Looking Ahead

We just published our Q2 2021 Look Ahead, you can view the presentation here or watch our narrated version here.

Consumer Strength – Close to Liftoff

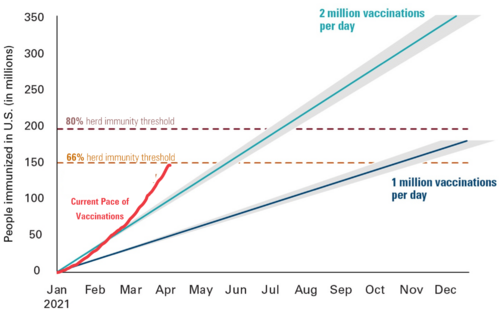

The coming quarter will be a period of rapid reopening, with COVID-19 vaccine availability occurring much faster than anticipated. By mid-April, 90% of all adults in the United States will be eligible for a vaccine and we could reach herd immunity by mid-May. [i]

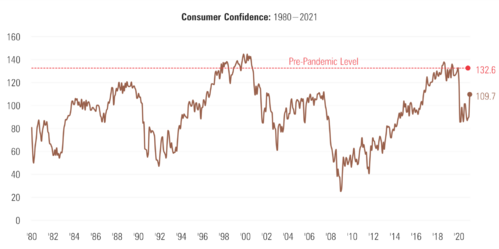

That will likely push up consumer confidence to pre-pandemic levels, an important step in getting consumers back to pre-pandemic levels of spending. [ii]

Interest Rates & The Fed

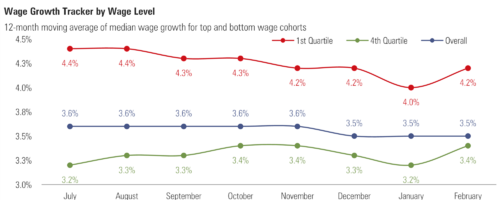

We know the Fed has two mandates: maximum employment and price stability. Midway through the pandemic, the Fed basically threw the price stability mandate to the wind and concentrated on maximum employment, with wage growth focused towards lower-wage cohorts. [iii]

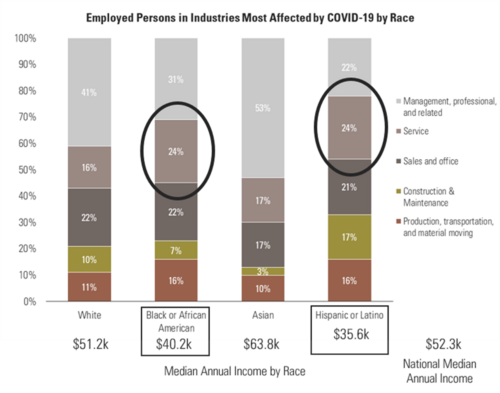

Looking at those in lower-wage industries – mostly in the service sector – you can see African Americans and Hispanics impacted the most and its clear the Fed wants to boost those wages before addressing inflation. [iv]

Take a look at our Q2 2021 Look Ahead here

Watch our narrated Q2 2021 Look Ahead here

Fixed Income – A Tough Year Ahead

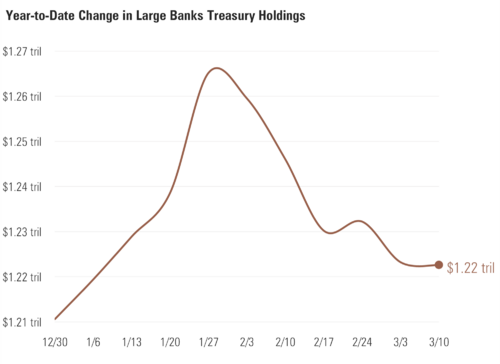

Banks have been sitting on massive levels of Treasuries and recently started selling those due to some changes in Federal Reserve policy. [v]

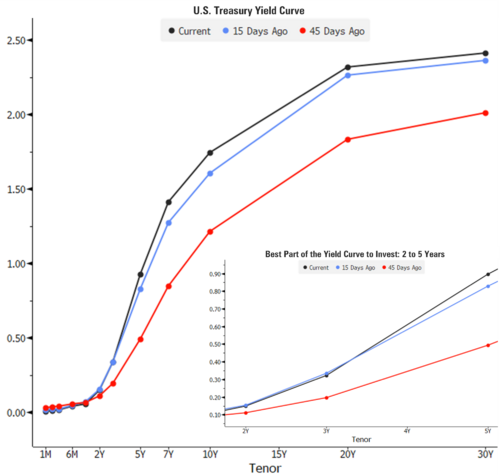

The safest part of the yield curve could be in the two-to-five-year range, but this could pose some challenges for fixed income managers in addition to lowering income and reducing some of the benefits to fixed income investing. [vi]

