Looking Ahead

Our Q1 2023 Look Ahead is available for review. The video link is here and the PDF version is here. In this post, we highlight some key themes we see coming this quarter.

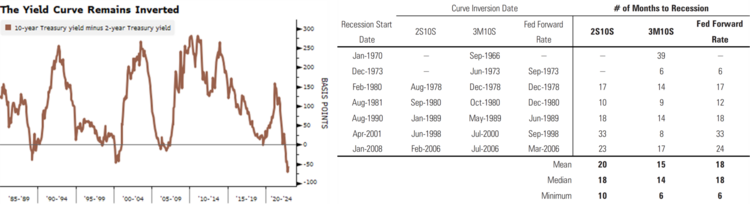

The main question for 2023 is whether a recession is coming. Our view is that although the yield curve is inverted, the fed the Fed should have time to react to any pre-recessionary tendencies and lower rates if needed. 1 2

Take a look at our Q1 2023 Look Ahead here

Watch our narrated version here

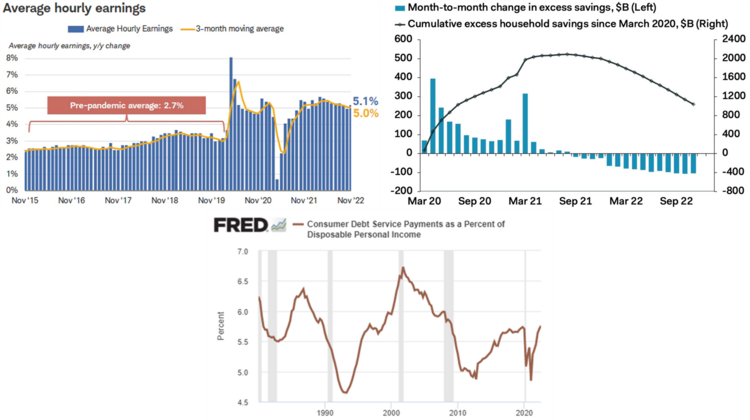

If you ask the consumer about a looming recession, they’d probably say, “Not yet.” Wages are growing above trend. There is ample accumulated savings from pandemic stimulus to spend down, and there is plenty of room to run before debt service levels return to pre-pandemic levels. A soft economic landing without a recession is within reason if inflation cools naturally and the Fed does not jam rates much higher. 3 4 5

Take a look at our Q1 2023 Look Ahead here

Watch our narrated version here

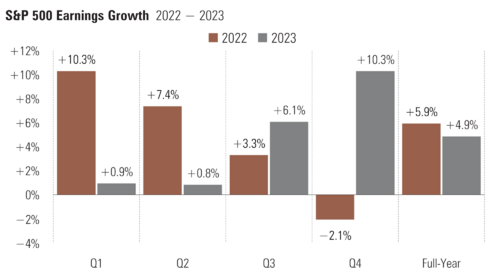

Earnings still matter the most and expectations are currently calling for weak Q1 and Q2 2023 earnings before a recovery in Q3 and Q4. 6

With corporate earnings backloaded, investors could begin to discount that growth sometime in the first half of the year.1 7

Take a look at our Q1 2023 Look Ahead here

Watch our narrated version here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: