It’s Ugly in the Short Run

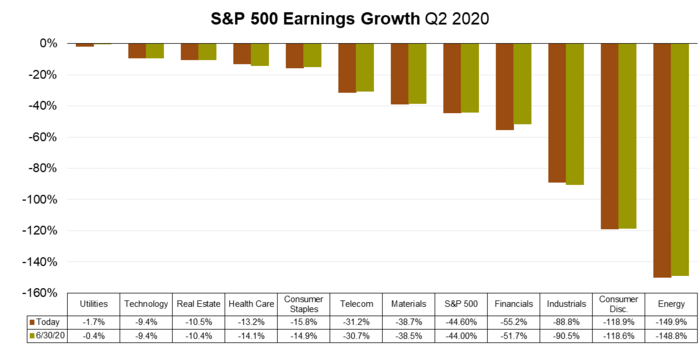

Second quarter earnings season commences this week and it will be ugly. S&P 500 companies are expected to report earnings declines in excess of 44% for Q2 according to FactSet. [i]

No sector or industry was safe from the pandemic-driven shutdown of our economy. Energy was the most impacted, with an expected year-over-year earnings decline of 150%. Even the best growth industries like Technology are expected to post declines.

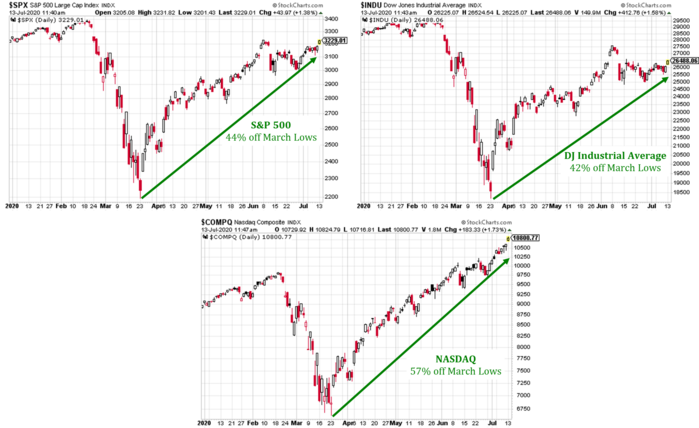

Simultaneously, we have seen U.S. equity markets rally with astonishing strength. [ii]

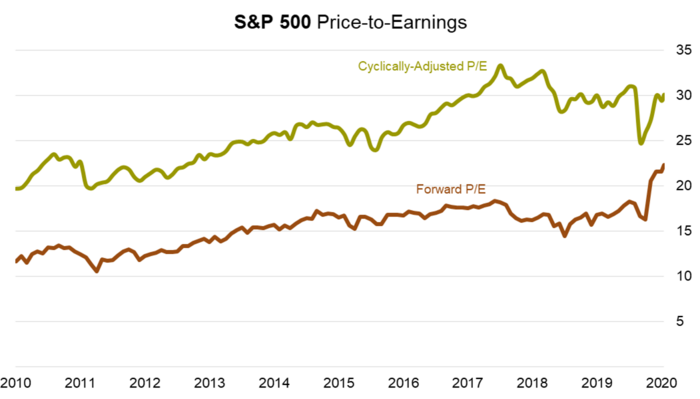

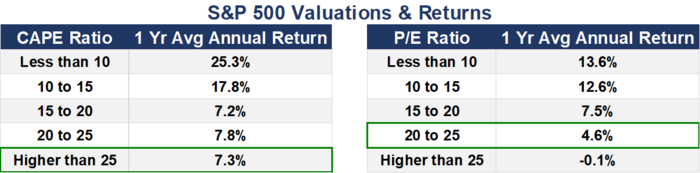

This divergent, almost counterintuitive move has created a large jump in valuations on a forward P/E basis and CAPE basis (cyclically-adjusted P/E). [iii] [iv]

It is clear that anyone expecting a Q2 earnings recovery has been living under a rock. No one should buy stocks in hopes of seeing a recovery in Q2 corporate earnings.

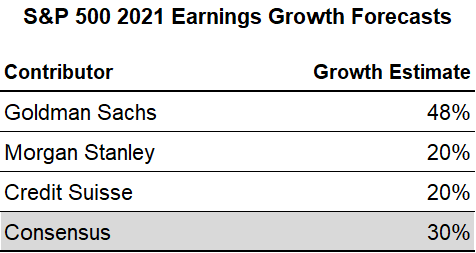

In fact, it’s hard to imagine any investor anticipating a recovery in corporate profits in 2020. It is my contention that investors have driven up stock prices in hopes of an earnings recovery in 2021.

According to FactSet, the consensus estimate for Q1 2021 S&P 500 earnings growth is 12.2%. [i]

Prospectively we have already received benefits from the current rally on the projected earnings recovery in 2021. Looking at forward expected returns based upon current valuation metrics, you get the picture.

Here is an example: [vi]

The bottom-line is we need 2021 to deliver or we should expect to see a few more hiccups in equity pricing. Although that should be expected at almost any time.

