Looking Ahead

We just published our Q4 2021 Look Ahead, you can view the presentation here or watch our narrated version here.

Jobs + Wages = Consumers

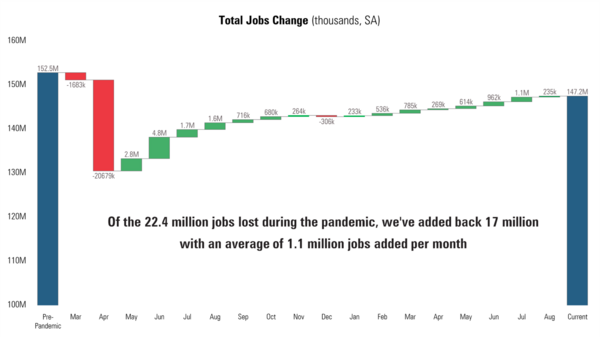

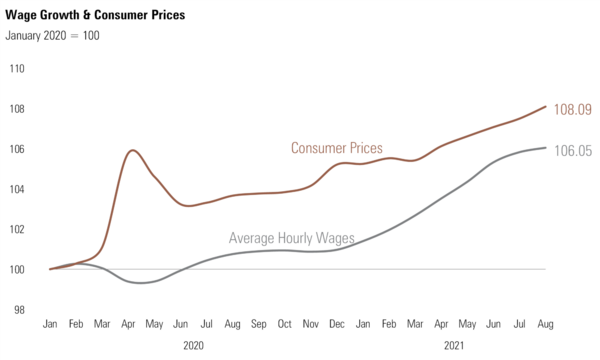

We expect wages and jobs to drive consumer behavior in the fourth quarter.

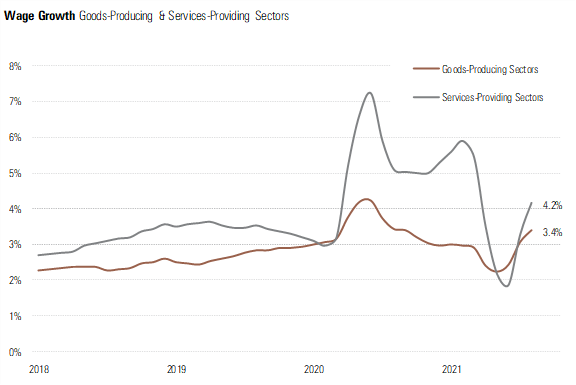

Rising wages, especially in the lower-wage service sector, are continuing to put more firepower in the hands of consumers. [i]

This should pull more workers off the sidelines and fill the unemployment gap which currently stands at 5.3 million jobs below pre-pandemic levels. [i]

Take a look at our Q4 2021 Look Ahead here

Watch our narrated Q4 2021 Look Ahead here

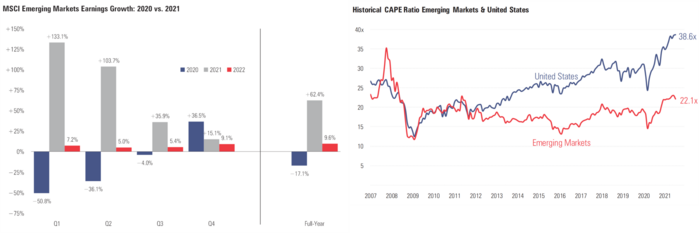

Are we at peak earnings growth?

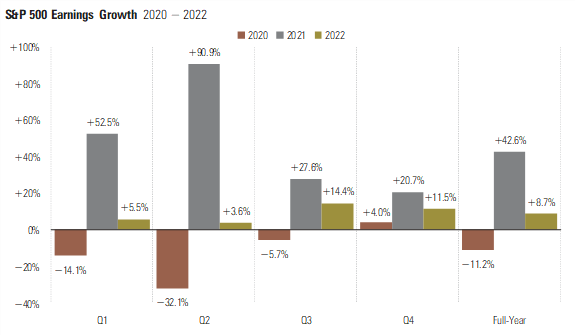

Corporate earnings growth has been strong and expectations for Q3 earnings are remarkable. However, with the pandemic base effect waning, the path forward becomes more challenging. [ii]

Inflation – Noise or Signal?

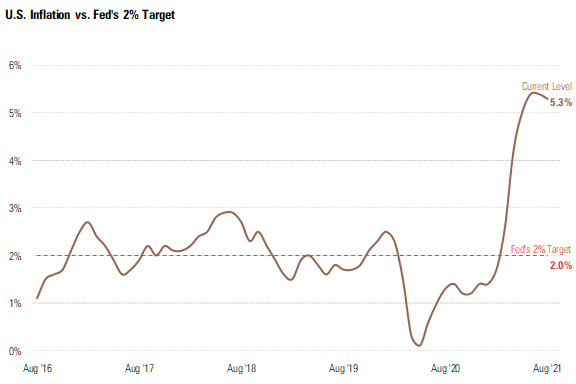

The base effect is still driving high inflation which is persistently running above the Fed’s 2% target. [iii]

With wages rising, while not in lock step with inflationary pressures, the net impact will be higher quality consumption for a larger population base. That should find its way into corporate earnings in the coming years. [i]

Take a look at our Q4 2021 Look Ahead here

Watch our narrated Q4 2021 Look Ahead here

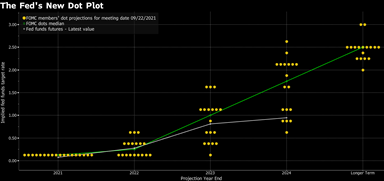

Tapering

The Federal Open Market Committee left the funds rate target range unchanged at 0–0.25% at the September meeting. [iv]

The statement noted that a reduction in the pace of asset purchases “may soon be warranted,” paving the way for the FOMC to announce the start of tapering at its November meeting.

What could tapering mean for the markets? Tapering doesn’t necessarily mean yields will spike higher. In the previous period of tapering, yields rose prior to the onset of tapering in 2013 but then fell during the implementation period. [v]

Take a look at our Q4 2021 Look Ahead here

Watch our narrated Q4 2021 Look Ahead here

Emerging Markets & China

From an earnings growth and valuation perspective, Emerging Markets remain favorable within the broad spectrum of equity investing. [vi]

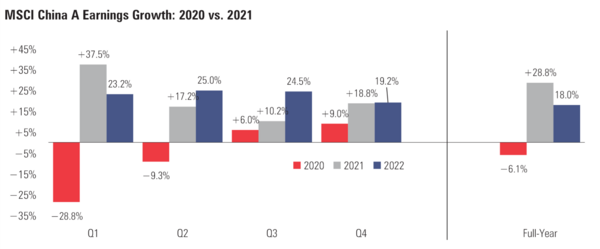

In China, the A-share market took a tumble in Q3 out of fear the CCP would move unilaterally against various industries.

But corporate earnings expectations remain strong, even with the pandemic base effect waning. [vi]

Our View

As we head into the fourth quarter, we anticipate Inflationary pressures will moderate and supply chain and employment issues abate. We expect the Federal Reserve will begin to wean investors off easy monetary policy, which could drive volatility in rates. We continue to see emerging markets as the best valuation and growth opportunity for equity investors, especially China where investors must take a long view on China to capture their growing middle-class consumer.

Take a look at our Q4 2021 Look Ahead here

Watch our narrated Q4 2021 Look Ahead here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bls.gov/

ii. https://insight.factset.com/topic/earnings

iii. https://www.bls.gov/cpi/

iv. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210922.pdf

v. https://www.schwab.com/resource-center/insights/content/fomc-meeting

vi. Bloomberg terminal