Lowering Expectations

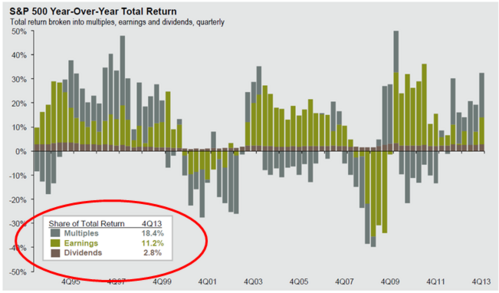

We are now 40% of the way through earnings season. It's a good time to take a quick look at how the scorecard looks—especially since we have seen much of our recent stock price appreciation driven by multiple expansion rather than earnings growth. [i]

According to our friends at Bespoke, 65.5% of all companies that have reported are beating their Wall Street estimates in Q4. Not since Q4 2010 have we seen this level of outperformance relative to estimates. [ii]

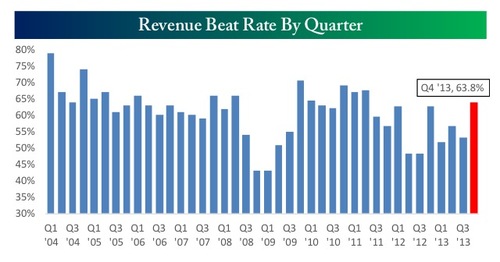

Further, 63.8% of all companies are beating Revenue targets. Not since Q2 2011 have we seen companies show such promise relative to estimates. [iii]

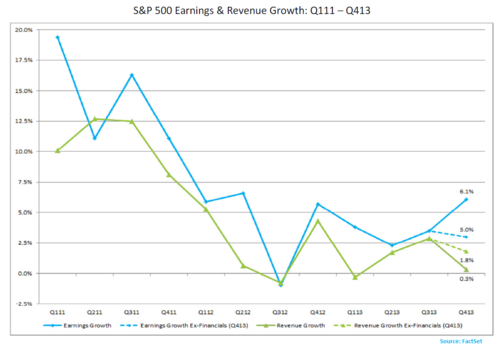

What's so positive about this data is that we could see continue stock appreciation driven by the right reasons: EPS growth. The average EPS growth rate for Q4 2013 is 7.9%. [iv} Expectations for S&P 500 EPS growth rates have been coming down throughout all of 2013. We may now have an opportunity to exceed those expectations. [v]

Guidance

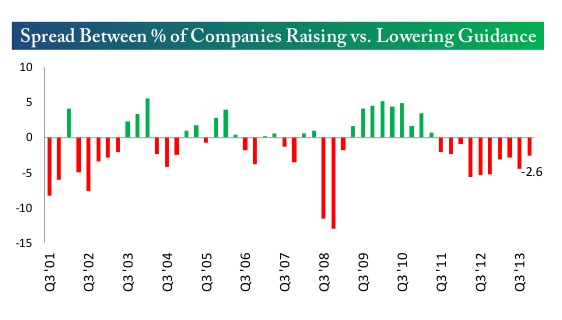

Unfortunately, corporate officers have gotten wise, in my opinion, to the game of managing expectations. Long gone (or so I hope) are the financial shenanigans CFO's who were playing games with inventory and revenue recognition. Now, they can simply look at macro stock market environments and determine if there is any benefit to their stock price for setting higher expectations or being conservative and surprising to the up-side later Bespoke shows that companies have been lowering guidance, and this looks like the "best worst" quarter for guidance in quite a while. [vi]

While we are only 40% through the quarter it would take some pretty bad data to crush the earnings trend. I do expect companies to be cautions on forward earnings guidance as there is no real benefit in this macro environment to forecast aggressively. Lowering expectations now might pay off big in a better valuation (Price to Earnings or Price to Earnings Growth) environment in the coming quarters.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “1Q 2014 Guide to the Markets”, JP Morgan Asset Management

[ii] “The Bespoke Report”, January 31, 2014, Bespoke Investment Group

[iii] Ibid.

[iv] “Earnings Insight”, January 31, 2014, FactSet.

[v] “It is the best of times and worst of times for the S&P 500 Financials sector in Q4”, January 11, 2014, FactSet

[vi] “The Bespoke Report”, January 31, 2014, Bespoke Investment Group