Looking Ahead

We just published our Q3 2021 Look Ahead, you can view the presentation here or watch our narrated version here.

The Consumer is in Control

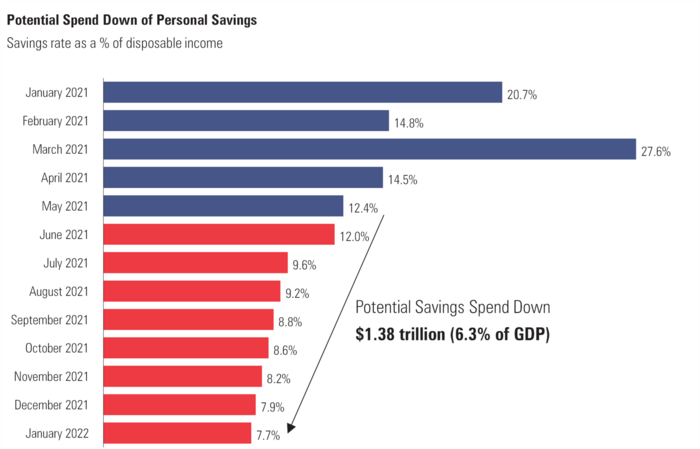

The U.S. Consumer has stockpiled approximately $2.3 trillion in savings, or 10.4% of GDP. As the economy reopens, we expect consumers to continue to spend down their savings, and it is not far-fetched to see the personal savings rate return to pre-COVID levels by January 2022. [i]

Take a look at our Q3 2021 Look Ahead here

Watch our narrated Q3 2021 Look Ahead here

But it will be a Bumpy Ride back to Normal

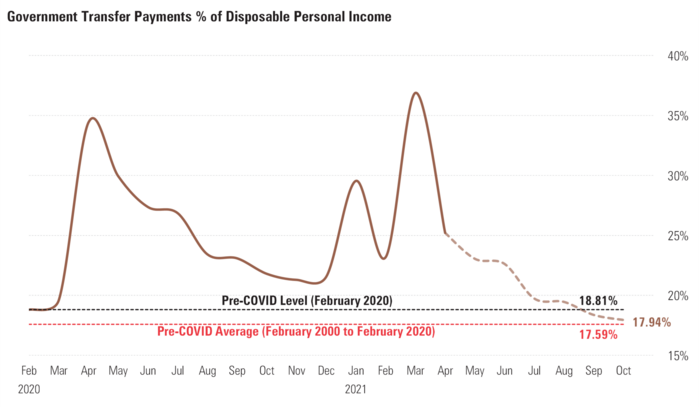

Government transfer payments as a share of disposable income remain elevated but, are declining. If the next few months follow a similar trajectory as Q2-Q3 2020, we could see this ratio decline back to pre-COVID levels by October. [ii]

We are still 6.9 million jobs below pre-pandemic levels. With 26 states cutting off extended unemployment benefits early and the “get off the couch” wage falling from $19.35/hour to $11.85/hour, a return to work will likely accelerate and wage inflation could perhaps lessen in the coming months.

Click here to see the timing and trajectory of when we believe a full jobs recovery could take place.

Higher Inflation – Lots of Noise, Not Enough Signal

Headline CPI for May was reported at a whopping 5%. [iii]

When breaking the components of the Consumer Price Index down, we find that the culprits driving inflation right now are areas that were hit the hardest by the pandemic.

So, what’s ahead? Right now, much of the inflation we are seeing is cost-push inflation, which is generally transitory. Click here to see why we believe high inflation is transitory.

