Is There An Alternative?

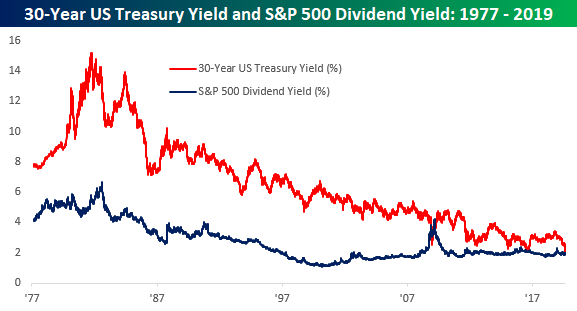

For the first time since the middle of 2008 Financial Crisis, the S&P 500 Dividend Yield is greater than the yield on 5-, 10-, and 30-year treasuries. [i]

Simply put, stocks are paying more income than bonds which is pretty rare. Historically, bonds tend to pay more income than stocks while offering much less principal appreciation.

What happened?

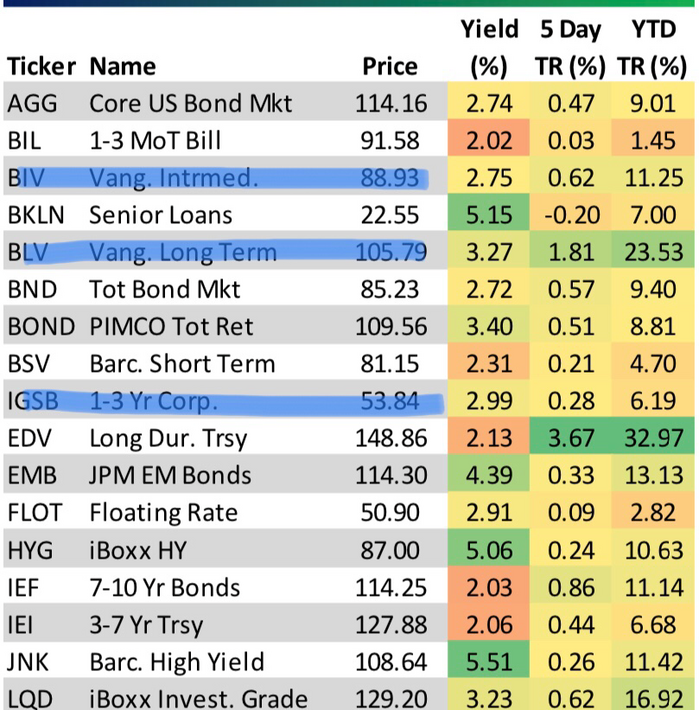

It’s my view that investors have been piling into bonds as a safe haven for assets as fears of a global recession emerge. Take a look at the returns on some of the bond funds this year: [ii]

Intermediate-term bond funds returned 11.25%, short-term corporate bond funds returned 6.2%, and long-term bond funds appreciated 23.5%. These vehicles are generally used for income, not capital appreciation.

In no small part, the global recession risk that has been the catalyst for this herd behavior has been, in our opinion, driven by Trump’s style and rhetoric surrounding his public fight with China.

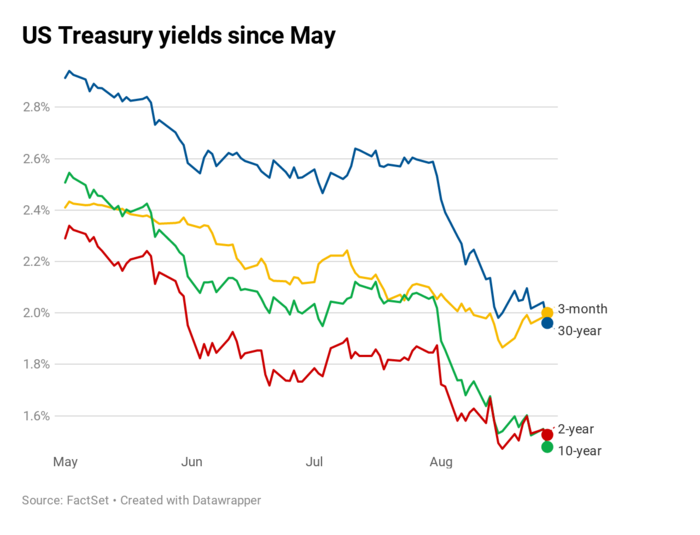

Look how far yields have dropped since May, keeping in mind that when yields fall, bond prices rise: [iii]

