Money in Motion

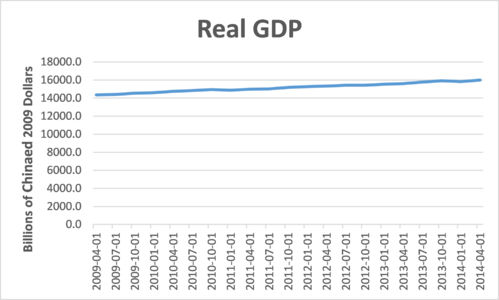

While the recent jobs report showed some weakness for the month of August, it's hard to argue that the US economy is slowing. US GDP is on an upward trajectory albeit slower than, and certainly not as strong as, most people would prefer.

In last week’s post, we discussed some extraordinary benefits from consumers borrowing and banks lending. In fact, we indicated a possible 2.1 percentage points of additional growth in GDP through the following calculation.[i]

- 1% of household disposable income = $127 billion.

(based on total disposable income of $12.7 trillion). - Total increase in debt payments = $127 billion x 3 = $381 billion.

(assumes household debt service increased from the current 10% to its peak of 13%). - Consumer borrowing supported by this payment level = $4.5 trillion.

(assumes 18% interest rate and 8.5% minimum monthly payment) - $4.5 trillion is 28% of current GDP ($16 billion), for a 12-year annualized growth rate of 2.1%.

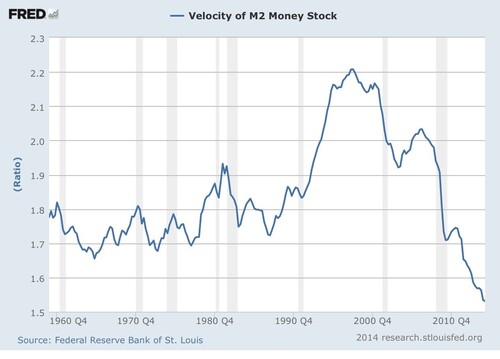

One thing that could occur as a result of this borrowing is an increase in the velocity of money in the economy. The frequency at which one dollar is used to purchase domestic goods or services in our economy is the measure of velocity; it's relevant as velocity is an indicator of growth and inflation.

Let's take a look at where velocity is now. As you can see, the movement of money in our economy is at historic lows.[ii] Intuitively, this is why we have not seen any signs of significant inflation (excluding food and energy). Simply, not enough money is chasing the same goods and services and prices do not rise.

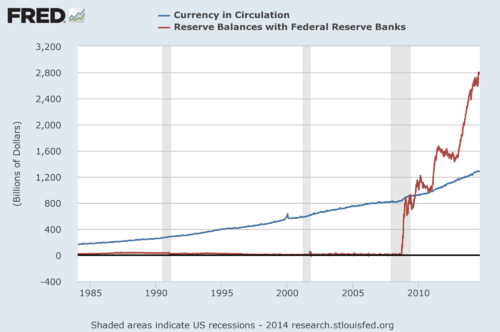

What's astonishing is banks are sitting on record levels of cash; in fact, one could use the word hoarding.[iii]

The reason is simple enough, currently banks have been getting paid to sit on cash. The Federal Reserve is paying banks to hold cash through the Excess Reserve Interest Rate program.[iv]

As an outcome, you can see that reserve balances are at historic levels, while currency in circulation is on a more normalized trajectory of a constant growing economy.

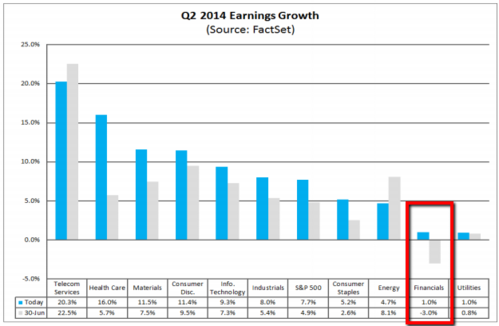

While earnings growth for financials lagged in Q2, banks are now poised to take a few more chances and lend (again see our previous week’s post).[v]

So while banks are hoarding cash, the Federal Reserve has pumped trillions of dollars into banks’ balance sheets and provided them with risk free profits. The party could end though, which might actually help increase the velocity of money in the economy, driving more consumption, jobs and higher wages.

If done dramatically, it can also create some hyperinflation. We will certainly be watchful and consider portfolio adjustments accordingly. Investments like commodities can benefit from aggressive inflation, if indeed it rears its ugly head.

We will be watchful.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Phillips, T. (Sep 2, 2014). More Fuel in the Tank – “Animal Spirits”. Phillips & Company.

[ii] Federal Reserve Economic Data.

[iii] Ibid.

[iv] Ibid.

[v] Butters, J. (Sep 5, 2014). FactSet Earnings Insight.