“It’s the transition that’s troublesome” – Isaac Asimov

Transitory might just rear its head again as a way to describe inflation. In the most recent reading of the Personal Consumption Expenditure (PCE), the Fed’s favored inflation gauge; inflation continued to ease ever so slightly. 1

Perhaps this is why we are seeing a small uptick in equities and a down tick in fixed income. 2 3

The best remedy for higher prices is higher prices. We all know quantity demand should decrease as prices rise and that will certainly be the case here. Call it demand destruction, first principals of macroeconomics, or common sense; we should be seeing more moderation on core inflation in the coming quarters.

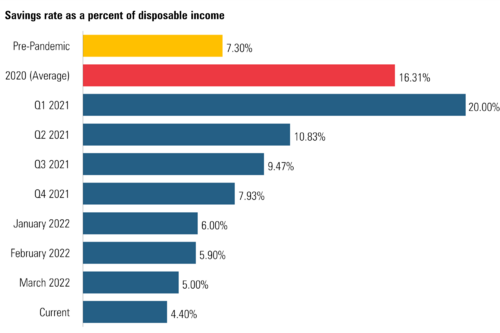

If price moderation will not occur naturally the fact that the consumer has spent down their savings should help. The personal savings rate as a percentage of disposable personal income is now well below pre-pandemic levels. 4

While this leaves $815 billion in spending fire power it will also push those that have been on the labor force sidelines back into action. I would expect labor force participation rates to gradually climb, putting a restrictor on wage inflation. 5

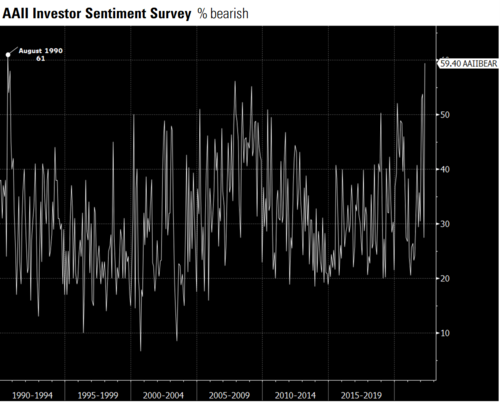

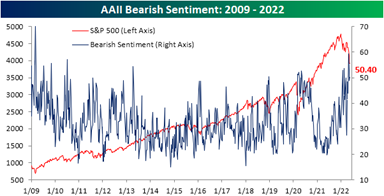

It would not surprise me to see peak inflation match peak investor bearishness. In fact, peak investor bearishness is a pretty good indicator for positive returns. According to the AAII (American Association of Individual Investors), investor bearishness hit a 30-year high. 6

Typically, investor bearishness fairly accurately signals market lows. 7

Markets, credit, and inflation are all in motion and moving back to an equilibrium – either an old one or new one. It’s the transition that’s troublesome.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bea.gov/data/personal-consumption-expenditures-price-index

- https://www.bloomberg.com/quote/SPX:IND

- https://www.bloomberg.com/markets/rates-bonds

- https://www.bea.gov/data/income-saving/disposable-personal-income

- https://fred.stlouisfed.org/series/CIVPART

- https://www.aaii.com/latest/article/17374-aaii-sentiment-survey-bullish-and-bearish-sentiment-both-rise

- https://www.bespokepremium.com/interactive/posts/think-big-blog/pessimism-worse-now-than-the-covid-crash