Midterms and Earnings

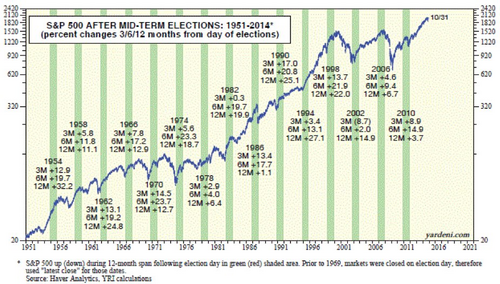

With the Republican sweep of the midterm elections in the rear view mirror and both houses of Congress now in clear control by Republicans, markets may view this landslide in very favorable terms. First, most midterm elections have produced very positive short-run results for US equity markets.

Since 1964, the average S&P 500 increase was 16.5% for the 6-month period after the midterm elections vs 3.7% for all other election years.[i] That's a pretty strong track record.[ii]

In fact, the best market results occur when Republicans control the House and Senate and a Democrat is in the White House.

The reasons seem fairly straightforward:

- Gridlock is viewed as favorable to investors.

- Pro-business policies could be enacted.

- Republicans are less likely to issue massive debt, which puts less pressure on interest rates.

In our current political environment you might see the 114th Congress tackle some pro-business issues like:

- Harmonizing the corporate tax code to allow US-based companies to onshore $1.2 trillion dollars at a reasonable tax rate (5%) vs the nominal US corporate rate of 35%.[iii]

- Approving trade agreements the President has been working on, such as the Trans-Pacific Partnership with countries like Australia, Malaysia, Singapore, Canada, Mexico, and Japan.[iv]

- Approving the Keystone XL Pipeline that can create jobs and stimulate significant spending on energy.

- Passing a massive transportation and infrastructure package that will create jobs and improve our surface transportation system.

- Actually passing a budget that the President might sign and perhaps we can see a slight improvement to our creditworthiness. Standard & Poor’s currently gives the U.S. an AA+ credit rating, below its previous AAA rating.[v]

While there should be a very healthy level of skepticism for anything passing a "do nothing" government, hope is a uniquely American trait. Perhaps that's why the markets moved higher last week, and the energy sector rallied over 4% since the midterms on Tuesday compared to 1% for the S&P 500.[vi]

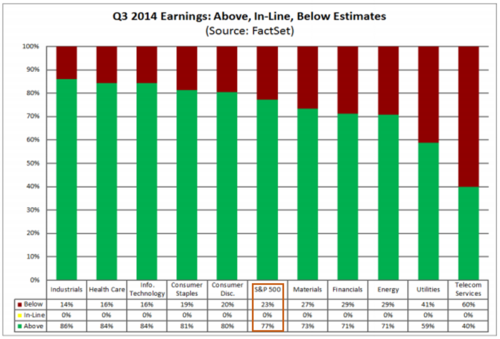

It's hard to believe markets can move higher based upon current valuations. However, earnings continue to pour in and consistent with prior weeks they continue to beat expectations. Of the 446 S&P 500 companies that have reported Q3 earnings, 77% have beaten their mean estimate.[vii]

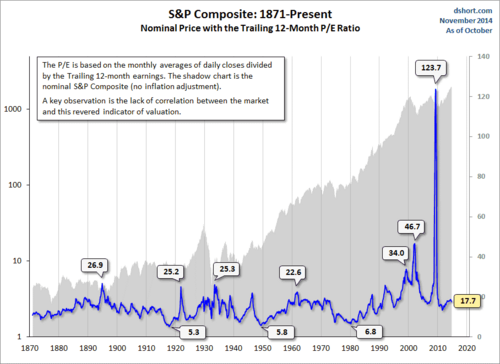

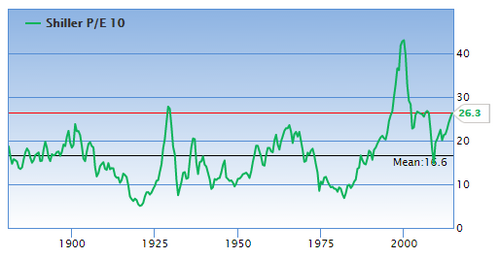

Valuations continue to trend to the upper range by most measures. My favorite measure is the cyclically adjusted price to earnings ratio (CAPE). Unlike the traditional P/E ratio that compares the current price to its trailing 12-month earnings, the CAPE measures the current price to the average inflation-adjusted earnings over a longer period of time, in this case 10 years. You can see how the two valuations give a different perspective on current valuations.[viii,ix]

I like using the CAPE because we all intuitively know companies don't reflect their valuations based upon one year's earnings. Company earnings move in cycles and capturing those cycles in a valuation methodology is probably more accurate, in my opinion.

If Congress and the President actually get things done, perhaps US equities merit higher cyclical valuations as companies and Americans can benefit from the simple list of policy improvements that I detailed above.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Egan, M. (Nov 5, 2014). Stocks love when midterm elections are over. CNN Money.

[ii] Yardeni, E. (Nov 3, 2014). Buying on Midterm Election Day Is One Of History’s Most Successful Trading Strategies. Business Insider.

[iii] Ehley, B. (Jun 5, 2014). Without Offshore Tax Havens, These Companies Would Owe the U.S. This Much. The Fiscal Times.

[iv] DePillis, L. (Dec 11, 2013). Everything you need to know about the Trans Pacific Partnership. The Washington Post.

[v] Detrixhe, J. and Katz, I. (Jun 6, 2014). U.S. Credit Rating Affirmed by S&P With Stable Outlook. Bloomberg.

[vi] Google Finance.

[vii] Butters, J. (Nov 7, 2014). Earnings Insight. FactSet.

[viii] Short, D. (Nov 3, 2014). Is the Stock Market Cheap?. Advisor Perspectives.

[ix] Gurufocus.com. (Nov 10, 2014). Shiller P/E.