Looking Ahead

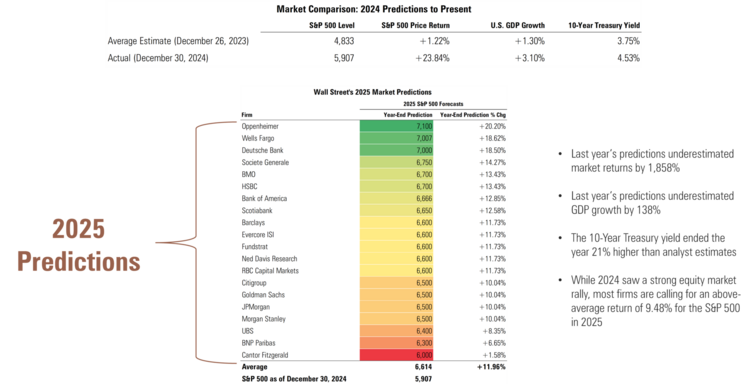

Wall Street’s annual tradition of “precise inaccuracy” is upon us again, offering a perfect moment to reflect on its forecasting ability. At the end of 2023, they projected a mere 1.22% gain for the S&P 500 in 2024, underestimating actual performance by over 1,800%, while their GDP growth forecast undershot reality by 138%. For 2025, they’re predicting slightly above-average market returns for the S&P 500. Let’s see how that turns out this time next year. 1

Take a look at how we see the coming quarter by clicking this link to our Q1 2025 Look Ahead.

Trump 2.0

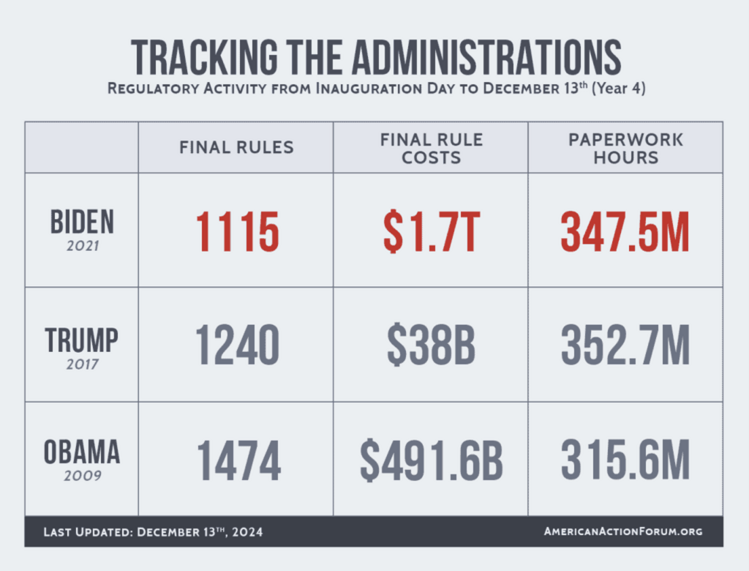

Performance in 2025 will likely be dictated by the Trump administration’s policy agenda for much of the year. Policy adjustments, including tariff adjustments and regulatory reforms, are making waves. Reducing Biden-era regulations, which cost $1.8 trillion (1.5% of GDP), could drive significant growth. 2

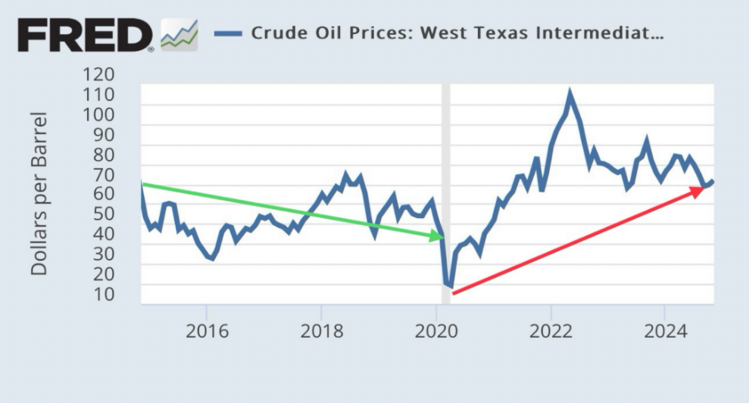

Energy deregulation will also take center stage. Increased domestic oil and gas production could lower energy prices, offering relief at the pump and potentially reducing inflationary pressures. 3

These topics and more are explored more extensively in our Q1 Look Ahead.

