Minding the Gaps

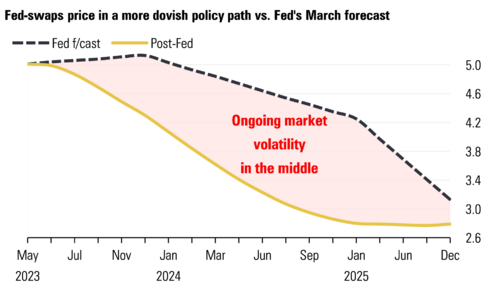

The gap between the Fed’s interest rate trajectory and what investors believe is still fairly wide. 1

However, recent macroeconomic data may have moved investors and the Fed a bit closer together.

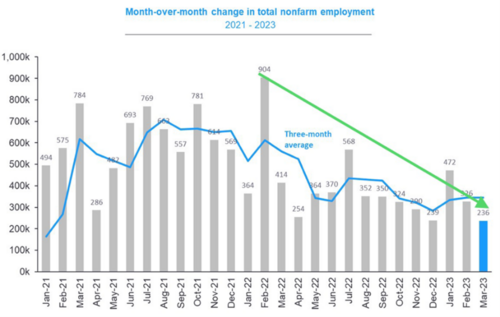

The 236,000 jobs added to the U.S. economy in March provided some relief to the inflationary pressures the Fed is hyper-vigilant about. The ongoing downtrend should bode well for a more temperate interest rate picture. 2

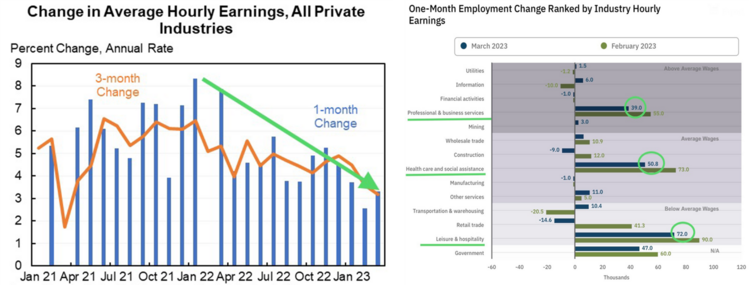

Additionally, the ongoing moderation in wages will allow the Fed the latitude to maneuver interest rates in the coming months according to the economic needs of the U.S. consumer and fragile banking sector. In fact, 30% of all jobs added in March occurred in below average wage sectors like leisure and hospitality. 3

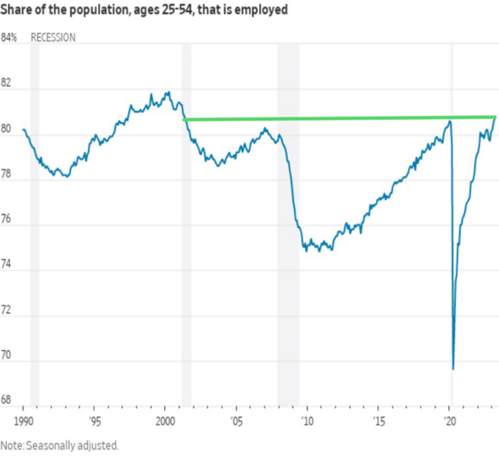

The prime age labor force participation rate (those engaged in the workforce) moved above pre-pandemic levels. That should allow employers to further normalize wage increases in the months to come. This is another strong indicator that inflationary pressures are moderating. 4

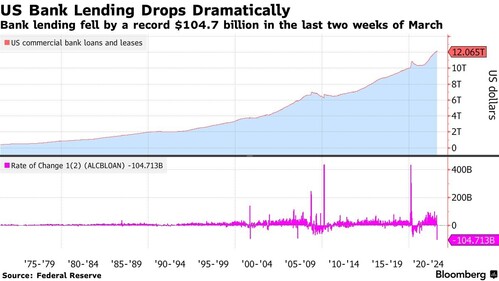

The weak banking sector is also supplying a natural and well-telegraphed brake to consumption. Credit conditions have tightened and will continue to do so until the Fed cuts rates to help repair the banks’ mismanaged portfolios. 5

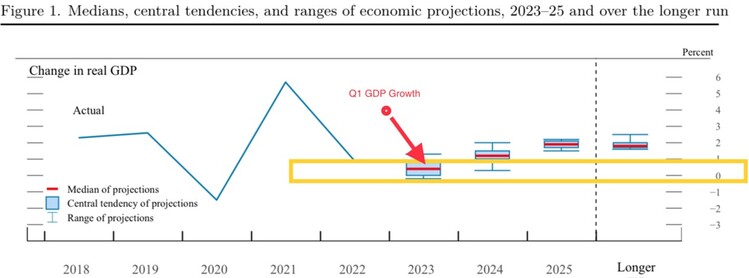

The biggest gap is in economic growth. It would take a massive and almost immediate downshift to match the Fed’s expectation for full-year 2023 economic output. If current Q1 GDP estimates are accurate and the economy grows at or near 3%, the economy would have to revert to a contraction to meet expectations. 6

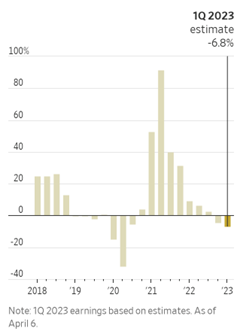

I simply don’t see that in the cards. The jobs picture is still too robust, wage growth is still positive, and more Americans are returning to the workforce. In fact, I expect Q1 earnings growth to come in slightly better than expected. The consumer is far too strong to have a complete collapse in Q1 earnings. 7

The gap between the Fed and investors’ expectations will likely narrow and a shift in policy is well within the cards even if the consumer remains resilient. The biggest gap might be in upcoming mid and small bank earnings. That crisis is not over yet.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/news/articles/2023-03-22/traders-price-in-more-fed-cuts-for-2023-even-as-officials-hike

- https://www.ey.com/en_us/strategy/macroeconomics

- https://www.atlantafed.org/blogs/macroblog

- https://www.wsj.com/livecoverage/stock-market-news-today-04-07-2023

- https://www.bloomberg.com/news/articles/2023-04-07/us-bank-lending-declines-sharply-for-a-second-straight-week

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

- https://insight.factset.com/topic/earnings