Looking Ahead

We just published our Q4 Look Ahead, you can view the presentation here or watch our narrated version here.

Heading into the end of 2020, our areas of focus are centered on:

The U.S. Consumer and a return to pre-pandemic consumption patterns.

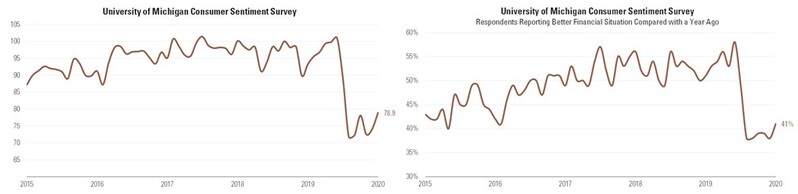

Despite increasing infection rates, political instability, and social unrest, the U.S. consumer seems to be more optimistic than expected. [i]

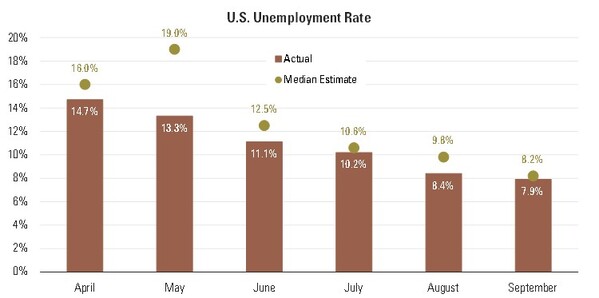

While confidence is one piece of the puzzle, the ability to spend on any sustained basis requires jobs, which have been recovering at a faster rate than anticipated. [ii]

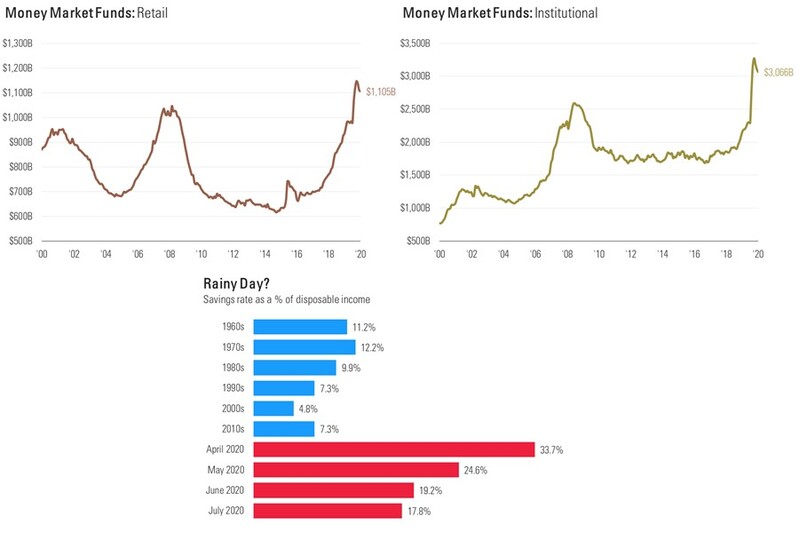

Add to that the record amounts of cash sitting in money market funds and we have the potential to add almost $2 trillion back into the economy if consumer spending habits normalize to pre-pandemic levels. [iii] [iv] [v]

The Earnings Cycle

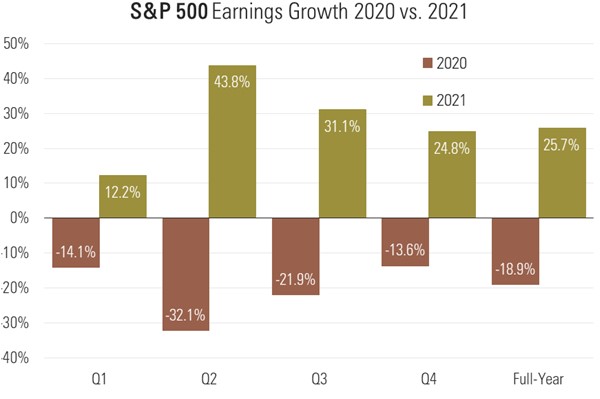

As we’ve mentioned here before, by any conventional wisdom, stocks currently look overvalued but, we are entering a year-over-year earnings growth cycle with the easiest comps to beat in a generation. [vi]

