It’s Scary Out There

Bank failures, ground wars in Europe, inflation, rising interest rates, and the impending doom of a recession. It’s enough to make any investor want to run for cover. This is the time where you, as an investor, and us, as your guide, tend to find friction in our relationship.

Client View:

If you know there is a recession coming, why not just shift out of stocks?

Advisor View:

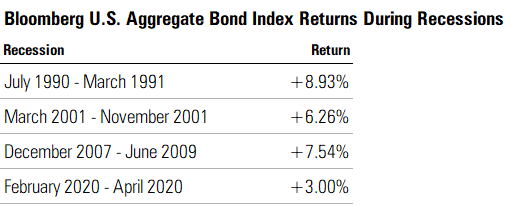

No one really knows there’s a recession coming. It’s a matter of probabilities versus certainty. That’s why we use some fixed income in balanced portfolios. 1

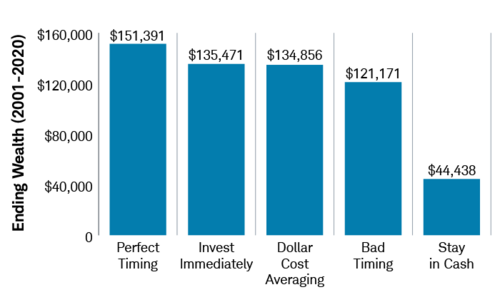

Trying to time in and out of equities is a fool's game. Don’t get me wrong. A lot of very successful and smart people try to control that game. Unfortunately, the overwhelming data suggests investors get it wrong. Is it worth it, even if you can be perfect, which is not possible. 2

Just being average at dollar cost averaging doesn’t cost you much in terms of returns compared to perfect timing or bad timing.

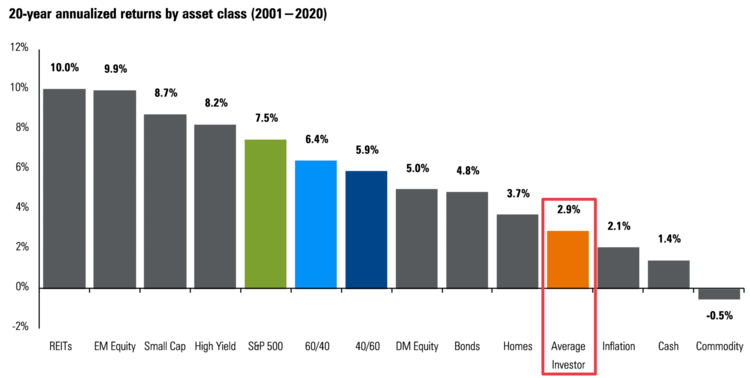

Put another way, the individual investors that try to time the market generate a far inferior return than a basic balanced portfolio of stocks and bonds rebalanced regularly. 3

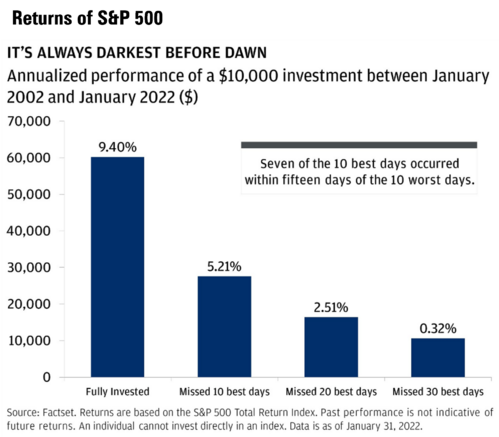

Just to drive the point home on how hard it is to time anything; if you just miss 10 days of the best returns you lose almost all the advantage. That’s as little as 0.13% of days. 4

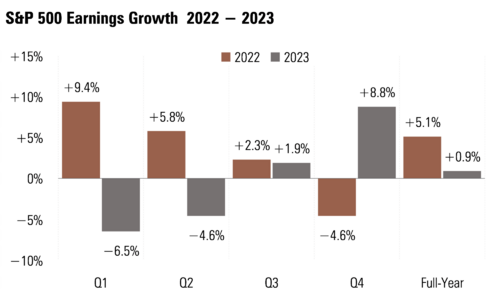

There is little doubt we will have a corporate earnings recession when you look at Q1 results (which are beginning to be reported) and expectations for Q2. 5

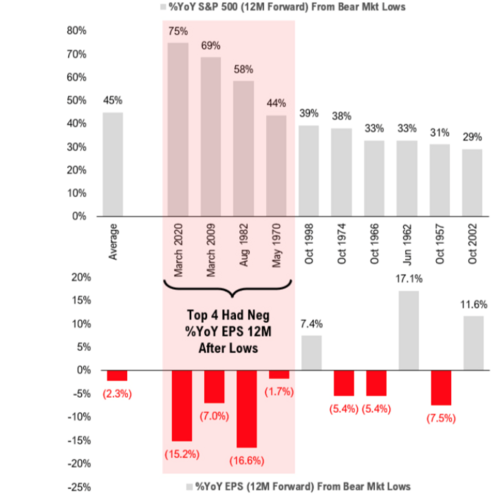

However, some of the strongest equity returns come on the heels of pretty dour corporate earnings. 6

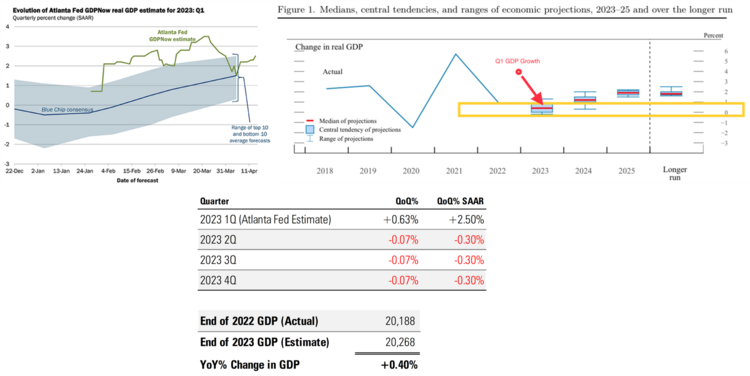

Further, if Q1 GDP growth comes in at or near expectations based upon the Atlanta Fed’s Now Cast; then we would need to have a couple of quarters of negative GDP to meet the Fed’s expectation. 7 8

It’s no wonder the media class are all calling for a recession and that may turn out to be true. So, if market timing is not a strategy what is?

Knowledge!

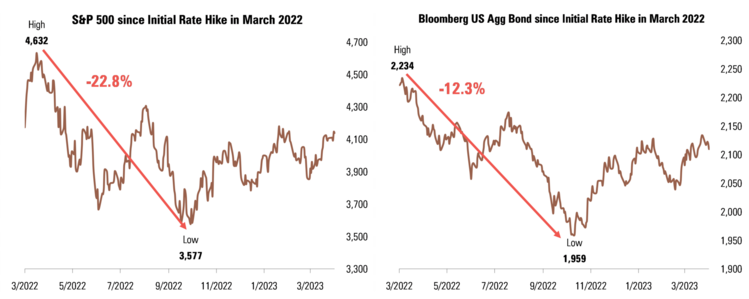

We just went through an aggressive rate hike period, with equity and bond markets contracting 22.8% and 12.3%, respectively, peak-to-trough following the initial rate hike in March 2022. 9 10

It’s pretty clear investors have been discounting a recession for over a year now.

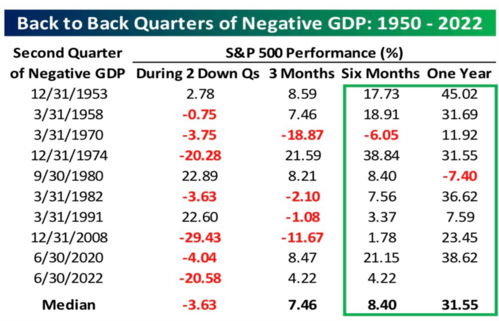

Additionally, recessions are not all that bad for equities, relative to paying capital gains taxes and trying to time markets. During two down quarters of GDP growth, the S&P averages -3.63%. However just 6 months later, and especially one year later, the picture looks much brighter. 11

It’s not complicated when it comes to understanding the counterintuitive nature of these returns.

Good investors tend to discount news well into the future. They buy, sell, or pre-position portfolios 6 months to 1 year in advance of events, in my opinion. That’s why we paid the price last year for rising rates.

Perhaps this year we accrue the benefits from a recession and falling rates, lower costs of capital, and in turn rising equity markets as companies return to earnings growth later in the year. This is why it’s not too scary for us as we navigate portfolios through this part of the cycle.

As a great reminder, watch our friend and best-selling author of Psychology of Money, Morgan Housel, talk about investor pain.

It’s scary out there for investors and perhaps the trick is not minding.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/quote/LBUSTRUU:IND

- https://www.schwab.com/learn/story/does-market-timing-work

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

- https://www.jpmorgan.com/wealth-management/wealth-partners/insights/the-case-for-always-staying-invested

- https://insight.factset.com/topic/earnings

- https://dailyshotbrief.com/

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

- https://stockcharts.com/h-sc/ui?s=$SPX

- https://stockcharts.com/h-sc/ui?s=AGG

- https://www.bespokepremium.com/interactive/research/think-big-blog/