Learning How to See – A Big Picture

We've spent so much time talking about inflation and interest rates over the course of the year that it's easy to lose sight of other factors influencing markets. Let’s step away from the inflation narrative and look at a long-term trend impacting equity prices: The supply and demand of shares.

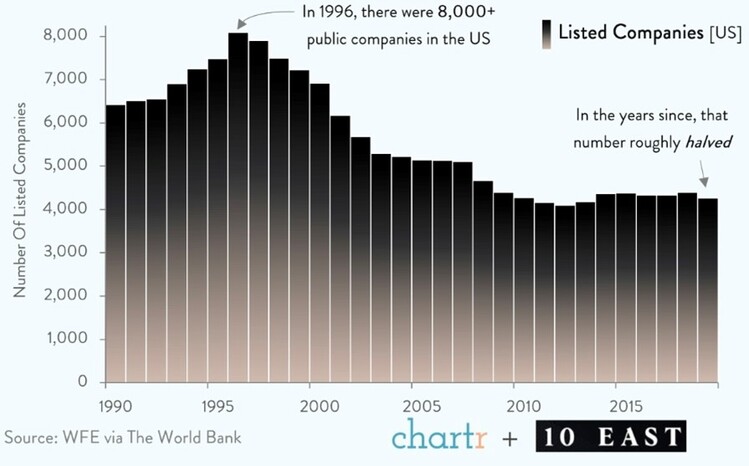

The ever-shrinking supply of stock is having a major impact on equity prices. Publicly listed stocks in the United States have been shrinking for decades. As shown below, in 1996 there were more than 8,000 publicly listed companies and today that number has roughly halved. 1

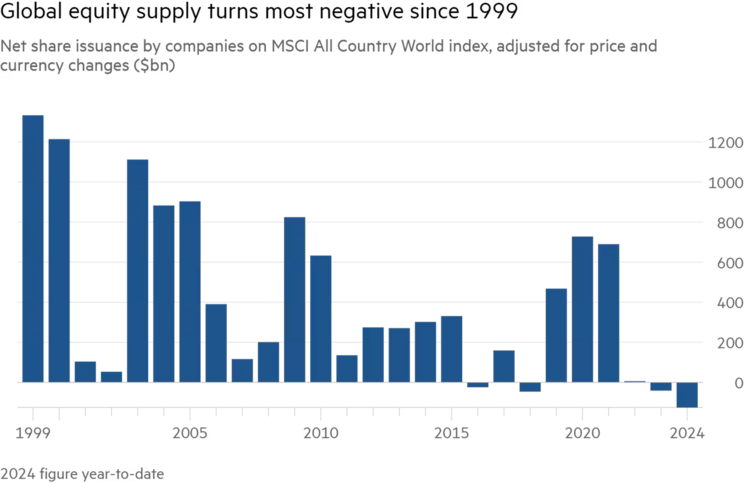

On top of that, the issuance of publicly listed companies has also been shrinking. In fact, it’s the most negative since 1999. 2

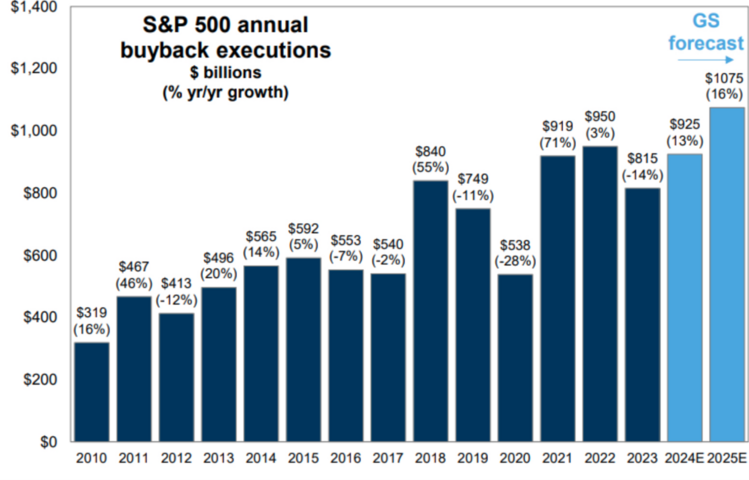

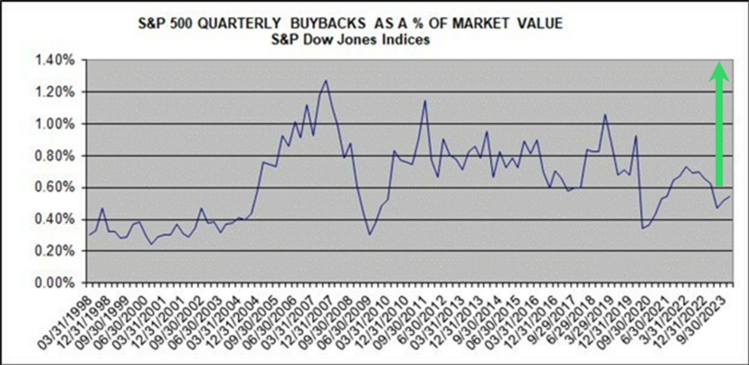

Layer in the number of companies shrinking their outstanding shares with buybacks. According to Goldman Sachs, buybacks are expected to increase by 13% this year and surpass a trillion dollars next year. 3

It’s hard to grasp what $1 trillion in share buybacks means for the S&P 500, but it’s significant. With the S&P 500 market capitalization at $44 trillion, $1 trillion in buybacks next year would represent about 2% of market value. That’s a significant and record amount of shrinking supply. 4