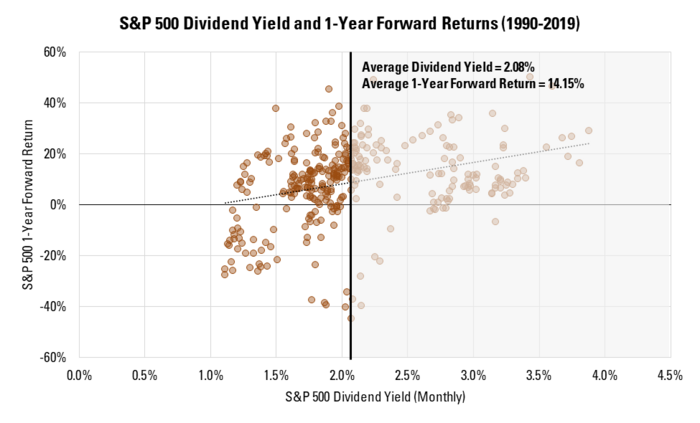

This flight to safety may have a profound impact on stocks when the trend reverses itself. If the dividend yield on the S&P 500 returns to its historic average of 2.08%, we could potentially see stocks rally up to 14%. [iv]

Right now, this bond rally is probably not exactly what Trump wants to stimulate the economy. In fact, the lower interest rates he’s begging for from the Fed could trim a meaningful amount out of the pockets of American savers in the form of lower deposit rates. Using FDIC data, the average rate on a 5-year CD has fallen from 1.25% at the end of 2018 to 1.07% at the end of August. Thus, a $10,000 investment at current rates would yield almost 15% less than it would have eight months ago. [v]

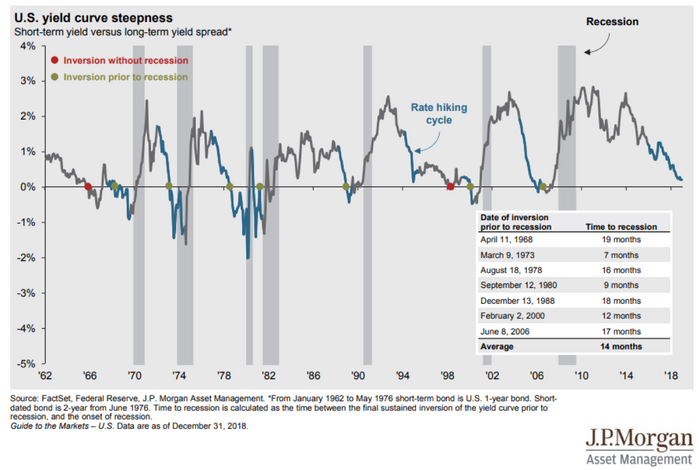

Finally, this flight to safety, and the inverted yield curve, does not immediately suggest a recession is around the corner. In fact, it could take up to fourteen months before a recession rears its ugly head, based on historical averages. [vi]

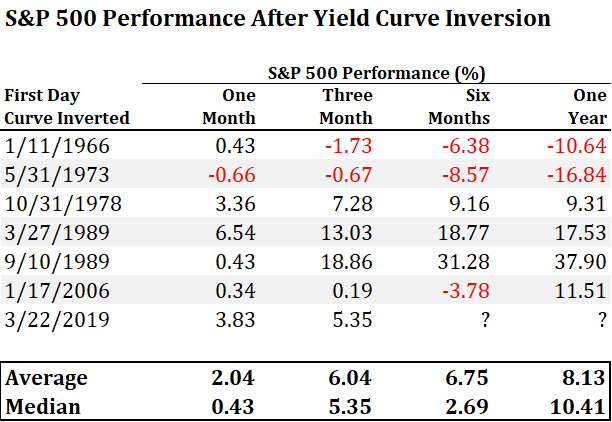

Further, an inverted yield curve may not lead to a contraction in the equity markets in the next year. [vii]

That’s not to say we can’t face a 20% decline as we did in December of 2018, especially if Trump does not resolve his trade conflicts fairly soon. Maybe our most reliable indicator is Trump’s desire to be re-elected as that certainly needs to involve a resolution with China.

It’s my view that we should see corporate earnings growth recover in the next two quarters, which in turn should support equity prices. Investors, such as major pension plans and retirement plans, probably won’t meet any meaningful return targets with 2% bond yields. They may need to rotate back into equities at some point.

Is there really any other alternative?

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bespokepremium.com/interactive/posts/think-big-blog/sp-500-yield-tops-the-thirty-year

ii. https://www.bespokepremium.com/get/Bespoke_Fixed_Income_Report_-_082819_by125.pdf (Paywall)

iii. https://www.cnbc.com/2019/08/27/the-30-year-treasury-yield-is-now-yielding-less-than-stocks.html

iv. https://www.multpl.com/s-p-500-dividend-yield/table/by-month

v. https://www.fdic.gov/regulations/resources/rates/#one

vi. https://am.jpmorgan.com/us/en/asset-management/gim/protected/adv/insights/guide-to-the-markets

vii. https://www.bespokepremium.com/interactive/research