Emerging Markets

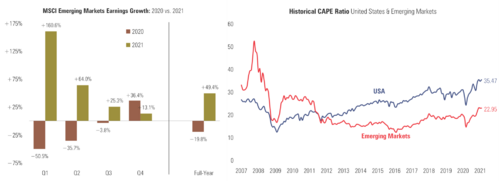

Emerging markets should have much higher earnings growth rates—at much lower valuations—than developed markets and the United States market. [vii]

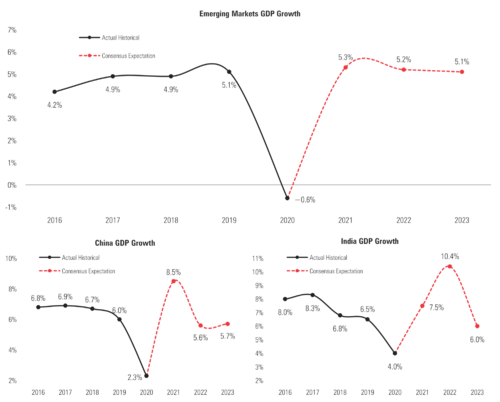

We expect emerging economies to return to pre-pandemic GDP growth rates in Q2, and both India and China to have tremendous economic activity throughout the rest of 2021 and 2022. [viii]

Take a look at our Q2 2021 Look Ahead here

Watch our narrated Q2 2021 Look Ahead here

Commodity Cycle – Cyclical or Secular?

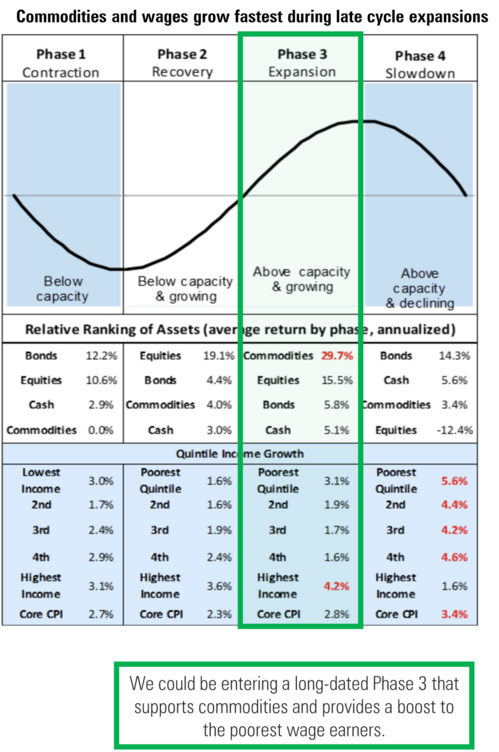

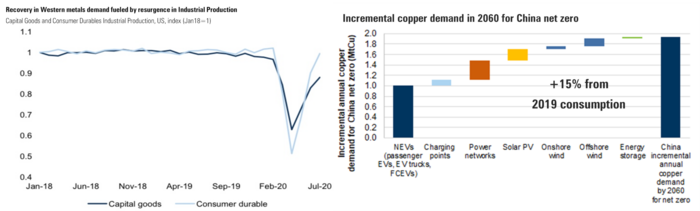

We continue to believe we are in the early innings of a cyclical bull market in industrial metals –particularly copper– and rare earths. We think we are in a recovery and expansion phase that will boost returns in commodities and also lift lower wages. [ix]

While industrial production will be a main driving force, a shift to electric vehicles in China will be a persistent factor for copper demand in the coming decades. [ix]

This will be a challenging quarter for investors and our hope is this look ahead will provide some clarity.

Take a look at our Q2 2021 Look Ahead here

Watch our narrated Q2 2021 Look Ahead here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://ourworldindata.org/coronavirus

ii. https://conference-board.org/data/consumerconfidence.cfm

iii. https://www.frbatlanta.org/chcs/wage-growth-tracker

iv. https://www.bls.gov/data/tools.htm

v. https://fred.stlouisfed.org/series/TASLCBW027SBOG

vi. https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

vii. https://indices.barclays/IM/21/en/indices/static/shiller.app

viii. https://www.bloomberg.com/news/articles/2021-03-12/charting-the-global-economy-u-s-is-turbocharging-the-world-gdp

ix. https://research.gs.com/