Looking Ahead: A Thin Green Line

We just published our Q1 2022 Look Ahead, you can view the presentation here or watch our narrated version here.

We look at this year as the “thin green line”, with a lot of threads that will make up the difference between success and failure in equity markets throughout the world.

Consumer Strength

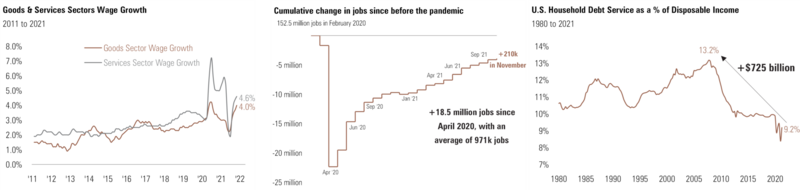

When we think about what drives the U.S. economy, it’s clearly consumption. What helps consumers spend money? Wages, jobs, and debt. 1 2

Current wage growth trends suggest the consumer should be in a strong position to continue to consume at high levels in the quarter to come. Higher wages should also pull more workers off the sidelines and fill the unemployment gap. Consumers’ ability to borrow and spend is another key factor. If the consumer borrowed at levels commensurate with the Great Financial Crisis, they would add a whopping $725 billion to GDP.

Take a look at our Q1 2022 Look Ahead here

Watch our narrated version here

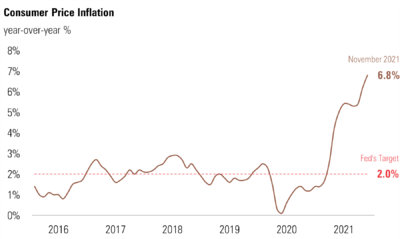

Inflation – It Must Transition

To keep the U.S. on the plus side of the “thin green line,” inflation must transition as it is eating away at the consumer’s purchasing power. 3

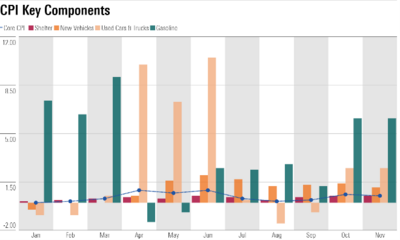

Much of what’s driving inflation is in a couple of components – Energy, Autos, and Rents. 4

If you strip those out, the “core” CPI readings would be more muted. When we look at the rate of change effect inflation is measured by, it’s our view that inflation numbers will moderate in the second half of 2022; perhaps even sooner, as we see commodity prices decline.

Take a look at our Q1 2022 Look Ahead here

Watch our narrated version here

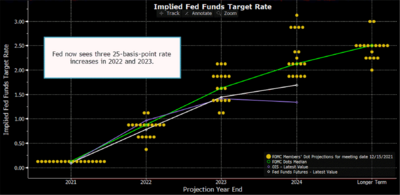

Federal Reserve Tight Rope – Frenemies of the Consumer

Managing inflation is predominantly falling on the Fed and we think they are walking a very tight rope. Will the Fed be friends or enemies of the consumer in 2022?

Fed policy makers have signaled rate increases will occur in the coming months, with two rate increases currently priced in for 2022, and our expectations is there could be three if inflation doesn’t moderate. 5

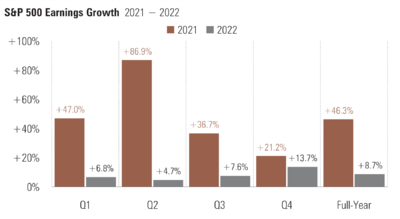

Earnings – High Hurdles

Earnings matter most over long periods of time, particularly when it comes to price appreciation for equities.

Continued wage growth, the spend down of precautionary savings, and companies leveraging pricing power to withstand rising material and wage costs should support earnings growth in 2022. However, the year-over-year hurdle rate is very high and any dip in consumption will likely lead to a mild earnings recession. 5

Take a look at our Q1 2022 Look Ahead here

Watch our narrated version here

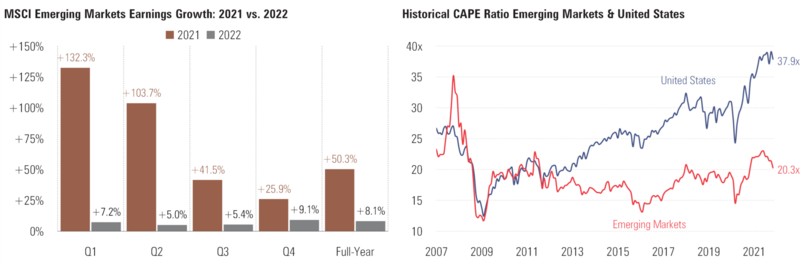

Emerging Markets – Valuation Jumps the Hurdles

One bright spot on the positive side of the “thin green line” should be Emerging Markets. While they too have high hurdle rates, we prefer a reasonable allocation to Emerging Markets over the U.S. as Emerging Markets are trading at about a 47% discount to the United States. 5 6

Higher GDP expectations relative to the U.S. should also provide opportunities for investors to find returns to meet targets in 2022. 5

Take a look at our Q1 2022 Look Ahead here

Watch our narrated version here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://beta.bls.gov/dataQuery/search

2. https://fred.stlouisfed.org/

3. https://www.bls.gov/cpi/

4. https://www.morningstar.com/articles/1071613/inflation-is-getting-worse-before-it-gets-better

5. Bloomberg

6. https://indices.barclays/IM/21/en/indices/static/shiller.app