Is the Soft Landing Already Here? What does the Smart Money Say?

What productivity, inflation, and the consumer are telling investors right now.

It’s easy to stay skeptical in a noisy world. But sometimes, the most bullish signals are the quietest. Zoom out, and a compelling picture emerges: recession fears are retreating, productivity is surging, inflation is stabilizing, and consumers are spending—not just surviving.

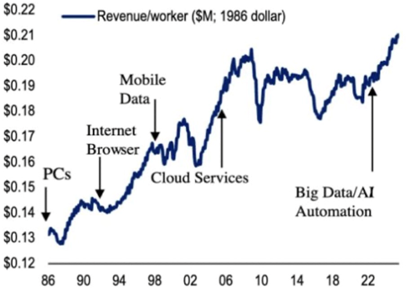

Are We in a Productivity Boom Nobody Believes In?

Real revenue per worker for S&P 500 companies has surged to the highest level in over two decades—adjusted for inflation. This isn’t just an AI story; it’s the culmination of decades of digital investment finally hitting the bottom line.

When margins expand without headcount growth, earnings get leverage—and so do equity multiples.

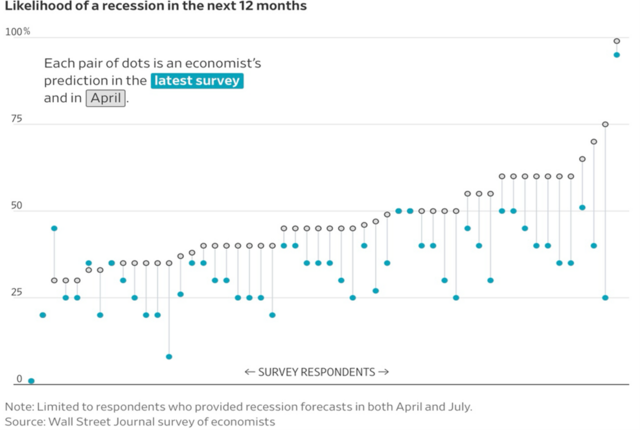

Have Economists Quietly Changed Their Tune?

A Wall Street Journal survey of 69 economists shows a sharp decline in recession expectations between April and July. The once-dominant chorus of doom is softening—perhaps because growth is turning out stronger than expected.

The market doesn’t wait for consensus. It moves when fear recedes.

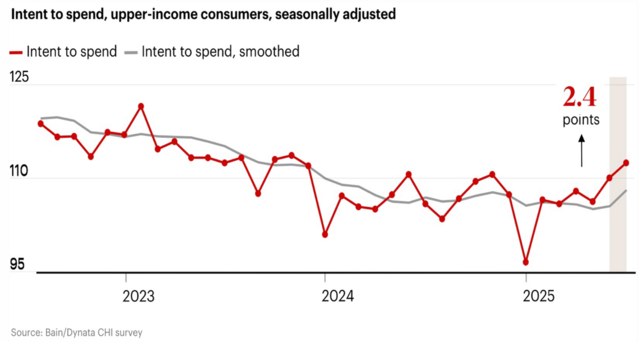

Is the Top 20% Driving the Next Leg of the Recovery?

Bain’s latest Consumer Health Index shows spending intent among upper-income Americans has bounced sharply—now sitting well above pre-tariff levels. This group disproportionately fuels luxury, travel, and equity inflows. They’re back.

When the high earners open their wallets, risk assets usually follow.

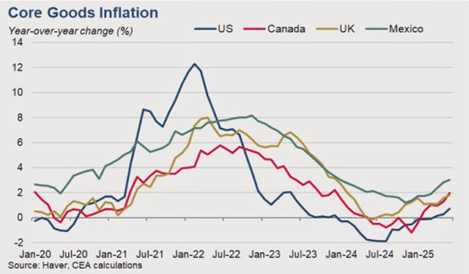

Has the Inflation War Quietly Been Won?

Core goods inflation in the U.S. is now tame, steady, and leading global peers. The disinflation is sticky, and the Fed’s most-watched components are behaving. That gives policymakers—and investors—more breathing room.

You can’t spell “pivot” without price stability.

Are Consumers Spending with Surprising Breadth?

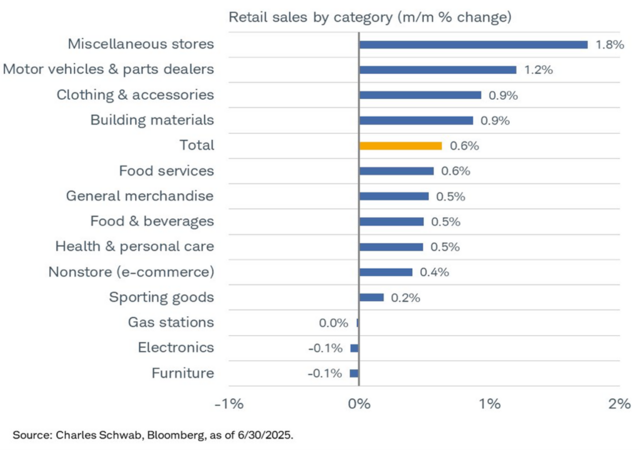

Retail sales rose in June across nearly every major category, led by autos, clothing, and building materials. This isn’t a narrow sugar high—it’s a broad-based rebound. Furniture and electronics lagged, but the consumer engine is clearly running.

Breadth in spending often precedes breadth in earnings beats.

The narrative has been fear. The data suggests resilience. In a market obsessed with tail risks, the data offers a clear message: fundamentals are quietly improving—and the soft landing might already have wheels down.

The smart money isn’t asking if the bull market is real. As more economic clouds lift, it's asking how long it will last.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.