It’s Chaos Out There

The macro noise is deafening.

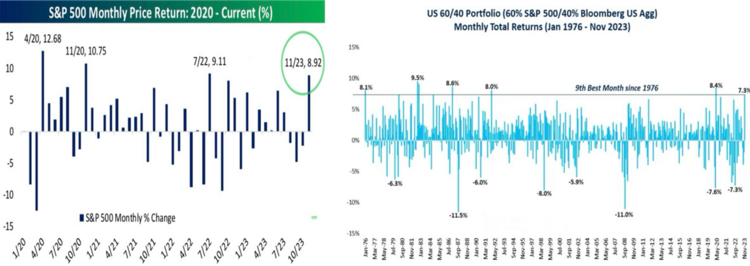

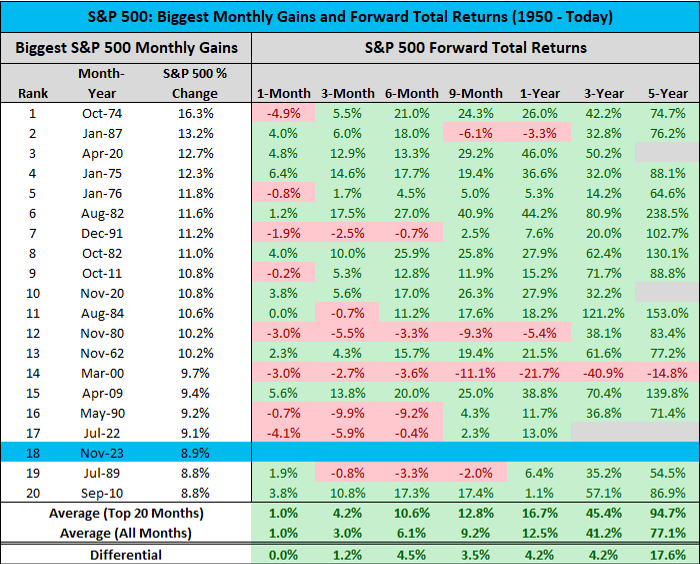

So how is it possible we just finished one of the best months equity markets have seen in a long time? The S&P 500 was up almost 9% in November and a balanced portfolio of stocks and bonds had their best month in 30 years, up 7.3%. 1

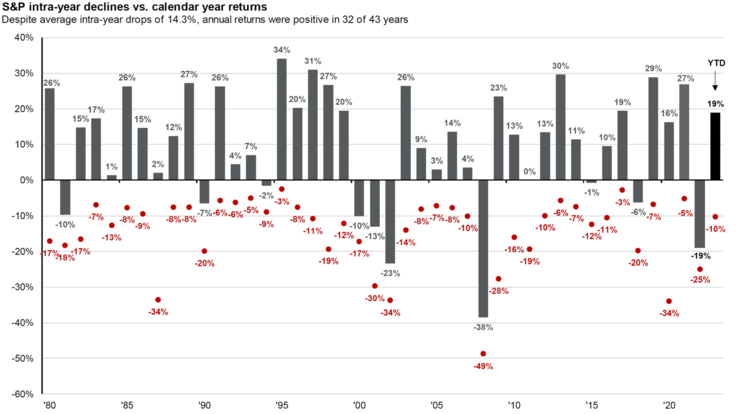

The first principal truth about equity investing is it’s always been macro chaos. The average annual drawdown in the S&P 500 is just over 14% even though 72% of the time we end the year positive. 2

