Looking Ahead

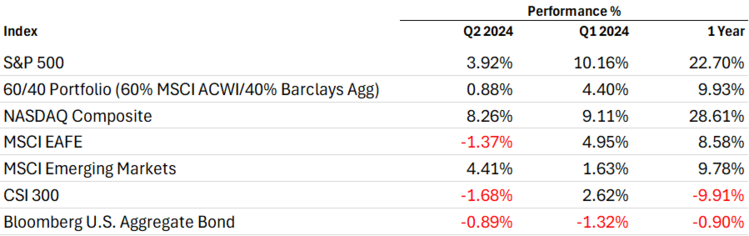

Overall equity markets rose in the second quarter, with the S&P 500 gaining 3.92% as investors have been digesting a mix of economic data points, including signs of a cooling labor market, receding inflation, as well as an evolving Fed policy outlook as the U.S. election cycle heats up for summer. 1

Take a look at how we see the coming quarter by clicking on this link to our Q3 2024 Look Ahead.

Consumer Strength – Work, Wages, & Wealth

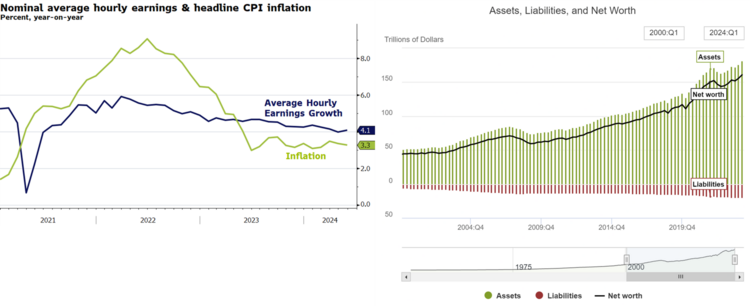

The U.S. consumer remains resilient. Wage growth continues to outpace inflation, albeit at a moderating pace, and household wealth has reached record levels driven by a surging stock market and increased home values. 2 3 4

While the U.S. consumer at the lower-end may show more strain in Q3, we expect the top 60% of income earners – which account for 79% of consumption – to continue driving results and provide a strong buffer against higher interest rates and slowing U.S. economy.

Our Look Ahead for Q3 lays this out in greater detail.

Economic Air Pockets

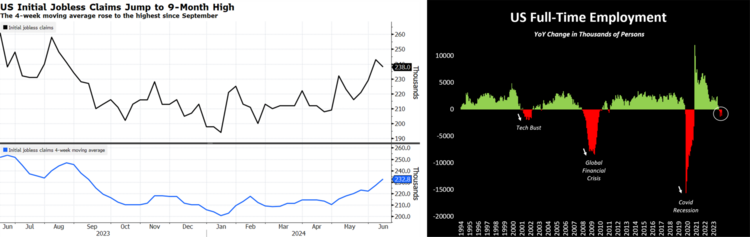

But not everything in the economy has been rosy and there’s a bit of an air pocket forming that could cause some economic turbulence. Initial applications for U.S. unemployment benefits continue to rise and full-time employment is on the decline, pointing to a labor market that continues to cool. 5 6

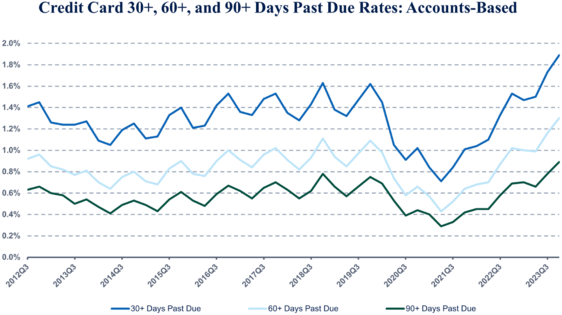

On the consumer side, credit card delinquencies were the highest on record in the first quarter, underscoring a notable downshift in consumer spending. So, while not perfect, the U.S. economy is chugging along with some drag effect in certain pockets. 7