Take a look at our Q3 2021 Look Ahead here

Watch our narrated Q3 2021 Look Ahead here

Federal Reserve & Fiscal Policy

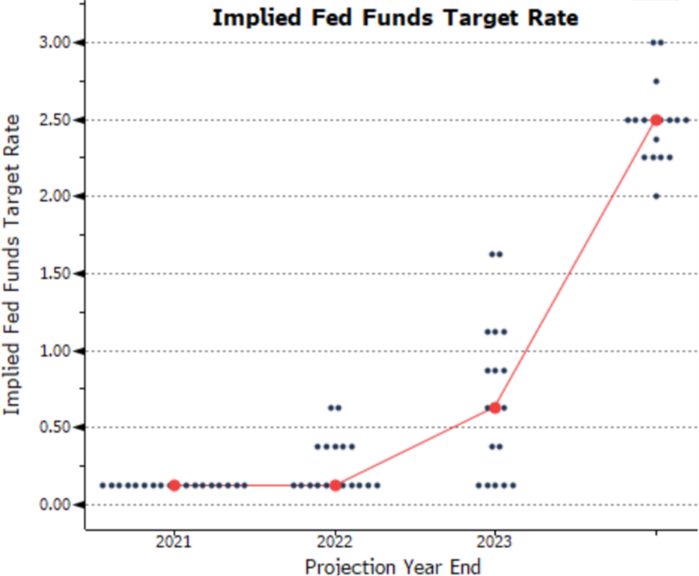

The Federal Reserve should continue to institutionalize lower rates, with the latest projections from the FOMC suggesting no rate hikes in the coming year or two. [iv]

Yet, ongoing talk of the Fed tapering bond purchases may add to market volatility. When might the Fed begin the tapering process? Click here to see what happened last time and our timeline for when the tapering process could begin.

Take a look at our Q3 2021 Look Ahead here

Watch our narrated Q3 2021 Look Ahead here

Emerging Markets

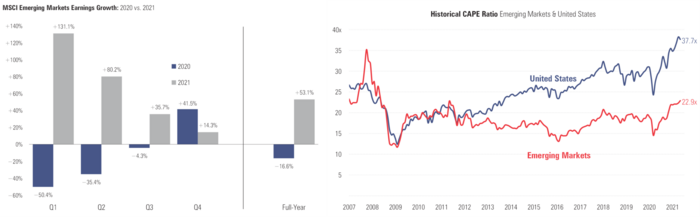

With Emerging Market valuations trading at a 39% discount to the U.S. and 2021 EPS expected to grow at 17.9% above the U.S. EPS growth rate, Emerging Markets remain the favorite within the broad spectrum of equity investing. [v] [vi]

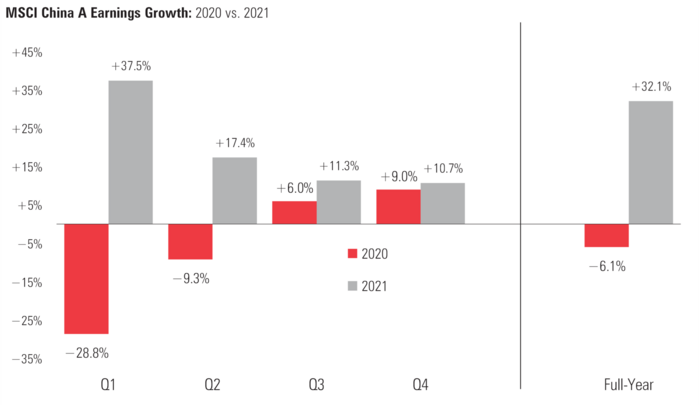

China, in particular, presents a clear opportunity. After achieving a post-pandemic recovery well-ahead of other countries, “Return to Normal” sentiment has led market participants to take profits in Chinese equities, which has led to muted returns so far this year. [vii]

However, earnings growth expectations for China remain amongst the best globally. [viii]

Click here to learn more about our case for Emerging Markets, and China specifically.

Take a look at our Q3 2021 Look Ahead here

Watch our narrated Q3 2021 Look Ahead here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/PSAVERT

ii. https://fred.stlouisfed.org/graph/?g=FaKh

iii. https://fred.stlouisfed.org/graph/?g=EFWY

iv. https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20210616.htm

v. https://www.msci.com/our-solutions/index/emerging-markets

vi. https://indices.barclays/IM/21/en/indices/static/shiller.app

vii. https://www.bloomberg.com/quote/SHSZ300:IND