Man Made Chaos

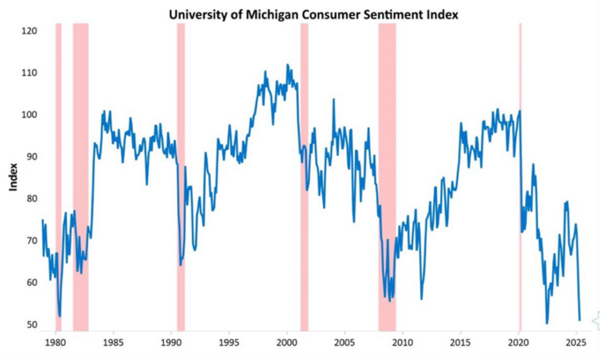

Consumer confidence took another perilous drop in last week’s Consumer Sentiment Index from the University of Michigan. This decline represents a multi-month drop in the consumer's attitude. In fact, consumer sentiment has been down over 30% since December 2024 and is hitting historic lows, almost certainly driven by trade war/tariff uncertainty and the threat of rising inflation.

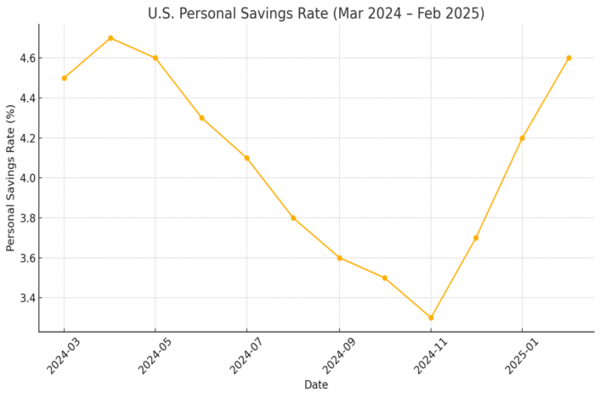

Comparing this rapid decline in the consumer’s feelings to their savings rate, it appears that the consumer is really acting on their attitudes.1

Comparing this rapid decline in the consumer’s feelings to their savings rate, it appears that the consumer is really acting on their attitudes.1

While an increase in savings would appear to be prudent on face value, it also moves money out of our consumption economy, and that’s a real threat. 2

The policy volatility will need to stop soon. This last weekend is a perfect example. On Friday, the President made one announcement on tariffs and on Sunday the Commerce Secretary seemingly contradicted that announcement.3

The consumer is the central theme I focus on, but the subplot is going to be the Federal Reserve, if the current administration can’t tamp down the policy uncertainty. The Fed will need to cut rates to prevent the economy from slipping into a consumption air pocket.4

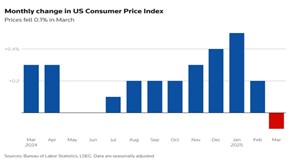

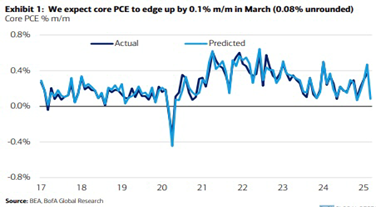

The good news is inflation is moderating and that will give the Fed some interest rate maneuvering room. Consumer prices dropped by 0.1% in March providing a little relief to an emotionally weary consumer.5

Expectations for inflation to moderate have increased lately, driven by lower energy prices and perhaps some softness in consumer demand. 6

It’s never great to rely on monetary policy to bail out the consumer, however, it’s a realistic expectation that the Fed will be a good guardian.

As was mentioned in the last blog (link here), there are several off-ramps to this chaotic period. The Fed with interest rate cuts is one. The administration declaring a trade war truce is another which appears to be in the works. A new one could be interest rates rising on the 10-year Treasury note. It seemed to be a seminal moment for the President in calling a partial tariff truce. The US consumer and US budget can’t afford higher rates, and everyone appears to know that now.7

There is certainly no easy way to adjust global trade. Yet creating more certainty around the policy changes will reduce the ambiguity.

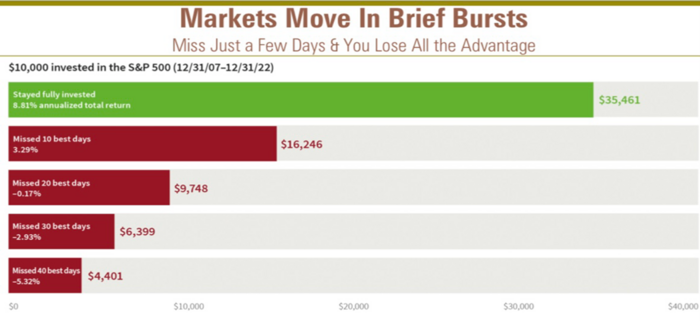

Last week was another great example of why timing markets and missing just a few days can eliminate all the advantages of equity investing. Especially when the chaos is man- made and can be corrected by the same.6

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/KobeissiLetter/status/1906411587771961400

- VOTE NOW in the 2013 Stack Overflow Moderator Election - Stack Overflow

- Trump Exempts Some Electronics, Including Smartphones, From Tariffs on China

- Tech Products Will Face Separate Tariffs Soon, Commerce Secretary Says

- JE$US on X: "https://t.co/0WVzs99c9Q" / X

- Neil Sethi on X: "BoA moves their core PCE tracking to 0.08% for March "a notable deceleration from the first two months of the year. However, February is likely to be revised up significantly to 0.5% m/m due to a very large upward revision to portfolio management. As a result, we expect y/y core https://t.co/7TfzKajUC8" / X

- US 10 Year Treasury Bond Note Yield - Quote - Chart - Historical Data - News

- Stay Invested

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.