Looking Ahead

We just published our Q2 2022 Look Ahead, you can view the presentation here or watch our narrated version here.

Consumer Strength is Weakening

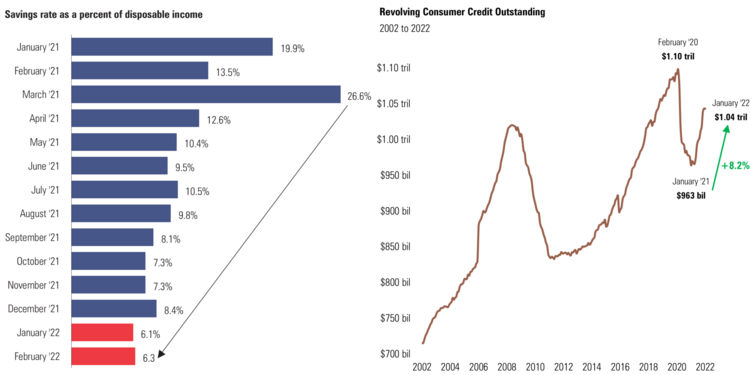

While wages have been lifting dramatically since the full re-opening of the economy, the consumer is facing some challenges. Savings have been spent down and consumers are now leaning into revolving credit versus savings to augment their spending. 1 2

The critical headwind will be sentiment. With rising interest rates, high inflation, and a ground war in Europe, the consumer might withdraw some of their “animal spirits,” impairing corporate earnings in the near-term.

Take a look at our Q2 2022 Look Ahead here

Watch our narrated version here

Inflation – Will it Transition?

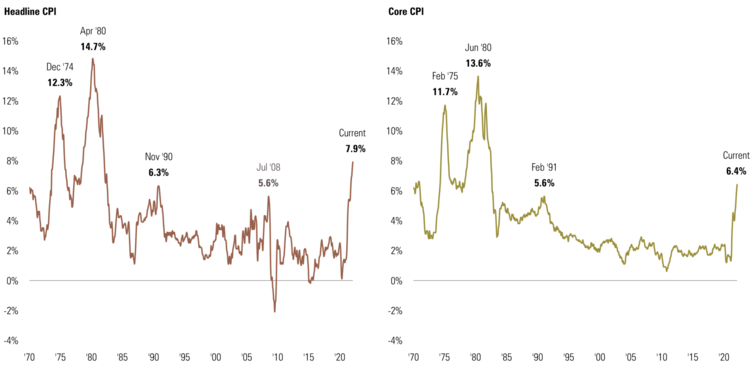

Record inflation is on everybody’s mind, with headline and core CPI both at levels not seen since the late 1970s. 3

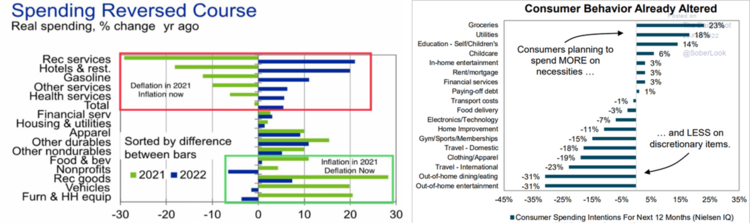

The base effect is still a contributing factor and the persistent inflationary backdrop is shifting consumer behavior from discretionary to less-discretionary spending which is another indicator of an increasingly reluctant consumer. 4 5

Take a look at our Q2 2022 Look Ahead here

Watch our narrated version here

Interest Rates & the Fed

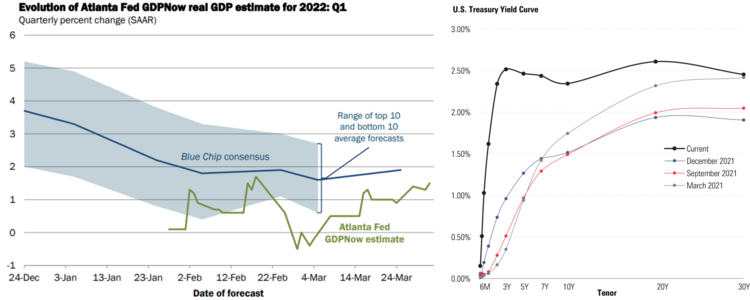

The risk of Fed policy errors is growing. With their current dual mandate of full employment along with price stability, they’re leaning heavily on rate increases to lower inflation.

With Q1 GDP growth expected to be muted and the yield curve flattening at the long end, there is a real possibility the Fed could induce a targeted, sector-driven recession later in 2022. 6 7

Take a look at our Q2 2022 Look Ahead here

Watch our narrated version here

Global Disruptions

Europe could flirt with a negative print on GDP growth in Q2 2022 induced by higher energy prices and a prolonged Russia/Ukraine war. 8

While the Russia/Ukraine war has ushered in another layer of U.S.-China tensions, we continue to believe China offers the best growth profile in the world. 9

For more on China macroeconomic policy, please watch our interview with Andrew Polk, co-founder and head of economic research at Trivium China, our Beijing-based research partner.

Take a look at our Q2 2022 Look Ahead here

Watch our narrated version here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bea.gov/data/income-saving/personal-saving-rate

- https://fred.stlouisfed.org/series/REVOLSL

- https://www.bls.gov/cpi/

- https://www.economy.com/

- https://www.trahanmacroresearch.com/

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.bloomberg.com/markets/rates-bonds

- Bloomberg

- https://research.gs.com/