Supercore = Super Tight

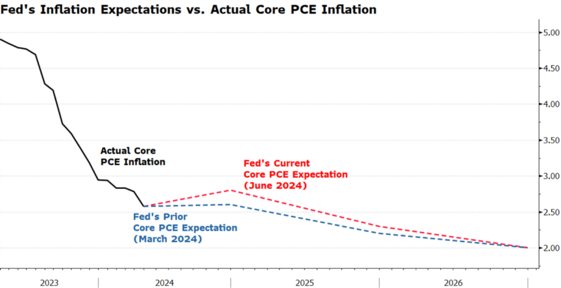

The Fed’s preferred gauge of inflation, core PCE, has been trending down on a year-over-year basis while the Fed’s 2024 core PCE inflation projection rose 0.2% to 2.8%, lowering the bar slightly for incoming inflation data to meet the FOMC’s expectations and keep rate cuts on track. 8

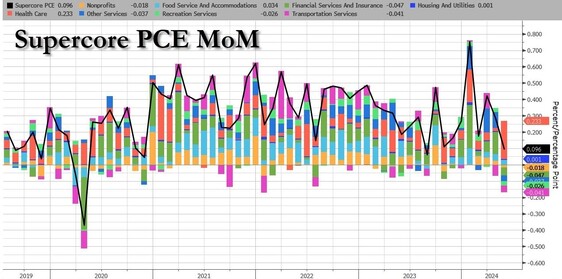

And when you take out the flawed housing measurements (“Supercore”), the economy is actually trending towards deflation territory. 9

With inflation moderating and the Fed stuck on a higher for longer path, monetary policy is getting super tight, and it will careen into a reluctant consumer unless the Fed cuts sooner rather than later.

Elections – Policies, Personalities, Perceptions, & Earnings

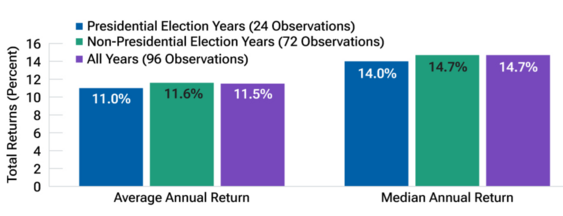

However anxious Americans are about the upcoming U.S. presidential election, the investment thesis still suggests strong market returns during Presidential election years. While the risk (volatility)/reward is not as beneficial, the historic returns are still solid. 10

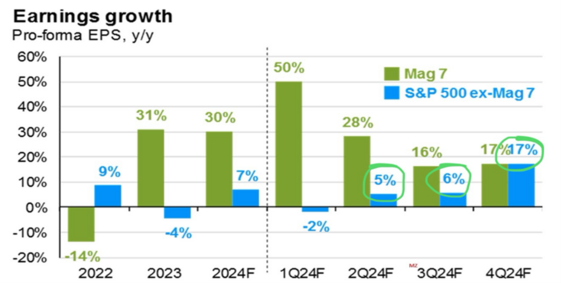

U.S. elections have consequences for taxes, spending, and geopolitics. So do earnings. The second half of 2024 looks to be very strong for corporate earnings growth rates (ex-Magnificent 7) and that’s likely to continue driving the current equity rally. 11

Click here to listen to all our views and recommendations on what we think will happen in the coming quarter.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://www.bls.gov/ces/

- https://www.bls.gov/cpi/

- https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/chart/

- https://www.dol.gov/ui/data.pdf

- https://www.bls.gov/cps/earnings.htm

- https://www.philadelphiafed.org/surveys-and-data/large-bank-credit-card-and-mortgage-data

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240612.pdf

- https://www.bea.gov/data/income-saving/personal-income

- https://www.troweprice.com/financial-intermediary/us/en/insights/articles/2024/q2/how-do-us-elections-affect-stock-market-performance.html

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?slideId=equities/gtm-mag7perfomance