Looking Ahead

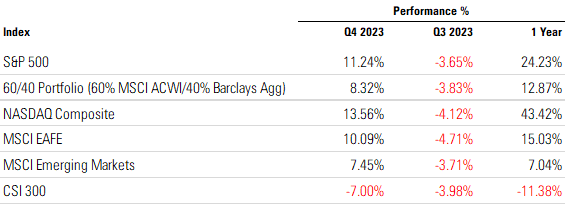

Equity markets rose in the fourth quarter, with the S&P 500 gaining more than 24% for the full year as investors have been navigating a steadily growing U.S. economy and an end to the Fed’s rate hiking cycle. 1

Take a look at how we see the coming quarter by clicking on this link to our Q1 2024 Look Ahead.

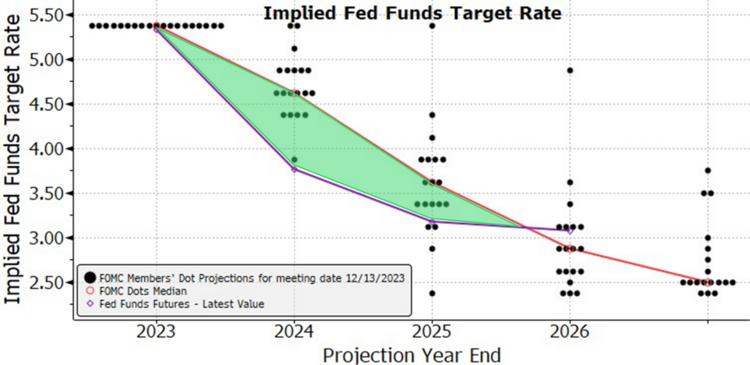

The Fed is going to cut rates in 2024, there seems to be no dispute about that. However, there is a divergence between what policymakers are forecasting (three rate cuts of about 0.75% in 2024) and what futures markets are implying (six rate cuts of about 1.5%) as shown in the green shaded area below. 1

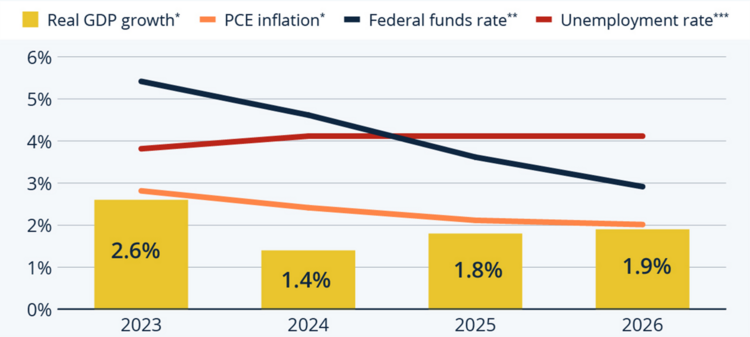

Are investors perhaps more pessimistic than Fed expectations? The Fed expects modest GDP growth, moderating inflation, and only a slight bump in unemployment in 2024. 2

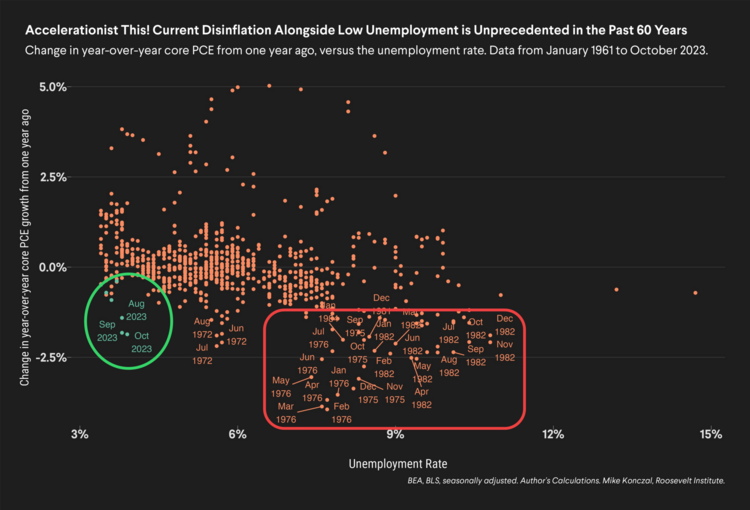

However historically it takes a rapid rise in unemployment to get inflation to moderate, and thus, see rapid rate cuts. 3

While there will be ongoing tension between what the Fed and investors expect in 2024, rate cuts can be great for equity and bond investors alike.

Our Look Ahead for Q1 lays this out in greater detail.

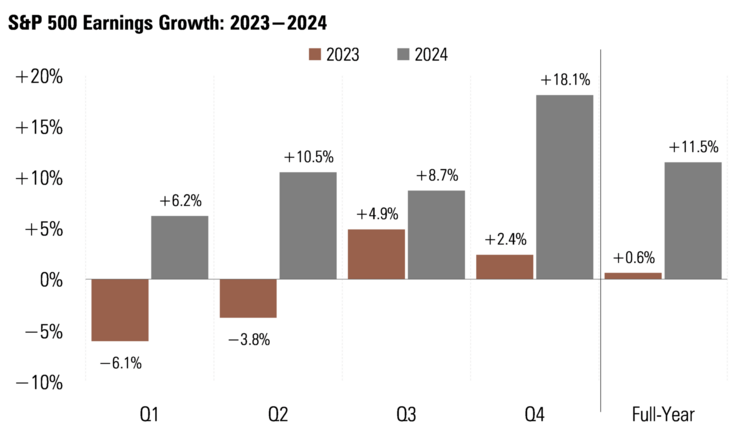

As for earnings growth, we are in a soft patch, but that should be in our rear-view mirror. The hurdle rate for 2022 earnings growth was hard to beat for calendar year 2023. Yet, 2024 by comparison, should get the benefit of the weak earnings growth seen in 2023. 4

In a world of chaos, with overlapping global crises over the last two years, it’s important to remember chaos is part of investing and it requires blinders at times.

As we head into the new year, reaffirming your investment strategy and maintaining strategic liquidity to cover spending needs remain top of mind. Click here to listen to all of our views and recommendations on what we think will happen in the coming quarter.

All of us at Phillips & Company wish you and your family a healthy, happy, and prosperous 2024.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: