Multiple Expansion?

Multiple Expansion?

Weekly Market Commentary 10-21-2013

Tim Phillips, CEO—Phillips & Company

As markets return to "normal" and participants attempt to discount and anticipate future events, it’s worth taking a look at what fundamentally drives value. Earnings growth is the one undisputed value driver for companies.

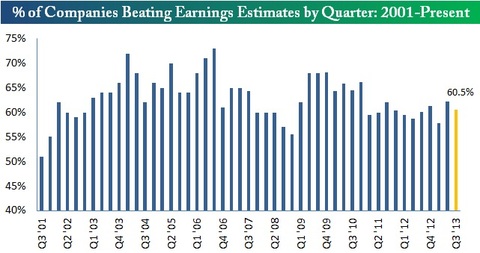

So far earnings are coming in weaker than anticipated. While it is still very early into earnings season, only 60% of companies have beaten estimates compared to the average of 63%.[i]

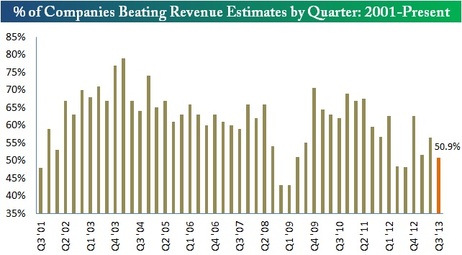

What's more concerning is revenue is coming in weaker than anticipated. Again our friends at Bespoke Investment Group provide the following data: [ii]

Much of these estimates are from Wall Street expert guessers that can be notoriously wrong. It's not surprising how off-based a 27 year old MBA with zero operating experience can be when working at a Wall Street firm and trying to guess at the future.

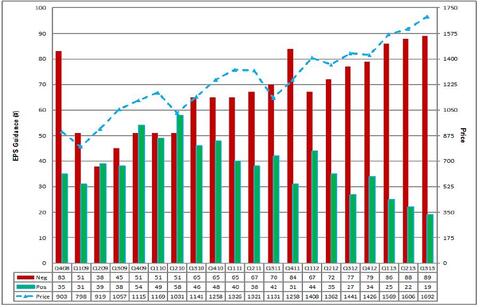

On the other hand, corporate CFO's and executives, whom have a much better feel for how their companies are doing have been painting a dreary picture: [iii]

Out of the 110 companies that have issued earnings guidance for Q3, 89 of them (or 82%) issued negative guidance. This is a record percentage since this figure was first tracked by FactSet in 2006. You can see in the chart above that negative guidance has been trending higher.

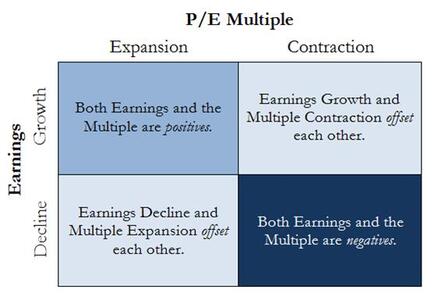

A few things can happen in the very near future. Earnings can grow albeit at a very slow pace and multiples can expand creating a continued uptrend in stocks (upper left). Earnings can grow at slower rates and multiples can contract (upper right) creating an offset in pricing action.

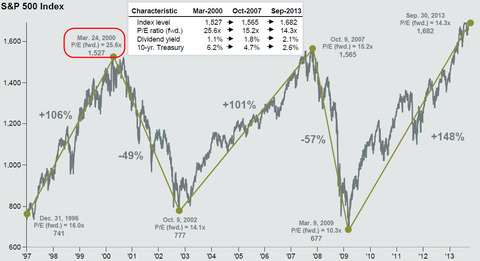

You could draw the conclusion that we are due for a correction, and that would be completely intuitive. Unfortunately, investing is far from intuitive. You can see from the chart below multiples can expand for a very long time while market timing investors tend to miss critical moves in the market:[iv]

Multiples have expanded from the trough of the market on March 9th 2009 by 38.83% to 14.3 where they sit now.

In my opinion, what drives investors to expand multiples is their belief that companies can sustain earnings growth at a reasonable rate. That was clearly the case in 2000 when new technology was driving investors to near euphoric levels.

It's clear we are not at that level yet but almost anything can happen when it comes to investing and it usually does.

I would anticipate a wider trading range in the next several weeks up or down 5% as we digest earnings and a possible slowing in growth rates.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “Third Quarter Earnings and Revenue Beat Rates”, Bespoke Investment Group, October 18, 2013

[ii] Ibid.

[iii] “Guidance—S&P 500”, FactSet, September 30, 2013

[iv] “4Q 2013 Guide to the Markets”, JP Morgan Asset Management, p. 6