Looking Ahead

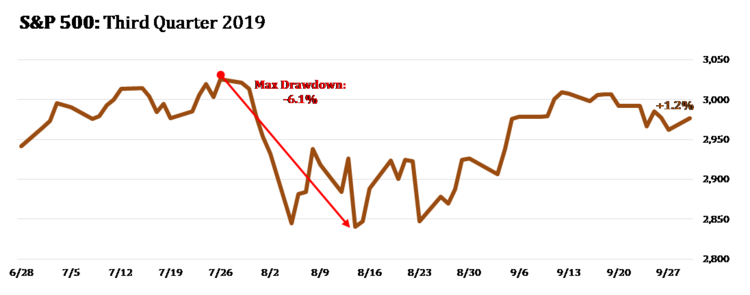

With all of the noise and turmoil in the third quarter, the S&P 500 ended with a small 1.2% gain. Between trade wars, oil disruptions, impeachment proceedings, and weakening domestic manufacturing data, it’s a wonder we didn’t experience more of a drawdown than 6.1% this quarter. [i]

While there is no doubt U.S. manufacturing activity is slowing, the U.S. consumer remains extraordinarily strong and it is our view that we are finally emerging from a prolonged earnings recession.

A complete turnaround may be in sight, but we believe Trump needs to resolve the trade war with China in order to see a recovery in the critical manufacturing sector as he heads into his re-election bid.

Take a look at our Look Ahead here to see all of our views in-depth.

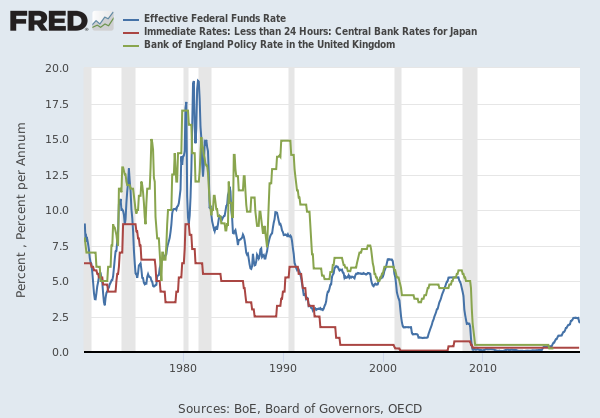

We know central banks are essentially ‘dropping money from helicopters’ in an effort to stimulate their respective economies, and it looks fairly coordinated. [ii]

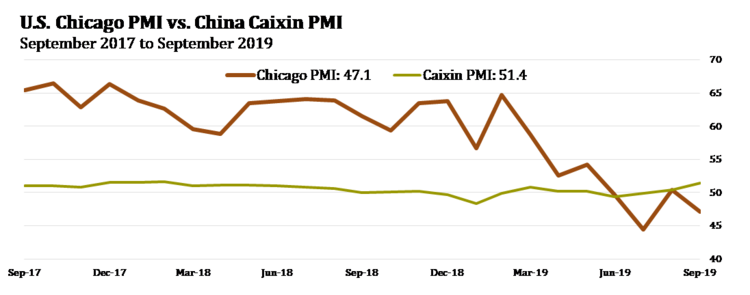

One major misconception in the market right now is the belief that Chinese manufacturing is slowing similar to the United States. That’s simply not the case, as shown in the chart below. [iii] [iv]

In fact, Chinese manufacturing is on a slight uptick, no doubt putting pressure on Trump to resolve the trade dispute heading into the 2020 election. It’s evident that he won’t achieve much with the domestic economic weaponry currently at his disposal.

We are facing some external threats as well and while that is not anything unusual, some of those threats could be significant in Q4. Take a look at those on slide 10 of our Q4 Look Ahead here.

Let’s get ready for Q4 and hope corporate earnings and the U.S. consumer act as guardrails against any destabilizing events in the next 90 days.

To see our views in their entirety, please click here for the PDF version and if you would like my narrated version click here.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://fred.stlouisfed.org/graph/fredgraph.png?g=nJKI&height=400&nsh=1&trc=1&width=600

iii. https://www.instituteforsupplymanagement.org/ismreport/mfgrob.cfm?SSO=1

iv. https://www.caixinglobal.com/index/