Losing the Bond War

Bond yields are once again on the rise—a trend that spells trouble for the U.S. consumer. The benchmark 10-year Treasury yield recently climbed to 4.51%, pushing 30-year mortgage rates back above 7%. This upward movement in rates is particularly damaging for the housing market, where affordability is already stretched.1

Bond Investors appear to be reacting to a wave of fiscal and policy developments. Chief among them is the House-passed “Big Beautiful Bill,” which, if enacted in its current form, could provide significant short-term stimulus. However, Senate negotiations are likely to introduce spending cuts, muting some of the bill’s initial impact.

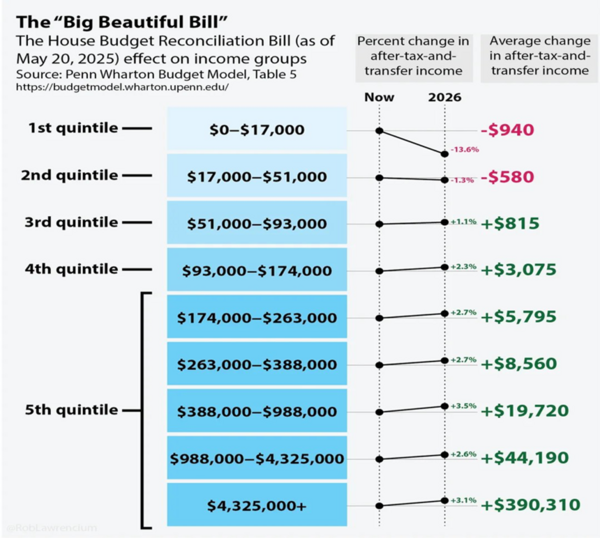

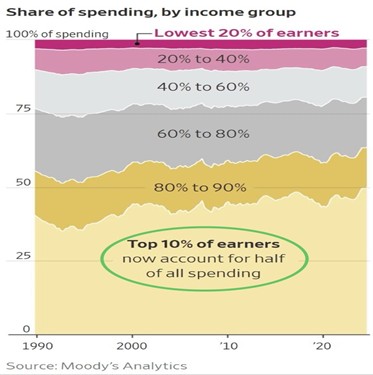

According to the University of Pennsylvania, the bill would shift after-tax income: lower-quartile earners would see their disposable income shrink, while top-quartile earners would enjoy a boost. Given that high-income households now drive a disproportionate share of consumer spending, this dynamic could initially support consumption—but not broadly.3

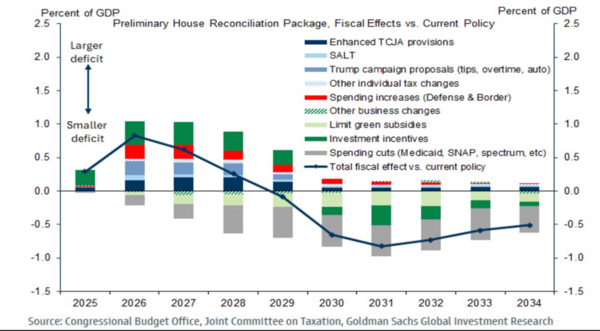

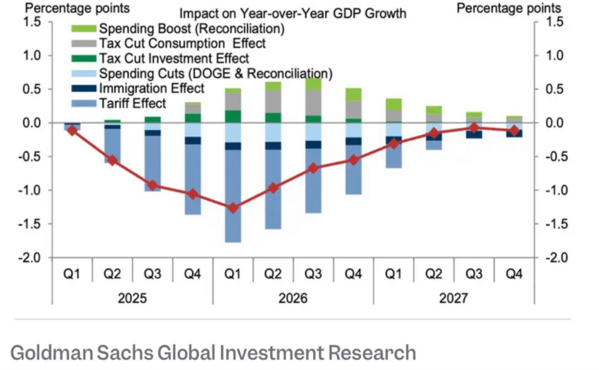

The bill’s design is front-loaded with tax cuts, lifting GDP in the near term, while back-loaded spending cuts scheduled for 2029 will subtract from growth later. Though pitched as “budget neutral,” the tax package will likely widen the deficit before those cuts arrive. That prospect—combined with longer-term economic risks—is putting upward pressure on Treasury yields, and bond investors are responding accordingly.5

Layered on top of this fiscal package are the new tariffs. As Goldman Sachs points out, the economic impact of tariffs resembles a consumption tax. For many Americans, the cost burden imposed by tariffs could easily outweigh the benefits of tax cuts. In that case, stimulus at the household level may fall short.6

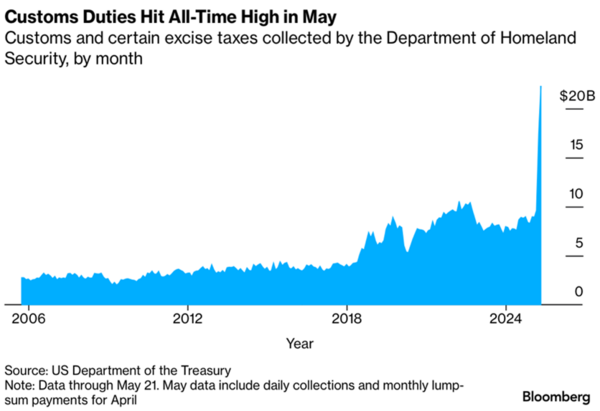

Since April 2nd, the U.S. government has implemented a 10% tariff on a range of imports. Through May 21st, nearly $22 billion in tariff revenue has been collected—annualizing to over $200 billion. Tariffs are now being charged on arrival, magnifying their immediate impact on prices and margins.7

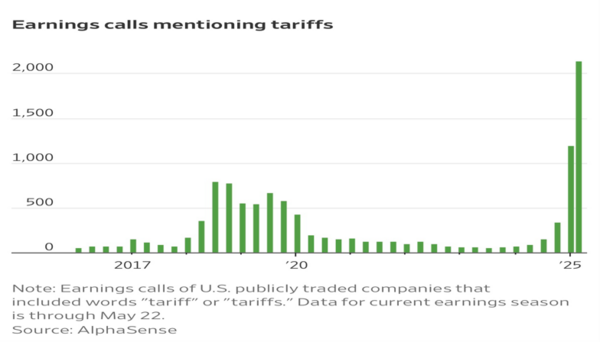

Earnings calls reflect this shift. CEOs are increasingly discussing the effects of tariffs on operations and outlooks. The mounting frequency of these mentions suggests that forward earnings expectations are being adjusted accordingly.8

This brings us back to bond markets. If investors believe the Trump tax package is insufficient to offset the drag from tariffs, confidence in long-duration Treasury debt will falter. Rising yields are the result. Which means Trump is going to lose the Bond War on higher rates unless he dials back uncertainty around tariffs, delivering a responsible and sustainable fiscal package, and laying out a clear path to moderate growth without runaway inflation.

Markets can adjust. So can policymakers. I expect they will.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

2.) Go to the St. Louis Federal Reserve FRED database and find d | Quizlet

3.) https://x.com/LP_CLC/status/1925916405288915418

5.) https://x.com/stanveuger/status/1925614822231544316

6.) Expect tariffs to cancel out any economic boost from Trump's tax cuts, Goldman Sachs says

7.) Stocks Rebound as Trump Tones Down Trade Rhetoric - Bloomberg

8.) Keeping Stakeholders Informed on Emerging Events With Earnings Calls

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.