Looking Ahead

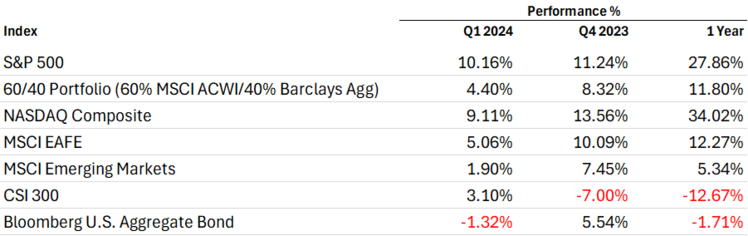

Equity markets rose in the first quarter, with the S&P 500 gaining more than 10%. Inflationary pressures eased only modestly in the quarter leaving investors guessing on interest rates. That provided a slight drag on fixed income in the quarter. 1

Take a look at how we see the coming quarter by clicking on this link to our Q2 2024 Look Ahead.

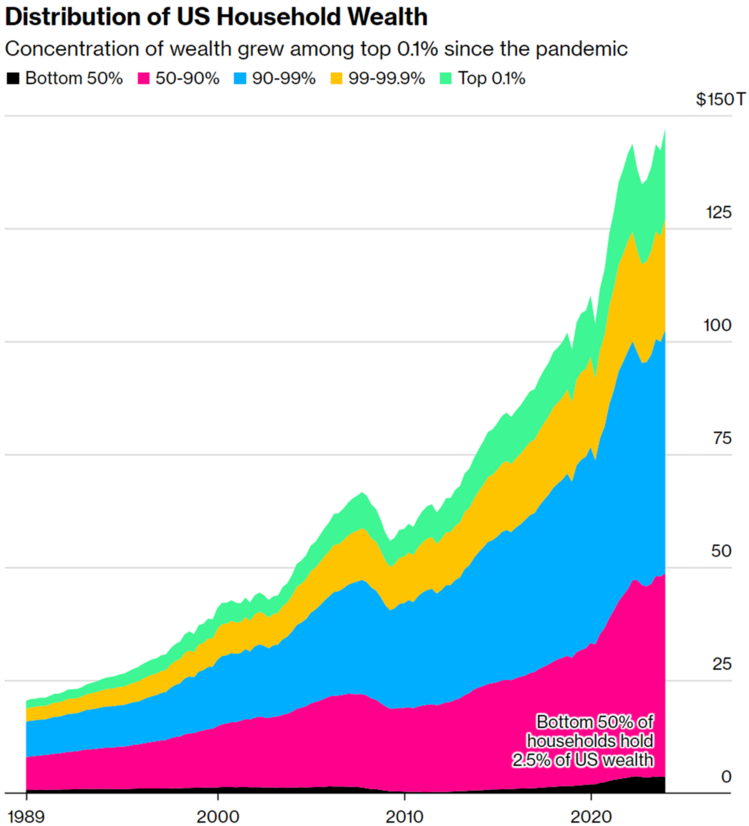

The U.S. consumer remains in great shape and wealth creation in the U.S. has been supercharged across most cohorts as U.S. consumers are reaping the benefits of a surging stock market and higher home values. 2

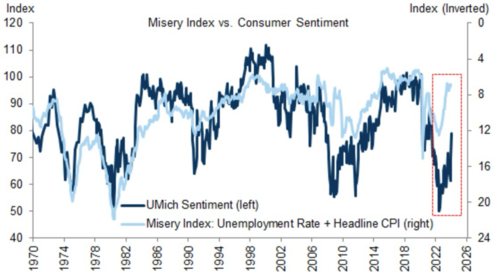

Yet the U.S. consumer is still miserable. According to Misery Index, which is calculated by adding the unemployment rate to the inflation rate, the U.S. is simply not feeling it. Most of this frustration is being driven by higher prices which could take some time to work through. 3

Continued misery might be the Achilles heel for the political class in America as well as the economy.

Our Look Ahead for Q2 lays this out in greater detail.

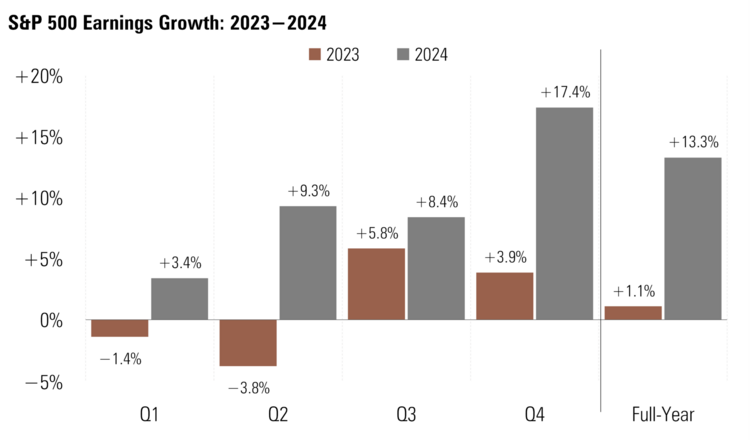

Corporate earnings results for the final quarter of 2024 signaled continued corporate strength. Earnings growth was close to 4%, with expectations for full-year 2024 earnings growth topping 13%. 4

While valuations are stretched, profit margins are expanding. With inflationary pressures easing and pricing remaining sticky, companies should reap the benefits of wider margins and higher profits.

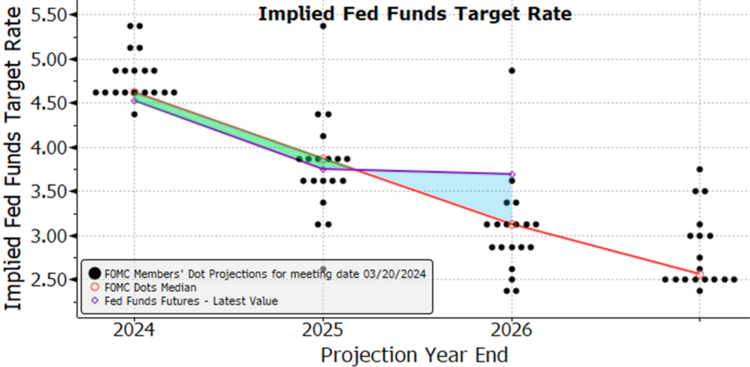

It’s been a bumpy road when it comes to interest rates and inflation. Coming into the year we knew of the large discrepancy between what the Fed was forecasting for rate cuts and what Wall Street believed was the making of market risk.

Today that picture looks entirely different. Wall Street is trending much closer to the Fed’s forecast than their prior forecast (green shading), However, beyond 2025 futures suggest a higher-for-longer approach compared to the Fed. We concur that the Fed Funds rate will likely rest around the 4% level. 1

Click here to listen to all of our views and recommendations on what we think will happen in the coming quarter.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: