More Certainty

Here is what we can put in the books at this point in the year.

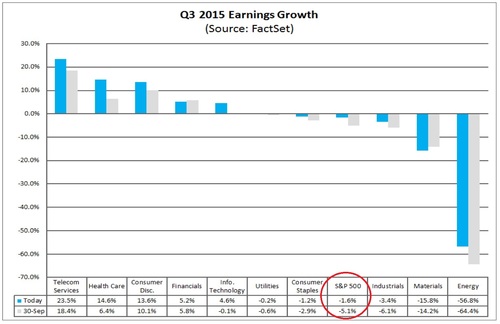

1) Third Quarter earnings per share continue their shrinking trend, putting us in an earnings recession for the first time since 2009. With only 19 companies left to report for the S&P 500, it's likely we will end the reporting season with two consecutive quarters of earnings declines. [i]

2) The Federal Reserve is poised to raise rates during their December meeting (December 16th). In their recently released minutes from October the Fed said,

“While no decision had been made, it may well become appropriate to initiate the normalization process at the next meeting.” [ii]

3) It's clear the economy, notwithstanding corporate earnings, looks to be expanding, and the unemployment rate continues to shrink - albeit slowly. [iii]

4) Markets have reacted positively to the almost certainty of an interest rate increase. This suggests, "getting on with it" prevails over fundamental earnings. The S&P 500 has rallied over 10.5% since registering its first 10% correction in four years on August 25, 2015. [iv]

S&P 500 August 25 – November 23, 2015

5) Earnings multiples have been expanding, suggesting investors are willing to speculate on a return to growth.

1) The price to earnings ratio, which shows how much investors are willing to pay for each dollar of a company’s earnings, grew 12.81% from the correction in August through today. [v]

S&P P/E Ratio August 25, 2015 – November 23, 2015

2) Shareholders are willing to pay more based on their belief corporate earnings will continue to grow. Although, they will have to wait a few quarters to see that come to fruition based upon current expectations. [vi]

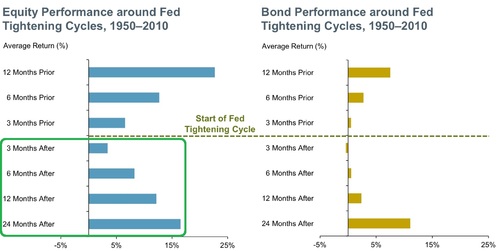

6) Investors may be moving to equities from debt as they seek shelter from rising rates. You can see from the chart below, stocks tend to perform better than bonds across the board during rising rate environments, at least during the first couple of years. While this is an average over a long period, much depends on the pace of the rate increases. [vii]

Earnings recession, multiple expansion, investor anticipation, rising rates; all are playing out with more certainty.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_11.20.15

[iii] https://research.stlouisfed.org/fred2/series/UNRATE

[iv] https://www.google.com/finance?q=INDEXSP%3A.INX&ei=G2NTVoGUI8qK0gSrj7_IBg

[v] Bloomberg Terminal, S&P 500 P/E 8/25/2015 – 11/23/2015

[vi] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_11.20.15

[vii] https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/Q4_2014_Market_Update.pdf