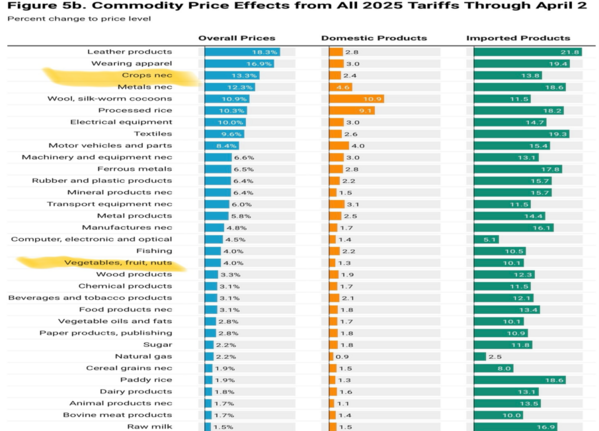

The tariffs are a sales tax on the consumer. According to the Budget Lab, the impact on the consumer is significant. $3,789 dollars a year is a large hit to their wallets and their animal spirits. Not to mention a possible 2.31% increase to existing price levels.6

As a percentage of disposable personal income, the tariffs will hit the exact people the administration was trying to help. The lower decile income earners take a disproportionate hit to their income as the tariffs impact the basics like bananas.7

As investors, we can’t do much about the policy. A lot of unwelcome news is being baked into equity prices with the S&P 500 down more than 10% in the last three days and 17% from the peak in February. However, it’s my view there must and will be policy responses, as the basic tariff formula is far from reciprocal and declaring a trade war on the entire world is not prudent. I believe markets will be looking for those policy responses as an off ramp:

- Tax cuts - These will need to address the income impact to consumers--at least the lower 50% of income earners (tax cuts on tips, overtime, social security, and perhaps auto interest and SALT changes). With this level of tariff, we need a consumer industrial policy.

- The Fed - They will certainly need to allow interest rates to come down as the consumer weakens. According to the Chairman of the Federal Reserve, they have a formula of sorts to address times when jobs are at odds with inflation. From their Monetary Policy Strategy Guideline:

“The Committee’s employment and inflation objectives are generally complementary. However, undercircumstances in which the Committee judges that the objectives are not complementary, it takes intoaccount the employment shortfalls and inflation deviations and the potentially different time horizonsover which employment and inflation are projected to return to levels judged consistent with its mandate.”

Under our current circumstances, jobs might take longer than the one-time inflation impact of tariffs to recover. Meaning we would get rate cuts due to the “one time nature of a tariff impact on prices”. Jobs are harder to restore, and with job losses comes inflation moderation. The Fed will favor job protection and cut rates perhaps by May or even sooner.

- Congress - They might intercede on tariffs to reassert their authority; however, this might be a less likely outcome as they will need a veto proof majority. Congress might even pass territorial taxes to offset tariffs. That would be a little easier on our consumer.

- Trump - He might begin negotiating tariff policy on a bilateral basis in which some countries might even pay some of the duty vs. our consumer.

The type of tariff implemented is not reciprocal and is a massive error that will need intervention. When we get any sign of relief equity prices should rebound. Historically, these massive multi-day drops lead to better times to come.8

While the price of bananas might be going up perhaps the tax cuts and lower interest rates will keep our banana smoothies within reach.

If you have any questions or comments, please let us know. You can contact us via X and Facebook, or you can email Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- GEE Group Is Expensive On These Record Earnings (NYSE:JOB) | Seeking Alpha

- IMF's Outlook on World Economy? Not Good | Seeking Alpha

- Macrobond Financial | Extensive macroeconomic data, financial time series.

- GDPNow - Federal Reserve Bank of Atlanta

- Analysts Made Larger Cuts Than Average to EPS Estimates for S&P 500 Companies for Q1

- Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2 | The Budget Lab at Yale

- Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2 | The Budget Lab at Yale

- The Week in Charts (4/6/25) - Charlie Bilello's Blog