It’s Official – We’re Maybe in a Recession?

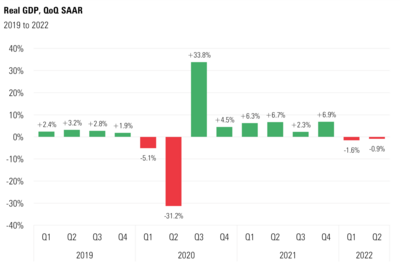

The U.S. economy posted its second consecutive quarter of negative GDP growth. 1

If you review our Q3 2022 Look Ahead, you can see the outcome was highly predictable.

The question is are we in a recession?

According to the Bureau of Economic Analysis, an independent federal agency that provides official macroeconomic and industry statistics, “the often-cited identification of a recession with two consecutive quarters of negative GDP growth is not an official designation.”

The National Bureau of Economic Research (NBER), a private economic research organization, defines an economic recession as: “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

The NBER is apparently the official arbiter of recessions in the United States.

If the NBER’s definition is the standard-bearer, let’s look at the data.

✓ Real GDP has declined for two consecutive quarters

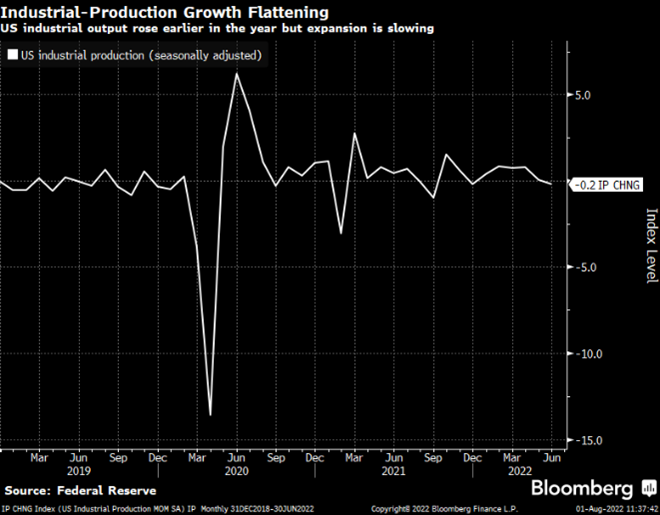

✓ Industrial production showed a slight decline in June after being positive in the first few months of the year 2

Wholesale-retail sales are still relatively strong 3

Real income is on the rise, not in decline 4

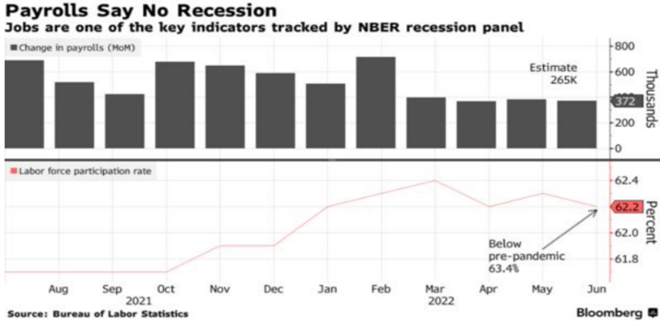

Employment is incredibly strong 5

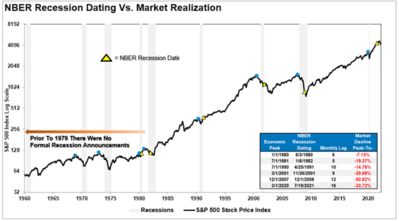

The official designation won’t come for months or quarters in any case, as the NBER typically lags by about 10 months on average when officially designating a recession. 6

In my opinion, it doesn’t really matter right now if we are in an “official” recession or a growth detour. The thing equity investors want and need is more certainty around the direction and level of interest rates. Knowing what the risk-free rate of return is allows us to value assets with more certainty and apply a more consistent risk premium to those equities.

To that end it’s been our view that we are much closer to the end of the Federal Reserve rate hiking cycle.

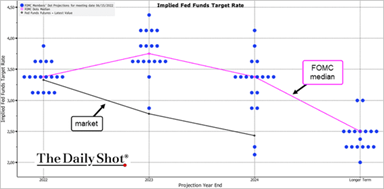

In spite of the Fed’s Dot Plot (direction on rates), bond investors believe the top of the Fed Funds rate will be in that 3%-3.5% range and occur this year. They are also expecting rates to be cut sometime in 2023. 7

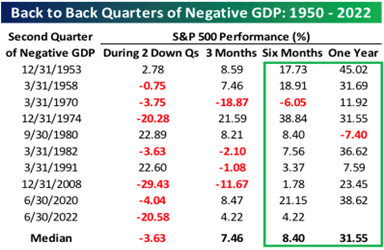

Regardless of if we are in a recession now or a soft landing, the Fed’s tools are going to be truncated as growth continues to moderate and inflation abates. Perhaps that’s why in almost every case, two consecutive quarters of negative GDP growth has been followed by a median return of 31.55% on the S&P 500 one year later. 8

Recession or not, getting to the end of the rate hike cycle matters most.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bea.gov/data/gdp/gross-domestic-product

- https://www.federalreserve.gov/releases/g17/current/

- https://fred.stlouisfed.org/graph/?g=Snh6

- https://fred.stlouisfed.org/graph/?g=SnhI

- https://www.bloomberg.com/news/articles/2022-07-12/no-us-recession-until-obscure-panel-of-eggheads-says-it-is-so

- https://realinvestmentadvice.com/the-right-strategy-is-critical-when-investing-during-a-recession/

- https://dailyshotbrief.com/

- https://www.bespokepremium.com/interactive/research/think-big-blog/