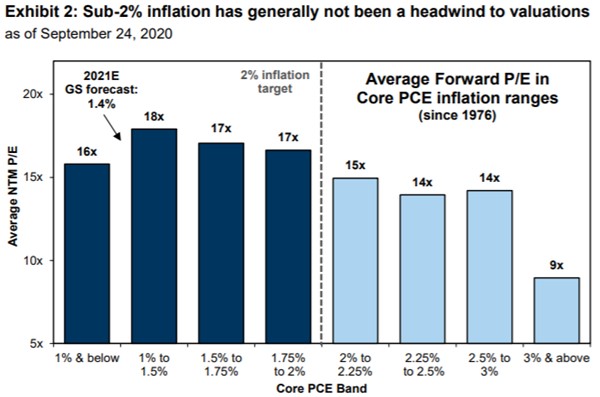

Inflation & Interest Rates

The Fed’s interest rate policy shift—whereby they will be targeting 2% average inflation over time instead of the previous hard 2% target—has changed the paradigm and has institutionalized lower interest for longer. [vii]

China’s Long Road Back to Global Dominance

You can view our dedicated Q4 China Look Ahead here or watch the narrated presentation here.

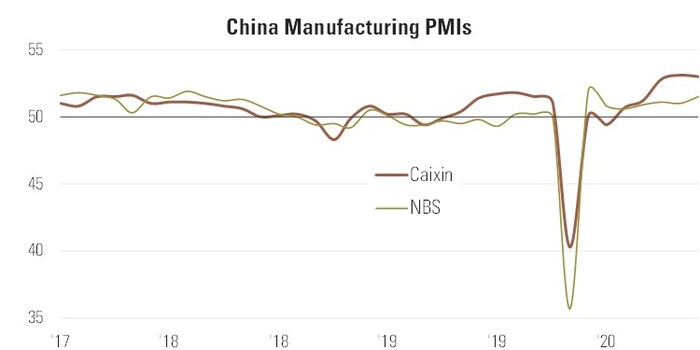

China continues apace in their recovery from COVID-19 with high frequency indicators like restaurant activity and steel demand back to pre-pandemic levels and manufacturing activity growing again. [viii]

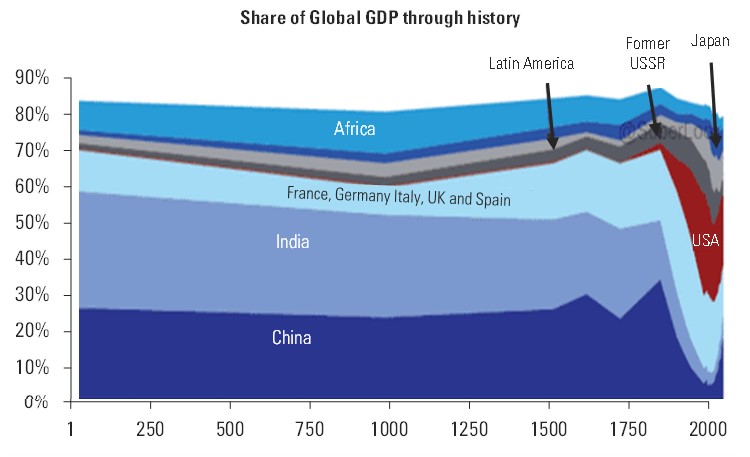

Favorable earnings, GDP growth, and forward valuations underpin our thesis that China may be ascending back to a position of global leadership and as a strong competitor to the United States – a position they held for a millennia until about 250 years ago. [ix]

Take a look at our Q4 2020 Look Ahead here.

Watch our narrated Q4 2020 Look Ahead here.

View our Q4 2020 China Look Ahead here.

Watch our narrated Q4 2020 China Look Ahead here.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. http://www.sca.isr.umich.edu/

ii. https://fred.stlouisfed.org/series/UNRATE

iii. https://fred.stlouisfed.org/series/PSAVERT

iv. https://fred.stlouisfed.org/series/WRMFSL

v. https://fred.stlouisfed.org/series/WIMFNS

vi. https://insight.factset.com/topic/earnings

vii. https://research.gs.com/

viii. https://www.cnbc.com/2020/09/30/china-economy-september-2020-official-caixin-manufacturing-pmi.html

ix. https://www.rug.nl/ggdc/historicaldevelopment/maddison/?lang=en