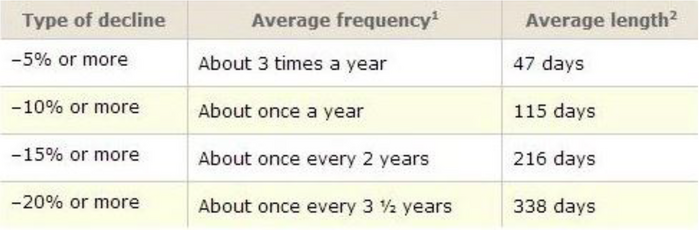

Under normal circumstances markets correct quite often. [vii]

Once every three years a 20% contraction is well within the norm. 10% corrections are annual events and certainly 5% corrections occur multiple times per year. In other words, we should expect it.

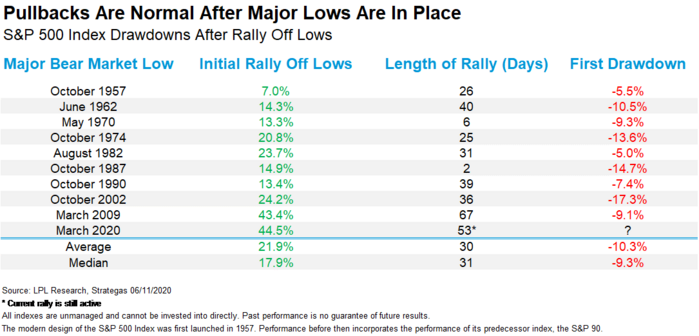

This is especially true after major lows are in place and we experience a rapid run ups in stock prices. [viii]

With the outbreak of COVID throughout the United States, those corrections become more likely as we continue to adjust to a “much” less than normal economy. [ix]

There is hope.

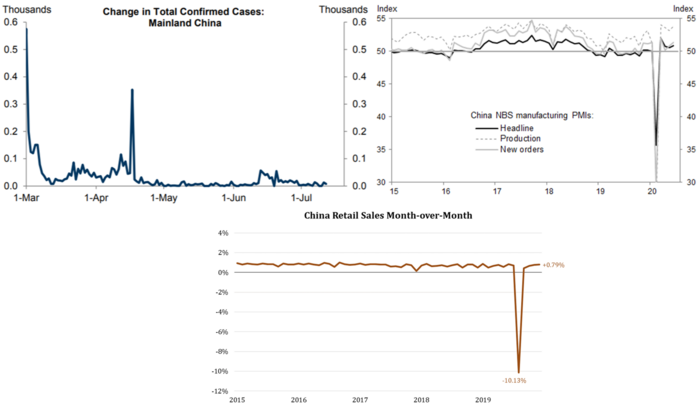

When you look at the containment and recovery in China both from COVID and economic data, there appears to be good news once we get past this recent outbreak. Both manufacturing and retail sales in China have recovered to pre-pandemic levels. [x] [xi]

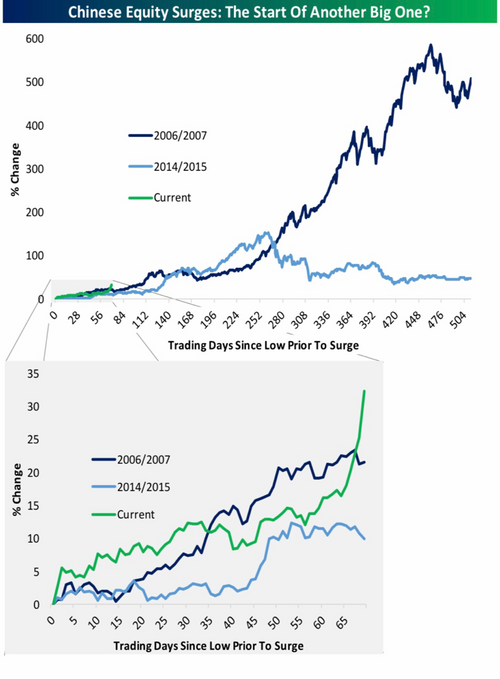

In fact, Chinese equity markets may just be on the verge of a massive “good news” rally. The 2006-2007 rally was over 500% and the 2014-2015 rally was well over 100%. Currently prices are up 30% in the last 65+ days. [xiii]

Earnings reports are going to be ugly in the coming weeks. Expectations are very low, which could lead to another surprise to the upside. However, investors should set their eyes on 2021 and the recovery in corporate profit growth to underpin their equity investing.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_071020.pdf

ii. https://stockcharts.com/h-sc/ui

iii. https://www.bloomberg.com/quote/SPX:IND

iv. https://www.multpl.com/shiller-pe/table/by-month

vi. https://awealthofcommonsense.com/2020/07/it-depends/

vii. http://phillipsandco.com/files/9615/4664/3284/Look_Ahead_2019Q1_Final.pdf

viii. https://lplresearch.com/2020/06/12/is-this-the-start-of-a-new-bear-market/

ix. https://phillipsandco.com/files/8215/9356/4131/Look_Ahead_-_2020Q3_-_Final.pdf

x. https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html#states

xi. https://research.gs.com/ xii. http://data.stats.gov.cn/english/swf.htm?m=turnto&id=1

xii. http://www.stats.gov.cn/english/PressRelease/202003/t20200317_1732694.html

xiii. https://www.bespokepremium.com/