Is the World Wrong?

For the past 8 years, Global Central Banks (agents for governments) have been fighting deflation using extraordinary policy tools, such as near zero interest rates, buying mortgages, buying corporate bonds, negative interest rates, and in some cases, buying equity in corporations.

Their desire to fight deflation has been well documented; in theory, avoiding episodes like the Great Depression or the Lost Decades in Japan.

In the course of fighting deflation and the perceived side effects on profits, jobs and economies, Central Banks have amassed massive assets on their balance sheets. In the U.S. alone, our Fed has accumulated over $4.4 trillion in assets. [i]

Here, you can see the same with Japan and the European Central Bank.

Japan has almost $3.6 trillion on its balance sheet. [ii]

The ECB has nearly $3.2 trillion on its balance sheet. [iii]

Last week, I met with noted economist David Ranson and we discussed some misconceptions on asset prices and deflation. I will try to summarize his concepts which are quite counterintuitive and perhaps controversial.

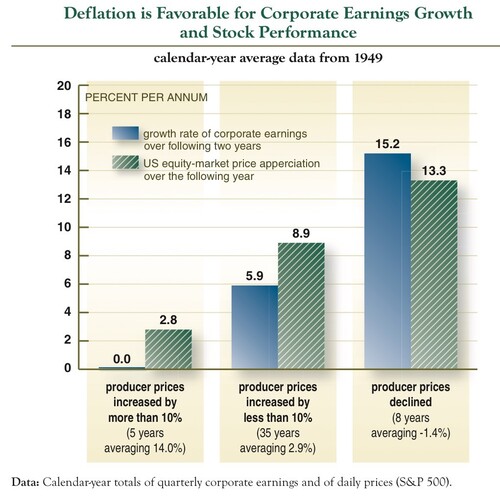

First, is deflation bad for earnings and stocks? Apparently, the data suggests it's not. Let's be perfectly clear on this point. This is certainly not conventional wisdom but let the data speak for itself. [iv]

You can see from the table above the years in which producer prices (the prices on commodities that go into making goods) increased by 10%, the following two years experienced earnings growth stagnation and weak stock performance. Conversely, when producer prices decline (-1.4%), corporate earnings expand (15.2%) and stocks rally (13.3%) over the following two years.

How is this possible; that after periods of commodity price deflation, producer profits and stock prices go up?

It actually seems quite intuitive. When prices fall on the components going into goods producers need to make their end product, they take advantage of the low prices, and in future years’, profits benefit from lower prices producers paid.

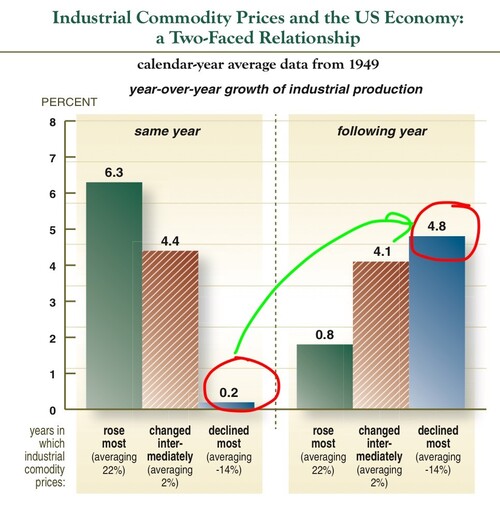

To prove it, David Ranson suggests the year following input price deflation, we see a recovery in total industrial production.

You can see from his table that the year industrial commodity prices decline the most (-14%), in the subsequent year, we see an expansion in production by 4.8%. Deflation is a good thing... Huh? [v]

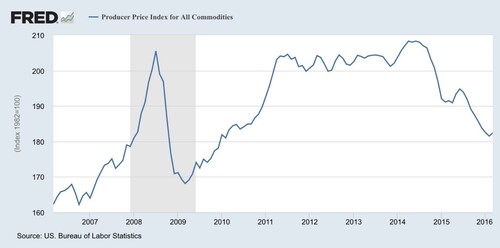

There is little doubt that we are in a bout of producer price deflation or, "lowflation.” [vi]

Commodities such as copper are down 25% in the last 12 months. That, according to David's thoughtful analysis, suggests that in the next 12 months we should see an improvement in overall output accompanied by growth in profits and stocks, if past performance is an indicator.

We could sure use something to end this boycott on earnings growth.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.yardeni.com/pub/peacockfedecbassets.pdf

[ii] http://www.yardeni.com/pub/peacockfedecbassets.pdf

[iii] http://www.yardeni.com/pub/peacockfedecbassets.pdf

[iv] http://www.hcwe.com/root_pages/root_downloads/PLcurrent.pdf

[v] http://www.hcwe.com/root_pages/root_downloads/PLcurrent.pdf

[vi] https://research.stlouisfed.org/fred2/graph/