It's Just Taxes

The overwhelming consensus from the clients and investors I speak to on a daily basis is a fear of what the election will bring. Actually, it is a fear of the market’s reaction to the election.

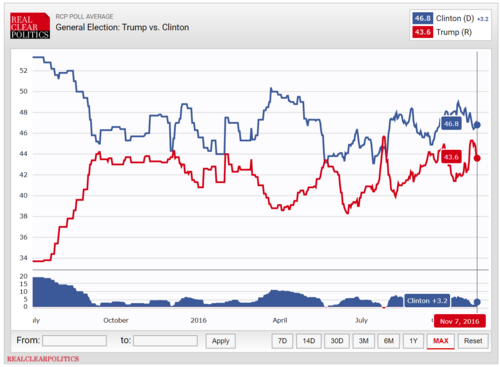

It is impossible to predict what will happen—and almost anything could. Four years ago, when then-candidate Trump was in the throes of controversy, most predicted he would lose. Public opinion surveys suggested Hilary Clinton was a lock for the Presidency. [i]

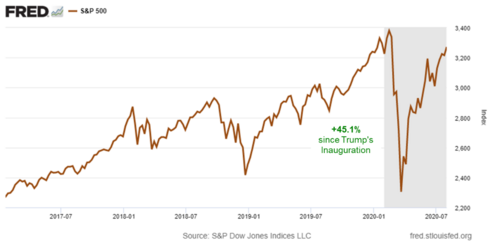

President Trump’s victory was greeted by many investors as the demise of our multi-national standing and in fact that may well be what occurs. The sell-off at the onset of his election victory night was sharp and short lived. [ii]

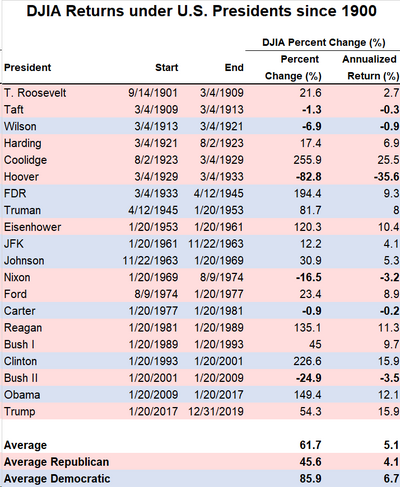

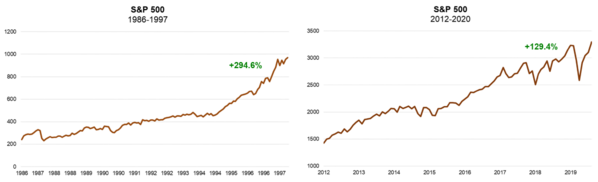

Investors ran for cover on what was expected to be a destabilizing, unpredictable Presidency only to miss a great bull market during most of his Presidency. [iii]

Even with the pandemic and economic shutdown, Trump’s tenure has led to strong returns. [iv]

Some of those same election year jitters are reemerging, but this time with candidate Vice President Biden.

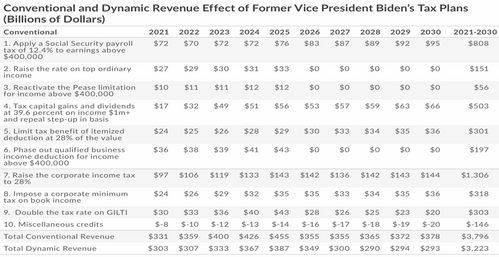

Let’s breakdown just what a Biden tax and economic policy environment might look like. [v]

The Tax Policy Center summarized the recent Biden plan and it is certainly clear there would be tax increases. Corporate taxes would go up, capital gains taxes on high income earners would go up, and payroll taxes would go up on high income earners ($400k per year).

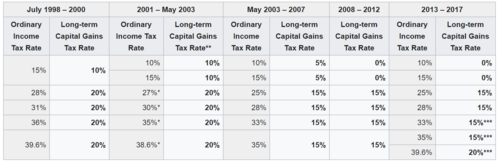

Taxes go up and taxes go down. That’s just part of our DNA. But look at the periods when taxes went up on capital gains or income taxes. [vi]

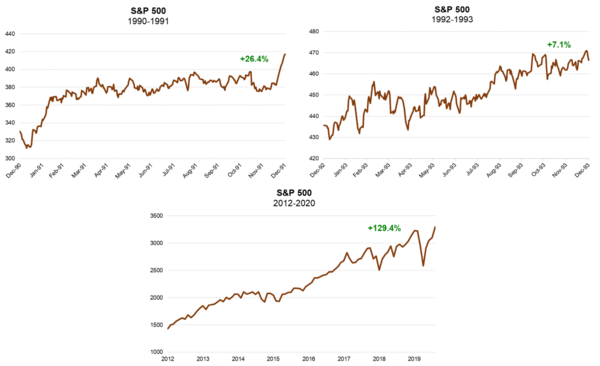

Markets might have corrected in the short run, but the overall market reaction was overwhelmingly favorable. [vii]

After a capital gain tax hike:

After an income tax hike:

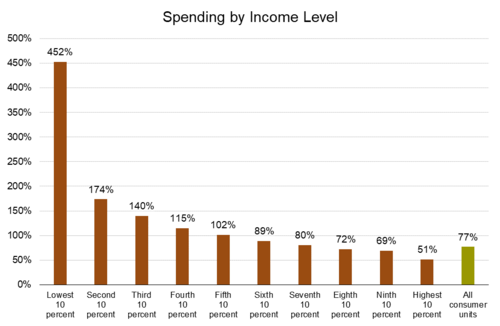

While we all might get caught looking at the shiny object of federal taxes, the real issue will be how Biden’s tax policy would impact the American Consumer overall. Will his policy cut taxes on the middle class? Will it stimulate targeted spending for healthcare or research and development? The economic inputs matter a lot. While it is better to have lower overall taxes, sometimes it is simply not in the cards.

Just look at those that spend their money versus save it. [viii]

If the Biden plan does not find ways to stimulate our economy—especially as we come out of this generational pandemic—then we will likely find ourselves with challenging equity markets. If the Biden tax policy is net stimulative for overall consumption, then it has a chance to fuel growth.

Taxes are just taxes if they are net stimulative to consumption. Tax rates are important, but it would appear—regardless of rates—consumers spend and investors invest.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.realclearpolitics.com/epolls/2016/president/us/general_election_trump_vs_clinton-5491.html

ii. https://money.cnn.com/2016/11/09/investing/dow-jones-trump-wins-election/index.html

iii. https://fred.stlouisfed.org/series/SP500

iv. https://media.bespokepremium.com/uploads/2019/12/The-Bespoke-Report-2020-Washington-ds9f3s-1.pdf

v. https://taxfoundation.org/joe-biden-tax-plan-2020/

vi. https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

vii. https://www.bloomberg.com/quote/SPX:IND

viii. https://www.bls.gov/cex/tables.htm