Looking Ahead - Confluences

I like to fly fish and have had the privilege of fishing some of the most amazing rivers in the world. One specific spot to angle for a really big fish is the confluence of two rivers. This spot is easy feeding for the fish but, hard for the angler due to crosscurrents, heavy water, and unstable footing which yields risk of falling headfirst into the water.

2020 appears about the same to me as an investor.

First, we have the muted expectations for 2020 equity returns by the Wall Street prognosticators. [i]

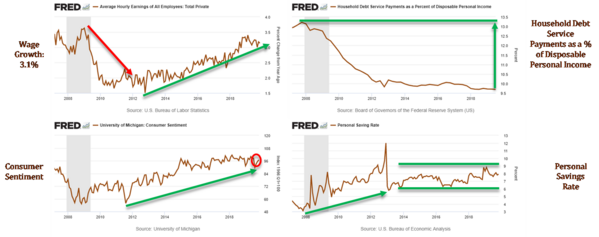

Second, we have an incredibly strong consumer that can prop up U.S. GDP growth and fuel corporate earnings. [i]

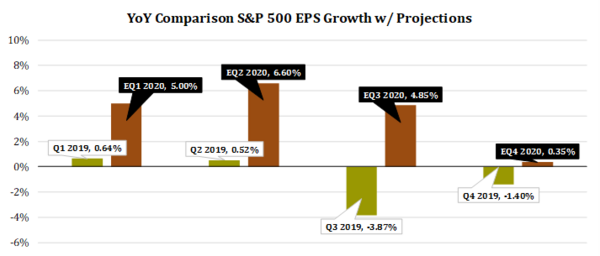

Third, we have incredibly low hurdle rates going into 2020 compared to 2019. This could create an opportunity to exceed expectations for investors and fuel equity prices even higher. [i]

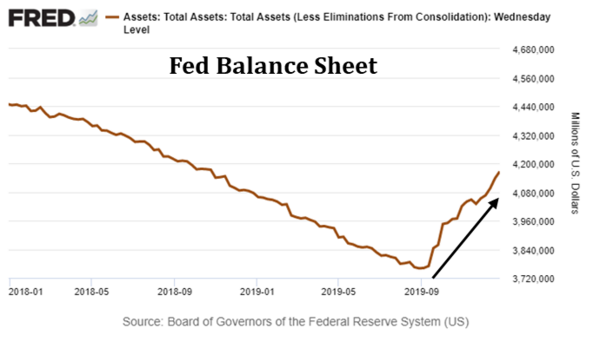

Finally, the Fed looks to be on hold, or at least maintaining an accommodative stance, for much of 2020 as they continue to pump billions back into the banking system with repurchase agreements. [i]

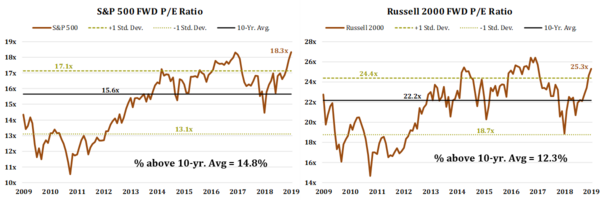

Juxtapose that against high U.S. equity valuations and you start to get the picture of the various crosscurrents churning their way through our equity markets. [i]

For a full look at our Q1 2020 Look Ahead click here.

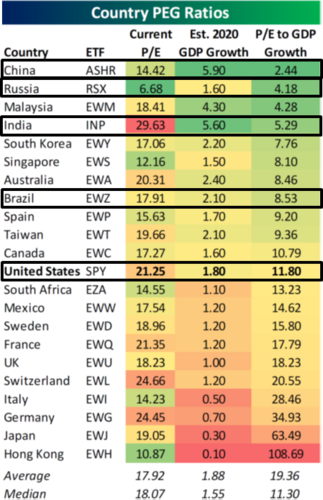

The waters look a little calmer for emerging markets. Both China and Russia provide better growth rates and equity valuations relative to the United States. [i]

Unfortunately, the noise of political silly season should add significant – albeit temporary – instability to our investing climate. You might be surprised to see what parties and sectors perform the best.

Click here to see how the political silly season historically plays out during Presidential election years (plus all of our views for Q1 2020).

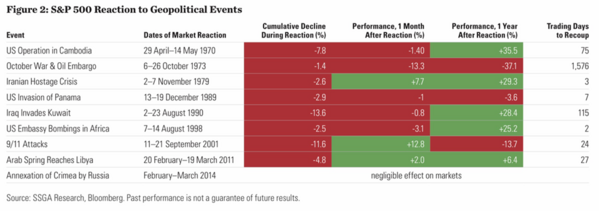

One special addition I wanted to add to this post is data around geopolitical risks. The recent spat with Iran has long been in the making. However, investors tend to react poorly during the heat of the moment and my goal for you is to assess and reflect on the data. While this is not in the Look Ahead, it is certainly timely. You can see the full report on geopolitical risks by clicking here, but here is the essence of the study. [ii]

The simple takeaway is no matter the perceived geopolitical risk the market tends to recover and in most cases very quickly.

Getting it right during 2020 will require tremendous investor discipline to look past the tumultuous waters and focus on long-term investment principles. While there will be some great opportunities to take advantage of, the turbulent waters will create some challenges.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://PHILLIPSANDCO.COM/files/7615/7800/3261/Look_Ahead_-_2020Q1_-_Final.pdf

ii. https://www.ssga.com/investment-topics/general-investing/2018/09/does-geopolitics-affect-financial-markets.pdf