Light at the End of the Tunnel

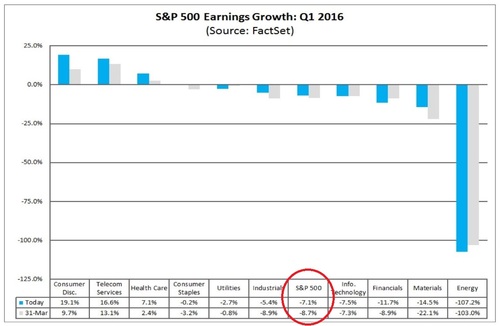

For months, we have been tracking the fact that U.S. corporate earnings are in a growth slump, or as we’ve been calling it, an earnings recession. With 87% of S&P 500 companies reporting earnings for Q1 2016, we can now confirm we will have a 4th consecutive quarter of negative earnings growth.

While the shrinkage is less than anticipated (-7.1% vs -8.7%), negative growth is just that and not supportive of the current elevated equity valuations. How is it the stock market keeps going up? In fact, the S&P 500 is up over 11% in the past 3 months. [i]

It's clear our markets are being driven by the Fed, as we live in a policy driven world like nothing I have seen before. [ii]

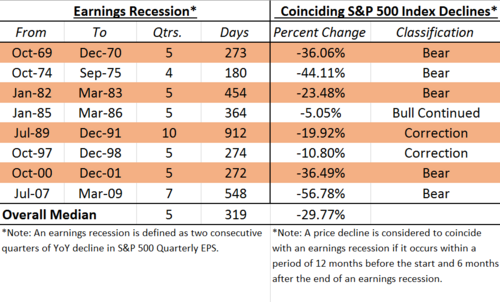

Typically, when we are in an earnings recession, we see markets adjust accordingly. We have had a few periods when earnings shrank for 4 consecutive quarters or more. During only two of those periods, ’85-86 and ’97-98, were we able to shrug off an accompanying economic recession. [iii]

At the end of the day, what investors are invariably betting on is Fed policy growing the economy through better wages, more jobs, and increased corporate spending.

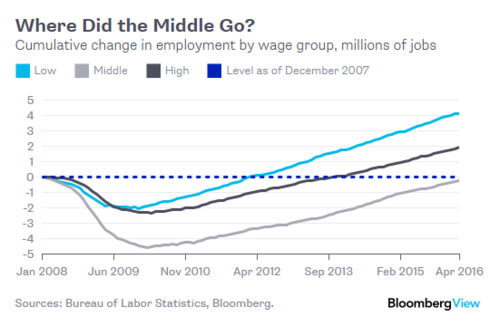

We know we have more jobs. In fact, the U.S. economy has added over 12 million jobs over the past five years. However, the jobs the economy has been adding are not the high paying jobs of the past, but lower wage jobs that make it hard for an economy to expand.

It would appear from the chart above, Low-Wage jobs (defined as $16.hr and below) have recovered and far surpassed their pre-financial crisis level; whereas, Middle-Wage jobs (defined as above $24/hr) have not crossed the pre-financial crisis level. [iv]

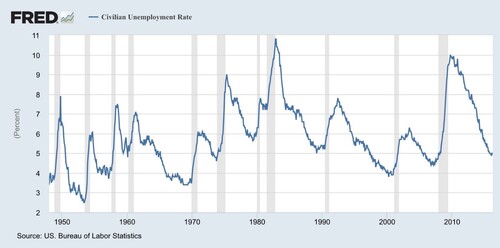

Yes, the unemployment rate is at very low levels, but it would appear that it's primarily driven by lower wage jobs. [v]

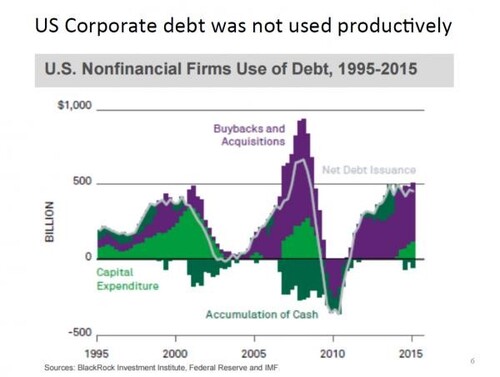

As far as Fed Policy, aka the impact of near-zero percent interest rates on Corporate America, the low-interest rate environment has simply created an adverse reaction. Instead of companies using low-interest rates to invest capital in plant, property, and equipment; corporations have chosen to financially engineer their earnings growth through share buybacks and acquisitions. [vi]

At some point, investors will get tired of no earnings growth and force corporations to make dramatic moves to improve profitability. The easiest way to grow earnings is to cut expenses, which may rest with terminating employees. After all, wages represent about 70% of companies costs on average.

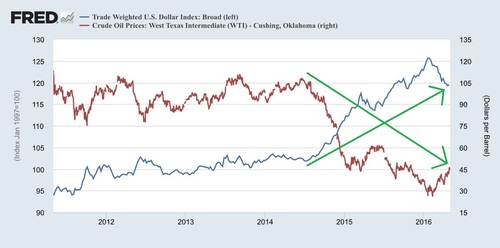

Can an earnings recession lead to an actual recession? The short answer is yes. However, our inclination at this time is the current earnings recession will not be accompanied by an economic recession, as much of the lack of earnings growth is attributable to the collapse in energy prices and the impact of a strong dollar.

The good news is the dollar is getting weaker and energy prices are climbing back up. [vii]

It's almost strange to say but let's hope for continued weakness in the dollar and paying more at the pump. Perhaps some light at the end of the earnings tunnel is ahead.

If you have questions or comments, please let us know. We always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_5.6.16

[ii] https://www.google.com/finance?q=INDEXDJX%3A.DJI%2CINDEXSP%3A.INX%2CINDEXNASDAQ%3A.IXIC

[iii] http://seekingalpha.com/article/2978956-the-earnings-recession-of-2015-stock-market-in-danger

[iv] http://www.bloomberg.com/view/articles/2016-05-06/the-job-market-s-missing-middle

[v] https://research.stlouisfed.org/fred2/graph/

[vi] https://www.blackrock.com/institutions/en-us/literature/whitepaper/bii-2016-outlook-us-version.pdf

[vii] https://research.stlouisfed.org/fred2/graph/