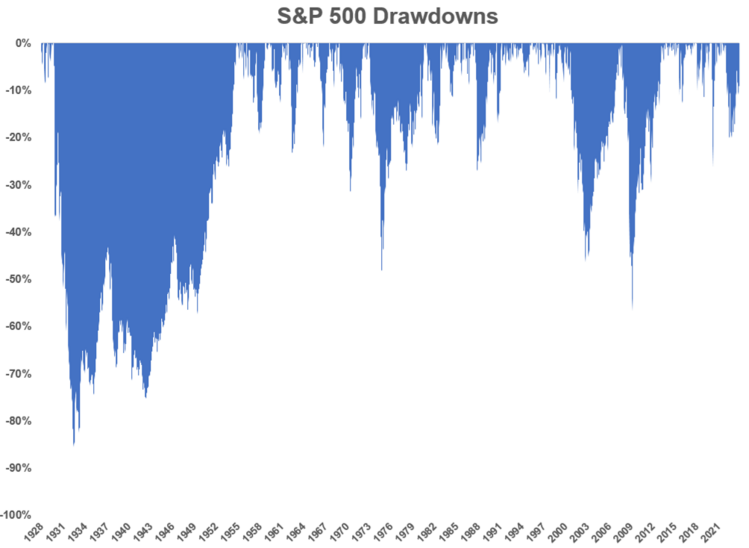

Looking at it in a different way; equity drawdowns are sheer violence. We spend most of our time below all-time highs. 3

- The average intra-year drawdown in years that have finished with a positive return for the S&P 500 going back to 1928 is -11.6%.

- The average drawdown when the S&P 500 has been up by 20% or more during a given year is -11%.

- The average intra-year peak-to-trough drawdown since 1928 was -16.4%.

- We spend about 25% of the time below all-time highs.

- We’ve been in a drawdown for nearly two years which is the longest since the Great Financial Crisis

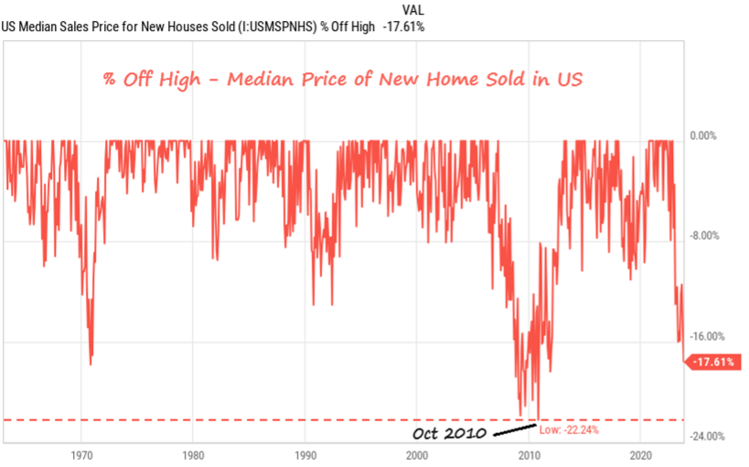

Stocks are not the only class that spends a lot of time in drawdowns. Your house does too. While stocks might be the most visible in price transparency, our homes also have dramatic drawdowns. It’s just that we don’t review our home prices daily on some app. 4

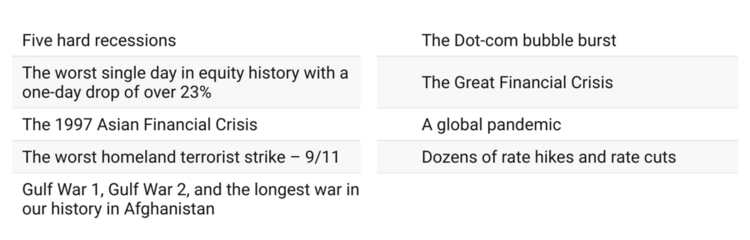

The repeated point is chaos is part of equity investing and it requires blinders at times. Since I’ve been a professional investor for over 35 years I’ve seen:

During this same period of time the Dow Jones has been up 26-fold (2,600%).

It’s impossible to time great months like November especially if you try and reflect on all the chaos of the day. However, the future of equity returns looks bright even after a huge rally month. 5

It’s easy to try and time these things but it’s best to just get used to equity investing being filled with chaos. The trick is learning not to mind.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bespokepremium.com/

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets

- https://awealthofcommonsense.com/2023/11/4-charts-that-explain-the-stock-market

- https://x.com/charliebilello/status/1729157244930204116?s=20

- https://x.com/charliebilello/status/1730363686261313841?s=20