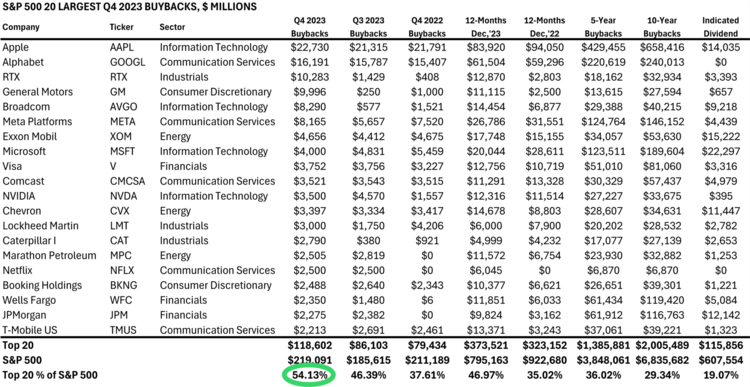

Who’s doing all the buybacks? 54% of all the share buybacks are with the top 20 S&P 500 companies. 4

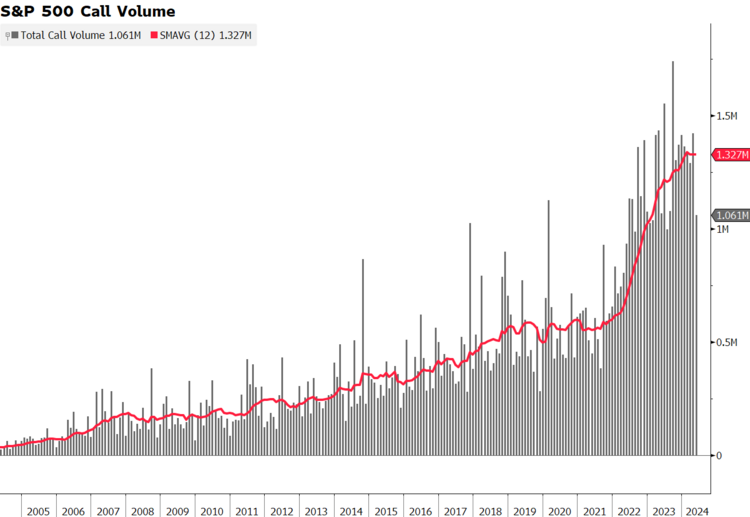

The supply of outstanding stock is clearly shrinking. How about the demand for stocks? Based upon S&P 500 call volumes (contracts to purchase shares), the amount of demand has been consistently growing. Demand has become almost parabolic. 5

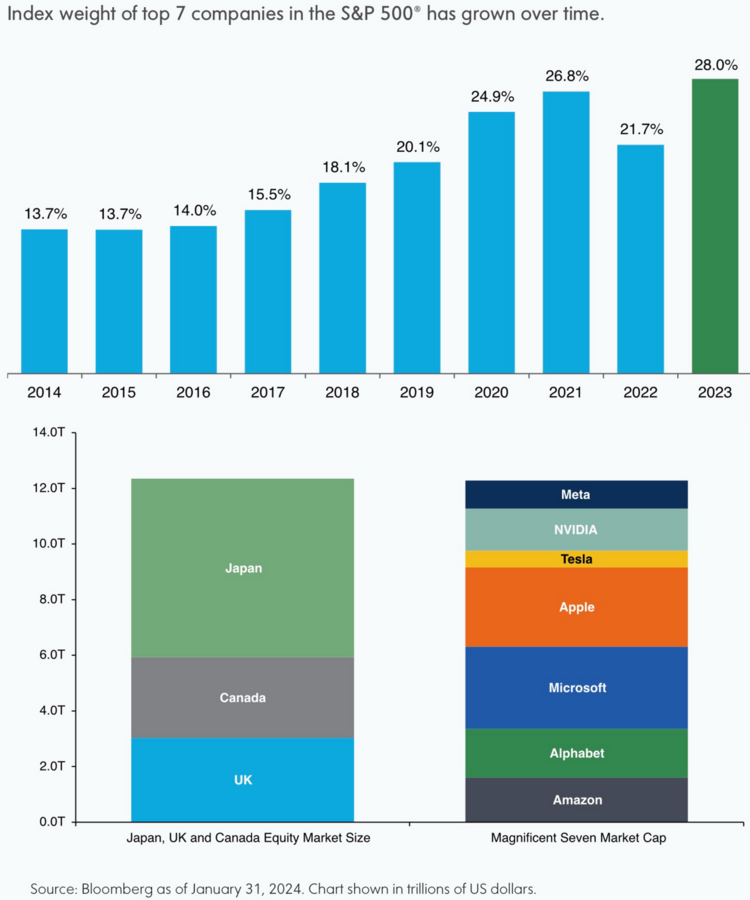

With a shrinking supply of stock outstanding and demand booming; it’s no wonder you see charts like these. Of course, the Magnificent 7 (the seven largest companies in the S&P 500) now have a larger combined market capitalization than the entire stock markets of Japan, Canada, and the UK – countries with perpetually slower-growing, highly socialized economies. 6

The combination of an ever-shrinking supply of shares to buy and an ever-growing demand for shares creates a floor under the markets. In the best-case scenario, this perpetual demand imbalance could drive equity prices higher in the long run. Perhaps it’s a reason to understand the big picture is in equity investors’ favor in the long run.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: