Is This Time Different?

2020 looks to be a complete bust and investors know it. I’ve had the chance to review over half a dozen conference calls on macroeconomic outlooks and corporate earnings and the story across the globe is the same:

- 2020 GDP growth will be negative in most countries, except for China

- 2020 corporate earnings are a disaster

- Unemployment in all cases (ex-China) will be at Great Depression levels

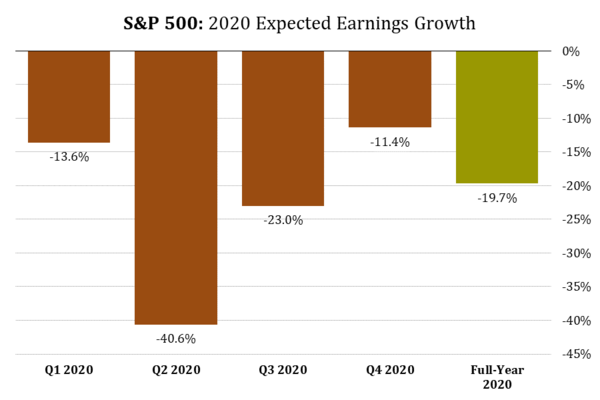

Just look at current S&P 500 corporate earnings quarter by quarter for 2020: [i]

You can see the complete capitulation on any earnings growth in 2020 from analysts. One could argue there might even be the basis for an upside surprise given how bad expectations are currently.

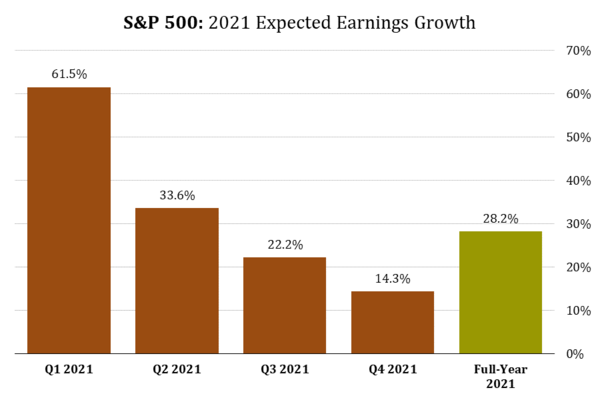

Investors are clearly trading on better times ahead in 2021 or we would likely be seeing another correction in equity prices. [ii]

Needless to say, the hurdle rate for 2021 earnings growth over 2020 is incredibly low.

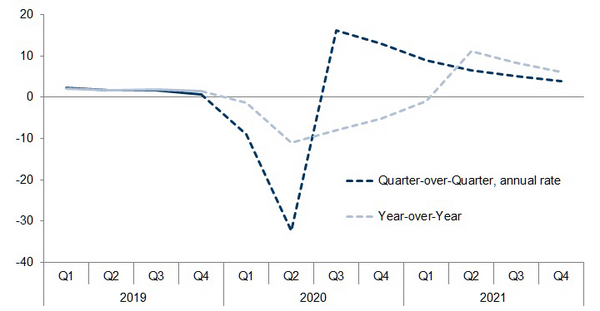

While the pundits argue over which type of recovery we will face, it is likely much closer to what Goldman Sachs highlights – a V-shaped recovery on a quarter to quarter basis and a “Swoosh”-shaped recovery when looking at GDP year-over-year. [iii]

This is consistent with the S&P 500 earnings growth expectations that we highlighted above.

So, you might ask, what is the opportunity to exceed expectations? Simple—no one I know has ever tried to estimate a restart to the global economy when governments around the world have essentially suspended corporate revenue. With no experience, I give us a 50/50 chance that analysts have set expectations heavily to the downside.

