Looking Ahead

Our Q4 2022 Look Ahead is available for review. The video link is here and the PDF version is here. In this post, we highlight some key themes we see in the coming quarter.

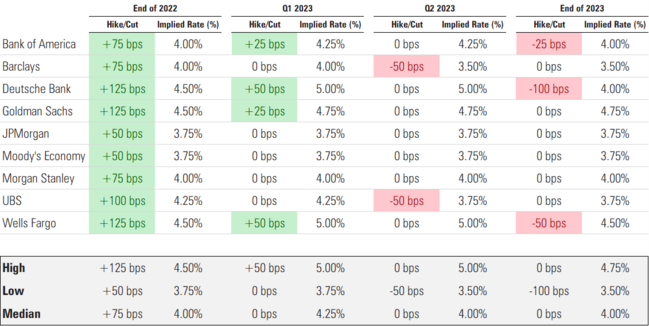

The Fed is on course to move the terminal fed funds rate to 4.25% by year-end. Historically the duration of time rates stay at elevated levels has averaged six months 1. In our case, that might put us in rate cutting territory by mid-2023. Wall Street estimates approximate that timeframe. 2

Take a look at our Q4 2022 Look Ahead here

Watch our narrated version here

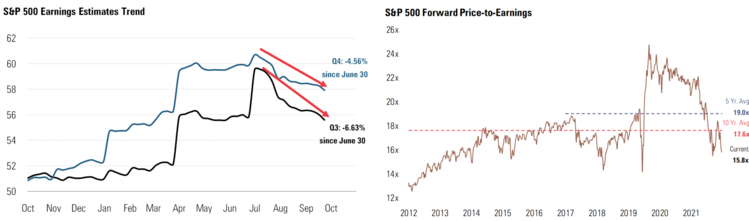

Putting aside the discussion on interest rates, what really drives long-term equity returns? Earnings. Estimates for Q3 and Q4 are being revised down and that’s probably part of the catalyst for poor equity performance.

However, S&P 500 forward valuations are below the 10-year average, which should draw some of the cash on the sidelines back into equities in the near future. 2

Take a look at our Q4 2022 Look Ahead here

Watch our narrated version here

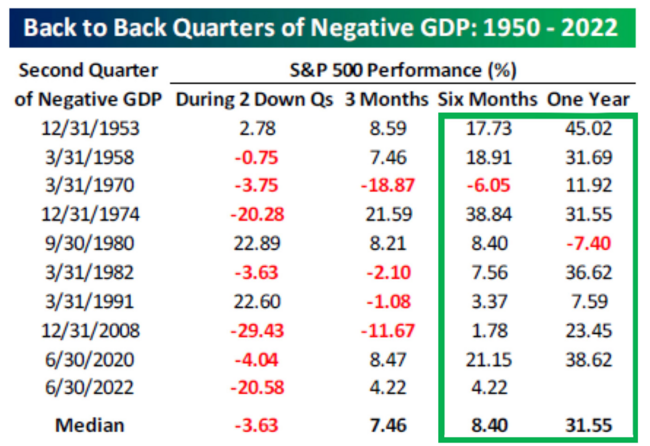

Regardless of if we are in a recession now or a soft landing, the Fed’s tools are going to be truncated as growth continues to moderate and inflation abates.

Perhaps that’s why, in almost every case, two consecutive quarters of negative GDP growth has been followed by a median return of 31.55% on the S&P 500 one year later. 3

Take a look at our Q4 2022 Look Ahead here

Watch our narrated version here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: