Managing Through the Cycle Not Outside the Cycle

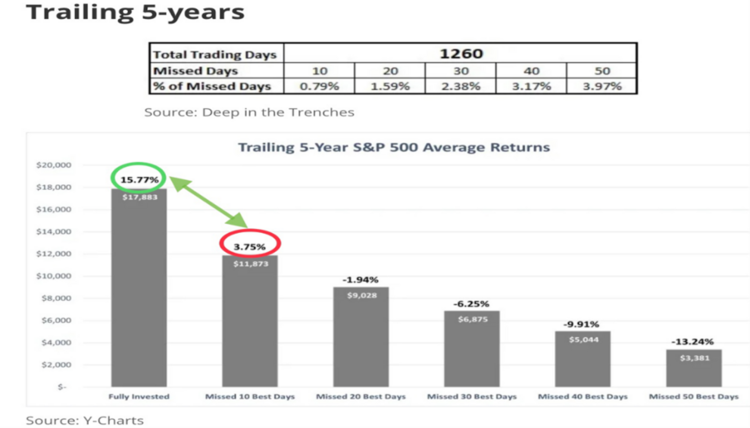

Last week was a classic reminder to those that believe they can outsmart and outwit equity markets. The notion that someone has a crystal ball into what moves millions of equity investors should be debunked for the time being. Our basic ground rule is equity returns occur in brief bursts and if you miss just a few days you lose all the advantage. 1

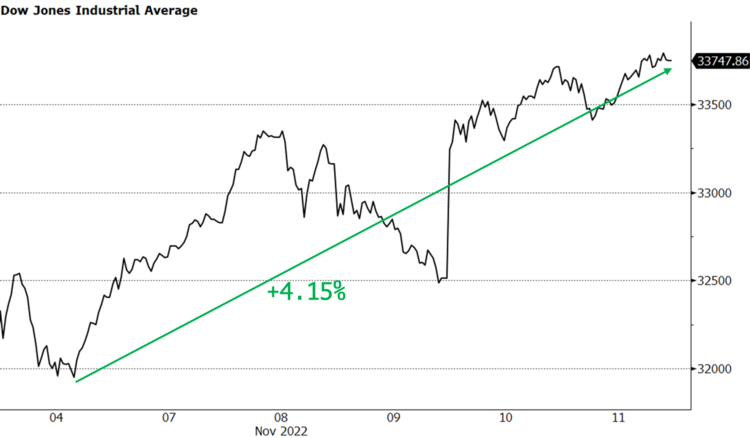

Equity markets rallied by 4.15% last week, with a powerful one day move of 3.70% on November 10th;based on a long-awaited cooling of inflationary pressures. 2

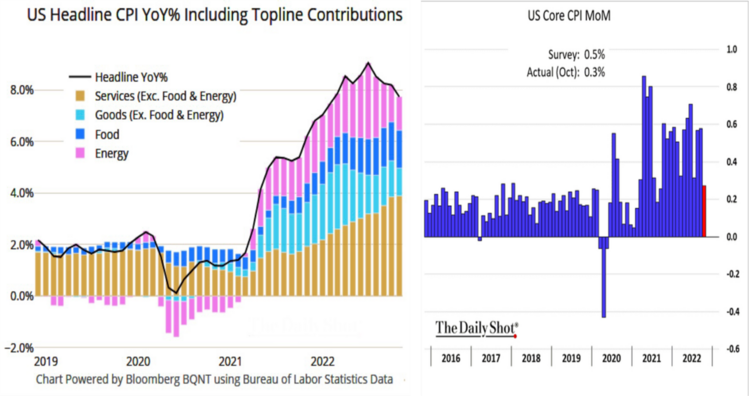

The most recent consumer price report showed, at least some, cooling of inflationary trends. Headline CPI increased by a below expectation 7.7% year-over-year. Core CPI (ex-food and energy) moderated substantially on a month-over-month basis to 0.3%, also below expectations. 3

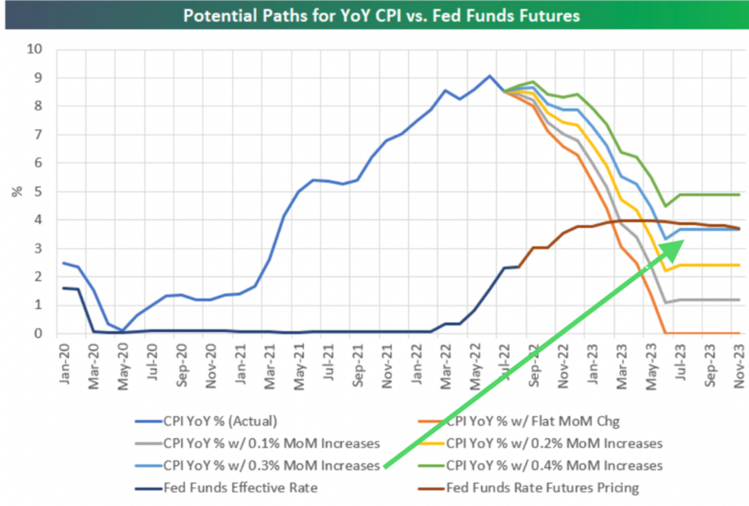

At 0.3% month-over-month, we could see inflation get cut in half by May 2023. 4

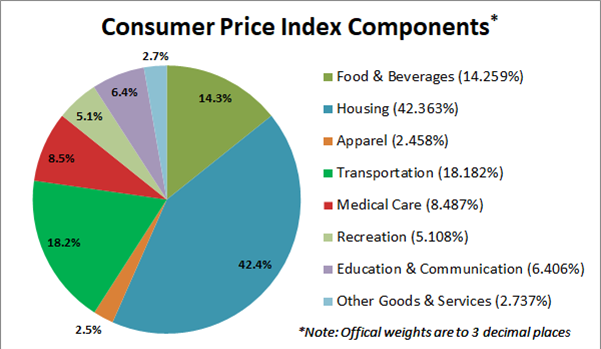

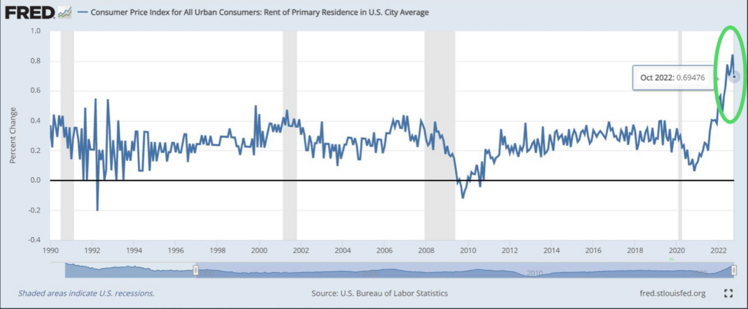

A moderation in housing inflation (rents) would solidify the current reversal in consumer prices, as rents make up over 40% of CPI. 5

As the largest component of CPI, the recent moderating trend is a welcome relief. 6

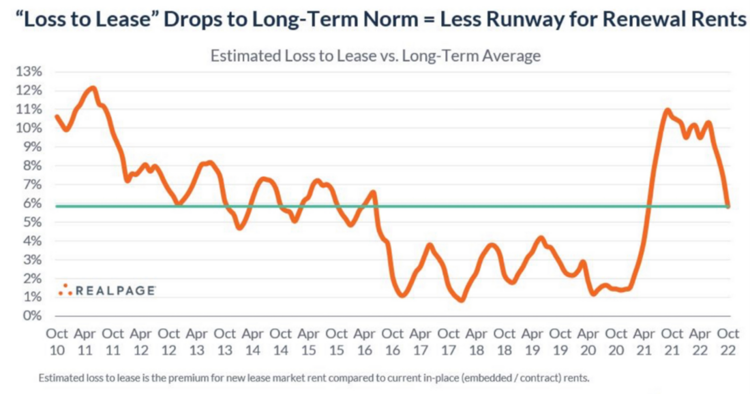

Another way to measure rent trends is to look at what landlords are collecting in current contract rents compared to what they could be collecting (“Loss to Lease”). The wider the spread, the higher future rents could inflate. Currently, the Loss to Lease ratio is at 6%; landlords are getting the rents they should be getting. This foretells a moderation in rental inflation. 7

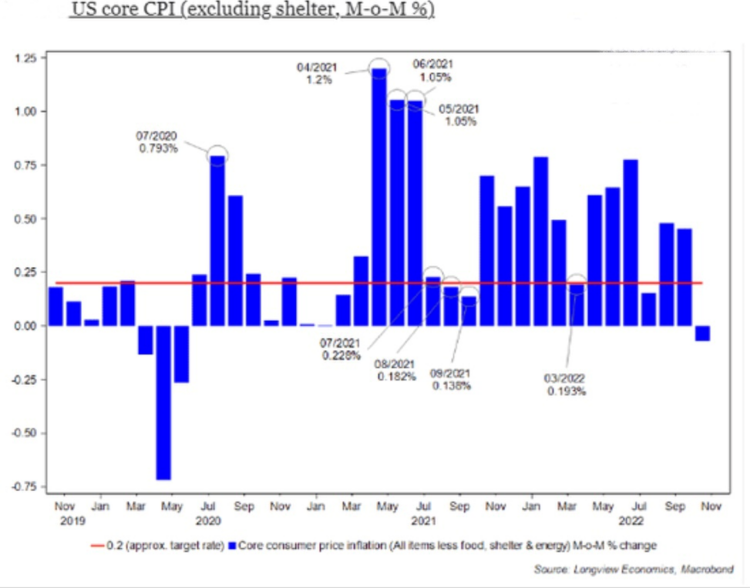

In fact, when we review core inflation excluding rents, prices are on the decline. 8

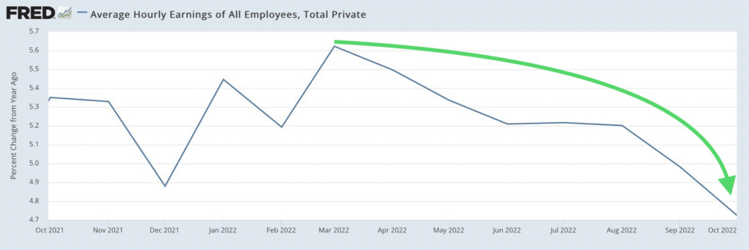

Another strong measure of inflationary trends is wages, which appear to be moderating. 9

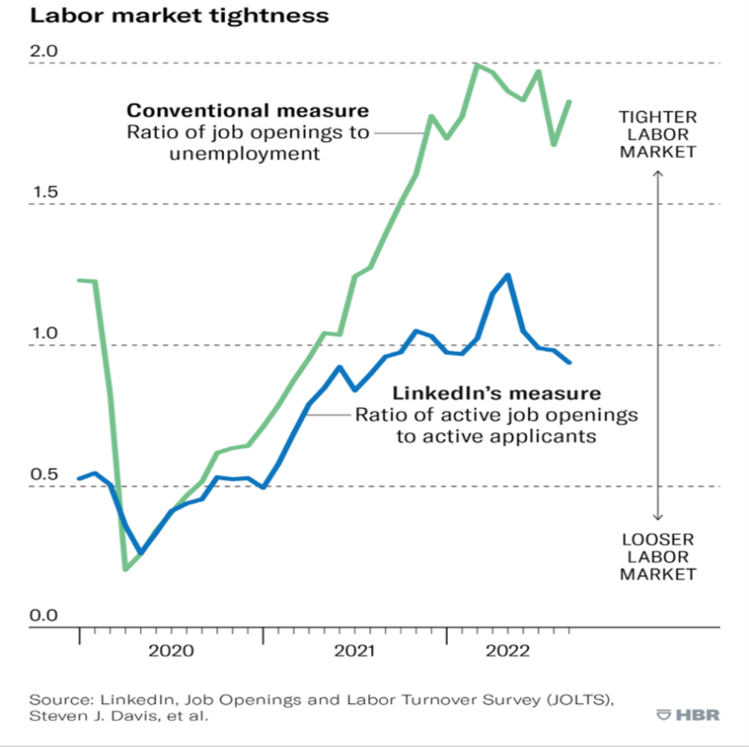

A recent article by Harvard Business Review suggests the Fed’s measure of job openings to available workers might be overstating the reality on the ground. Current readings suggest there are nearly two jobs for every available worker. If this were the case, then wages would need to increase substantially. In reality there might be much more parity, and that may be why wages have been trending down. Harvard used LinkedIn data to look at current trends. For a host of reasons stated in the report, the Fed may be overestimating labor tightness and potential wage inflation. 10

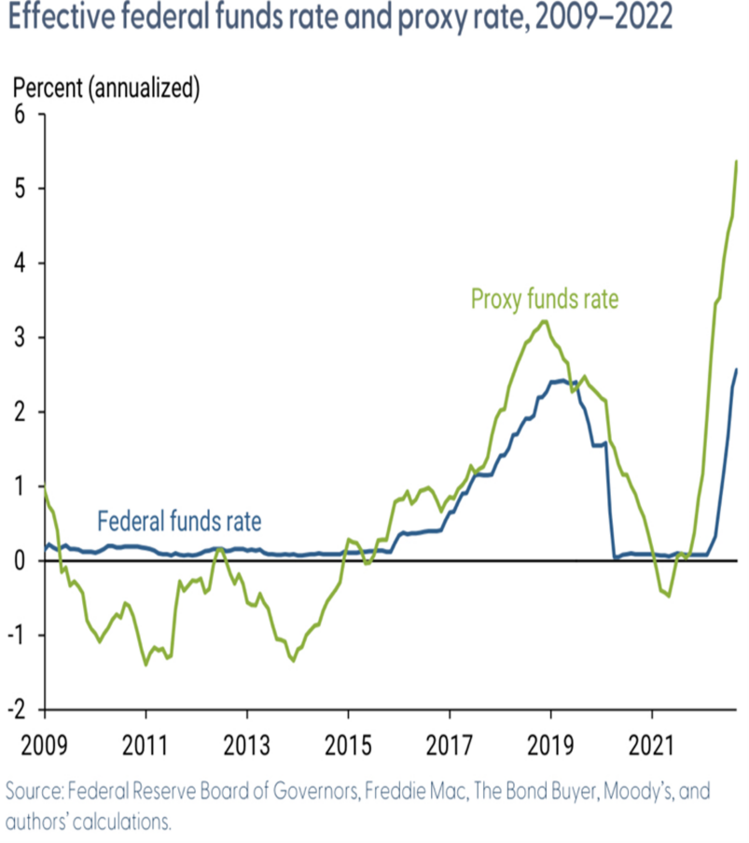

Finally, and quite possibly, the Federal Reserve has over-lifted their primary policy tool – the Fed Funds rate. Another recent report produced by the Federal Reserve Bank of San Francisco, suggests the actual Fed Funds rate might be understating what’s actually happening when you take into consideration all the tools available to the Fed, including their forward guidance. An actual Fed Funds rate of over 5% might be what’s really circulating in our economy vs. the current 4%. 11

None of this is to suggest inflation is transitioning for good. In fact, there may be plenty of evidence it might be stuck at higher levels for a little longer. It does, however, suggest a couple of things:

- The Fed knows the actual economy reflects a much higher real rate on the Fed Funds vs. the current Fed Funds rate.

- Trying to guess economic trend reversals is too difficult.

- The power of the moves, when trends reverse, is too dramatic to miss out on when equities are part of your portfolio.

- The Fed may moderate future rate increases to see where we stand in the current economic cycle.

The only way to prepare a portfolio for any economic pivot is to be invested in a strategy that manages through cycles, not outside cycles.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://deepinthetrenches.com/missing-the-best-days-in-the-market/

- Bloomberg

- https://www.bls.gov/cpi/

- https://www.bespokepremium.com/

- https://www.advisorperspectives.com/dshort/updates/2022/10/20/components-of-the-cpi-september

- https://fred.stlouisfed.org/graph/?g=WoML

- https://www.realpage.com/analytics/loss-to-lease-is-plunging-suggesting-renewal-rent-growth-will-cool-off/

- https://www.longvieweconomics.com/

- https://fred.stlouisfed.org/graph/?g=WoMQ

- https://hbr.org/2022/11/the-u-s-labor-market-is-less-tight-than-it-appears

- https://www.frbsf.org/wp-content/uploads/sites/4/el2022-30.pdf