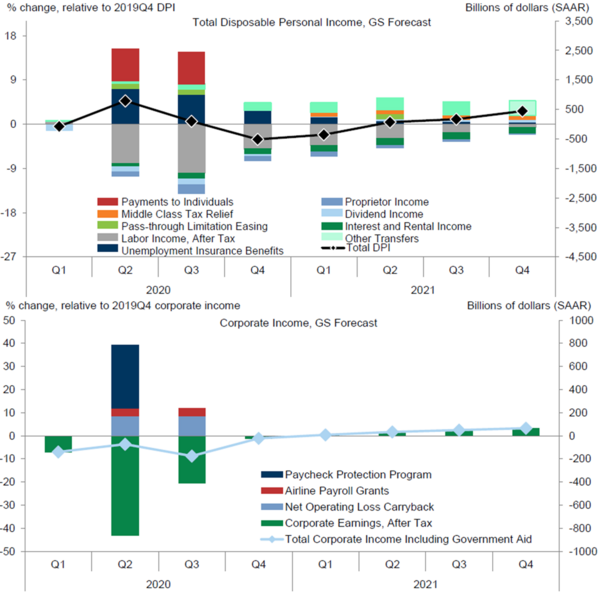

Just look at the stimulus supporting both U.S. corporate and personal income: [iii]

While it might be difficult to accurately gauge the corporate earnings implications, we do know that personal and corporate stimulus will provide an offset in the near term.

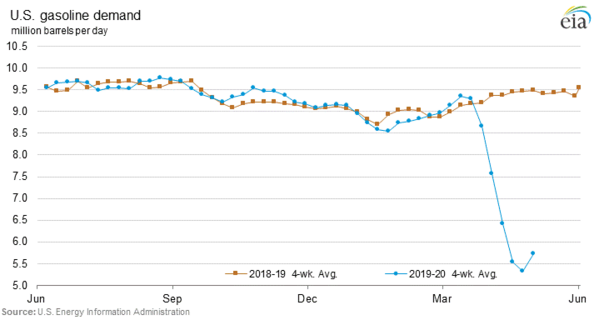

Further, we know there is an increase in driving which is reflected in a surge in gasoline demand. [iv]

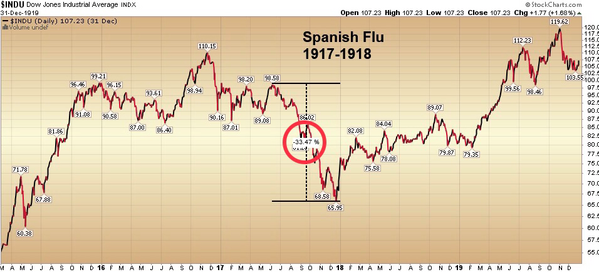

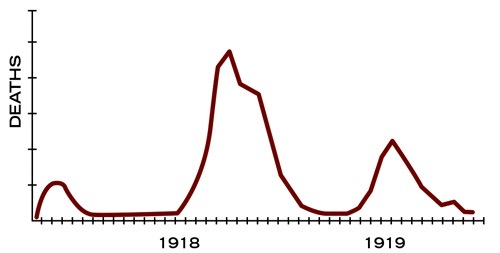

One interesting, and perhaps coincidental, data point is how investors in 1918 reacted to the Spanish Flu and how we are reacting to the coronavirus today. [v]

Investors sold off the Dow Jones by 33% during the early stages of the Spanish Flu pandemic and never looked back despite three distinct and devastating waves of the virus. [v]

Perhaps we are reacting in a similar manner; selling off the Dow by over 37% only to bounce back 33% percent. [vi]

Maybe human nature has not changed in 100 years – particularly when it comes to investing – and we react to fear the same way, especially when that fear is death. Conceivably, we will react to hope the same way investors did 100 years ago, especially if we know we’re not going to die. Hope for a prosperous future, better incomes, and a better life. After all, no one takes equity risk to diminish their well being or that of their family.

I can’t say if we have hit the bottom and are bouncing, never to return to those levels. I certainly can’t say if we will have another wave of the virus. I can’t even say if we will react as our predecessors did 100 years ago.

What I can say is if you have ample time, your outcomes will likely be favorable. That old saying, “this time is different” might prove to be incorrect. Maybe this time is actually the same.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_050820.pdf

ii. https://www.bloomberg.com/quote/SPX:IND

iii. https://www.goldmansachs.com/insights/

iv. https://www.eia.gov/petroleum/weekly/gasoline.php

v. https://www.marketwatch.com/story/market-behavior-a-century-ago-suggests-the-worst-could-be-over-for-stocks-if-not-for-the-coronavirus-pandemic-2020-03-19

vi. http://schrts.co/jHhmVUQY