Looking Ahead

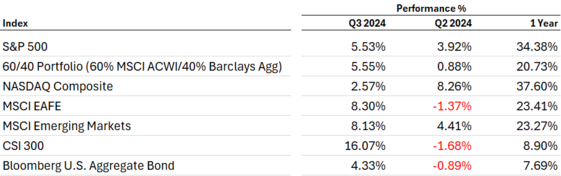

Equity markets maintained their upward momentum in the third quarter. For the first time in several quarters, large cap core outperformed growth. As interest rates began to decrease, we witnessed a tech sector recovery late in the quarter. This rate reduction also boosted bond market performance, particularly for longer-duration bonds. The Chinese government’s substantial fiscal and monetary stimulus towards the quarter’s end sparked a strong relief rally in China and emerging markets. 1

Take a look at how we see the coming quarter by clicking on this link to our Q4 2024 Look Ahead.

Are We Recession Bound?

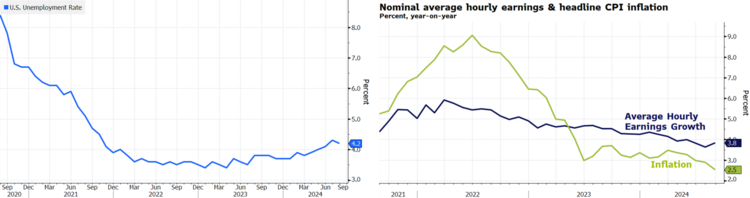

Examining typical recession indicators, unemployment remains low while wage growth now exceeds inflation, offering some relief from high prices. 2 3

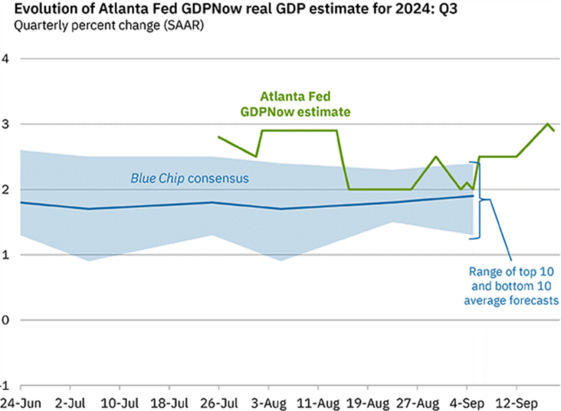

The current 3% GDP growth forecast suggests we’re not in a recession. While conditions can shift, current trends indicate Q4 2024 and Q1 2025 are unlikely to face significant recessionary pressures. 4

Our Look Ahead for Q4 lays this out in greater detail.

Economic Weakness Is Lurking in the Shadows

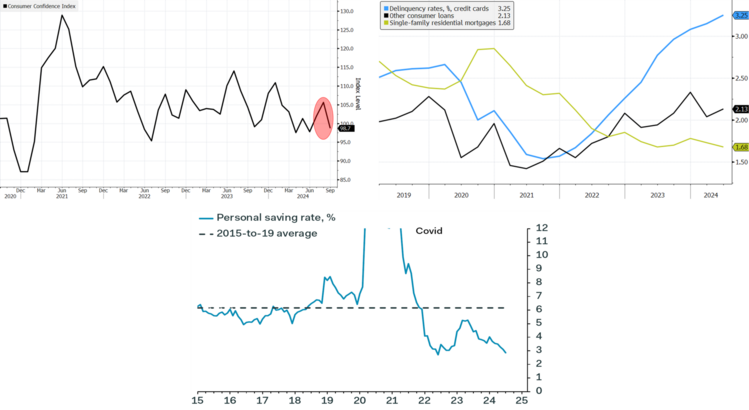

Despite apparent stability on the surface, underlying economic currents hint at potential challenges. Consumer confidence has dipped to 2021 lows, credit card delinquencies are increasing, and personal savings have fallen below long-term averages. 5 6 7

These early warning signs merit close attention, as they are early indicators of potential recessionary threats.

These topics and more are explored more extensively in our Q4 Look Ahead.

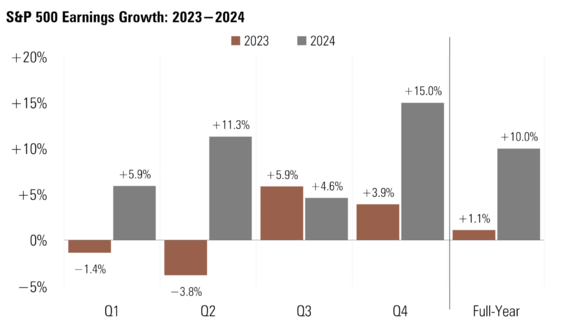

Earnings Still Matter

In the long run, one truth remains constant: earnings still matter. Q2 2024 saw impressive corporate earnings. This momentum is expected to continue, with projections pointing to a robust 10% earnings growth for the full year 2024. 8

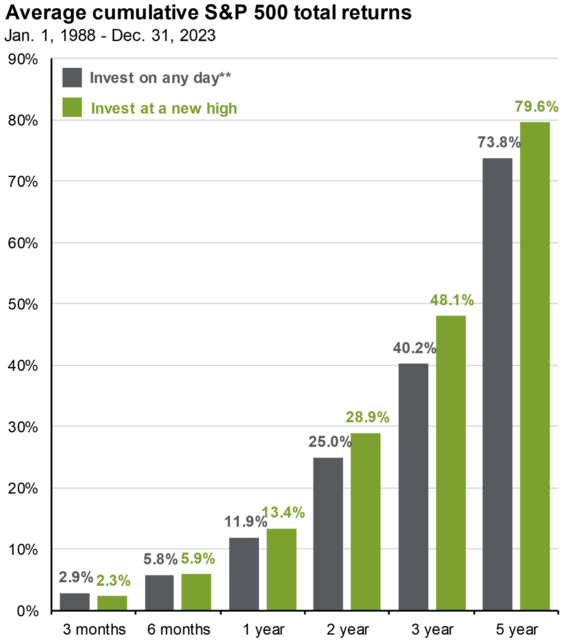

While P/E multiples typically expand following Fed rate cuts, economic growth remains vital for equity prices. Despite high valuations, historical data suggests that investing during market peaks doesn’t significantly impact long-term returns. 9

Click here to listen to all our views and recommendations on what we think will happen in the coming quarter.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://fred.stlouisfed.org/graph/fredgraph.png?g=1uzuv

- https://fred.stlouisfed.org/graph/fredgraph.png?g=1uzuS

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.conference-board.org/pdf_free/press/TCB-ConsumerConfidence_US-2024_09_Press.pdf

- https://www.philadelphiafed.org/surveys-and-data/2024-q1-large-bank

- https://www.bea.gov/news/2024/personal-income-and-outlays-july-2024

- https://advantage.factset.com/hubfs/Website/Resources Section/Research Desk/Earnings Insight/EarningsInsight_092024A.pdf

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=investing-principles/gtm-investingalltimehighs

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.