Earnings Still Matter

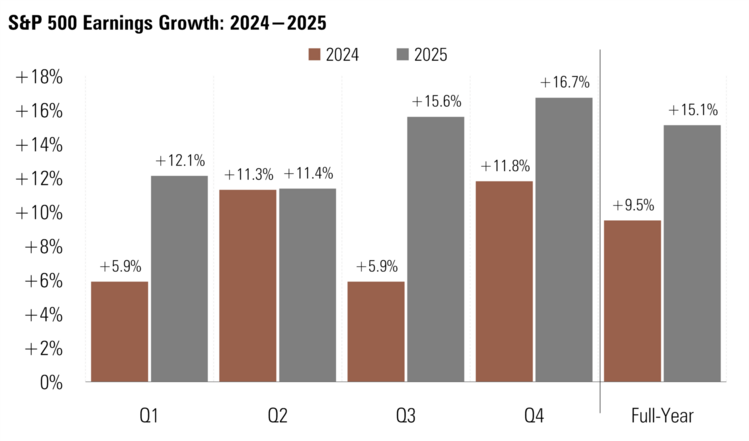

Corporate earnings showed strong Q3 2024 performance, with forecasts of 12% growth in Q4 and over 15% for 2025. 4

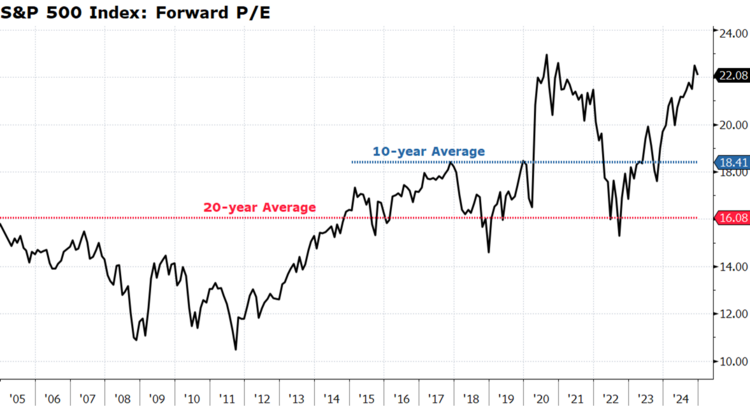

Looking forward, P/E multiples are currently close to record highs and well above 10-year and 20-year averages. 1

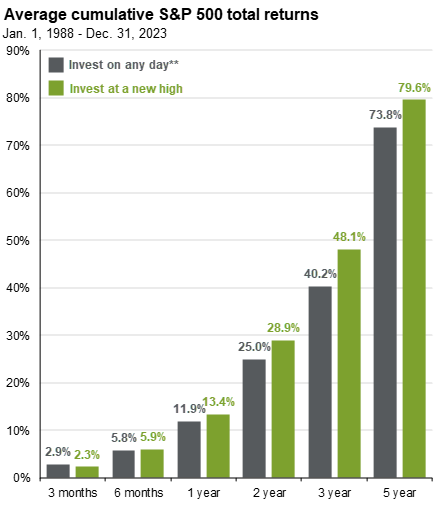

Despite concerns about high valuations, historical data shows investing at market peaks has yielded returns exceeding 5% across all but the shortest timeframes. 5

As we navigate through 2025, multiple catalysts could drive market performance despite historically high valuations. Strong corporate earnings growth, regulatory relief, and energy sector reforms present compelling opportunities – suggesting that maintaining a disciplined, long-term investment approach remains prudent even at current valuation levels.

Click here to listen to all our views and recommendations on what we think will happen in the coming quarter.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://www.americanactionforum.org/daily-dish/what-next/

- https://fred.stlouisfed.org/graph/?g=1AmNz

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_121224.pdf

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=investing-principles/gtm-investingalltimehighs

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.