New Year's Resolution- No Panic Selling

This time of year brings the traditional wishes of health, happiness, and prosperity for 2016. We at Phillips and Company certainly echo those wishes for you and your family.

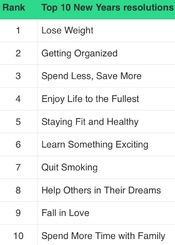

Another time honored tradition is the making of New Year's resolutions. In fact, 45% of Americans make a New Year’s resolution. The top 10 resolutions are provided by the folks at the Statistics Brain Research Institute. [i]

All are noteworthy, but I think we all need to add one critical resolution for 2016.

No Panic Selling!

In my estimation, 2016 (at least the first 3 months) will provide many challenges for investors. Allow me to enumerate:

- Positive earnings growth is not expected to return until Q3 2016, according to FactSet.

- Continued uncertainty around the pace of interest rate increases will persist for the next 90 days. At some point this year the Fed may signal a normalized course of action.

- Declining commodity prices continue to create uncertainty in the High Yield market as well as many large energy exporting countries. Creating even more uncertainty for an already beleaguered oil market is the fact that Iran is rumored to be able to extract crude oil anywhere from $1 to $20 per barrel.

While there are other issues that investors will have to grasp, my guess is the period of time before corporate earnings return to positive territory will provide the greatest volatility.

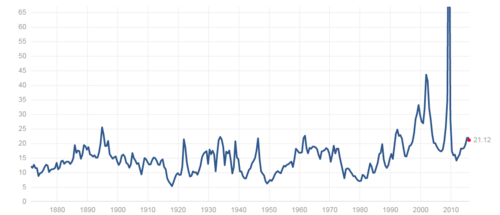

Looking at the last time we had 3 quarters of negative earnings was in 2008 and the Volatility Index (VIX) skyrocketed.

In 2008 the VIX reached almost 80 out of 100. [ii]

In 2015 the VIX peaked at just over 40, during the September market correction. [iii]

In the next 4 months you may be tempted to market time or panic sell due to market pressures, but that would be a mistake. Let's not let short-term jitters dictate long-term strategy. In fact, when you look at the data, panic selling is not a reliable strategy.

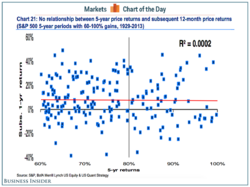

You can see from the chart below there is no relationship between 5 year price returns and 12 month price returns. In fact, the R² =0.0002. That's a 14% correlation, and 86% random dots. Long-term market trends and short-term market movements are not statistically related. [iv]

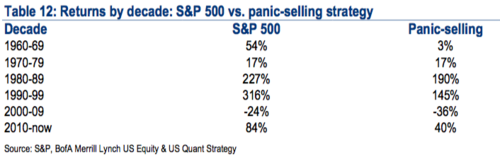

Further, if we were to define a panic seller as someone that sells out when the market is down 2%, the following table shows you how an investor performed versus simply holding through the volatility.

You can see for yourself, panic selling is not a strategy. [v]

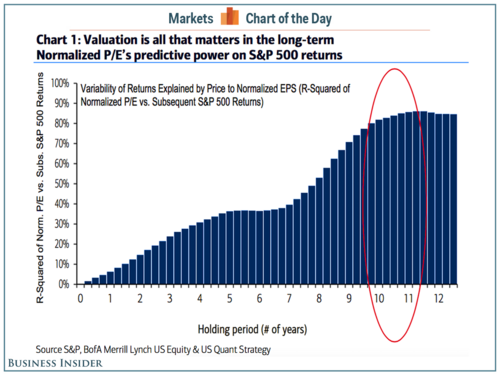

Perhaps, the best indicator of long-term market trends is looking at the Price to Earnings ratio (P/E). This is a gauge of how much investors are willing to pay for a company’s earnings. While P/E is a poor short-term timing indicator, it is the single most important determinate of long-term returns, according to Bank of America Merrill Lynch’s Savita Subramamian. In fact, P/E trends can explain up to 90% of subsequent returns over a 10-year horizon. [vi]  Historically, the P/E for the S&P 500 has been growing. We expect it will continue to do so. [vii]

Historically, the P/E for the S&P 500 has been growing. We expect it will continue to do so. [vii]

I suspect the first half of 2016 will test your long-term resolve and that is certainly normal. It's never a bad time to review your investment strategy, especially if you base your returns on what you need.

However, let's all resolve ourselves to not base our long-term investment strategy on Panic Selling.

We at Phillips and Company wish you and your family health, happiness, and prosperity in 2016. We look forward to working with you and your loved ones in the New Year.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.statisticbrain.com/new-years-resolution-statistics/

[ii] https://www.google.com/finance?q=INDEXCBOE%3AVIX&sq=vix&sp=6&ei=8eeKVpGbEcr2jAG6q5GwBQ

[iii] https://www.google.com/finance?q=INDEXCBOE%3AVIX&sq=vix&sp=6&ei=8eeKVpGbEcr2jAG6q5GwBQ

[iv] http://www.businessinsider.com/sp-500-relationship-between-5-year-returns-and-subsequent-12-month-returns-2015-8

[v] http://www.businessinsider.com/baml-panic-selling-vs-sp-500-returns-2015-8

[vi] http://www.businessinsider.com/baml-single-most-important-determinant-long-term-returns-sp-500-pe-2015-11

[vii] http://www.multpl.com/