Nimble, Humble, and Now Ahead of the Curve

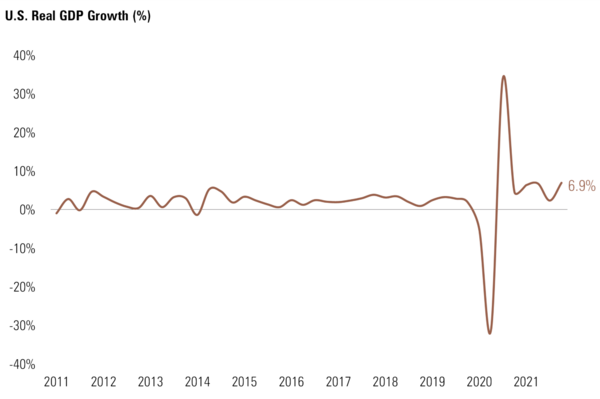

The U.S. economy painted an incredible growth picture in the fourth quarter of 2021, with GDP growing at a whopping 6.9%. 1

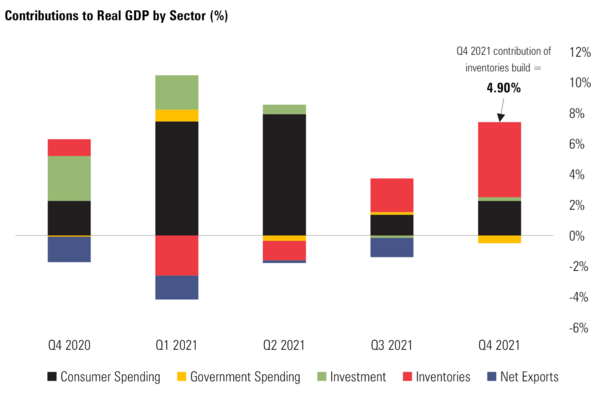

The headline is amazing but, it is what’s behind the headline that really matters. Of the 6.9% GDP growth, 4.9 % of that growth was driven by a massive rebuild in inventories. 1

It’s not likely the economy will get a boost from another round of inventory rebuild in Q1 2022.

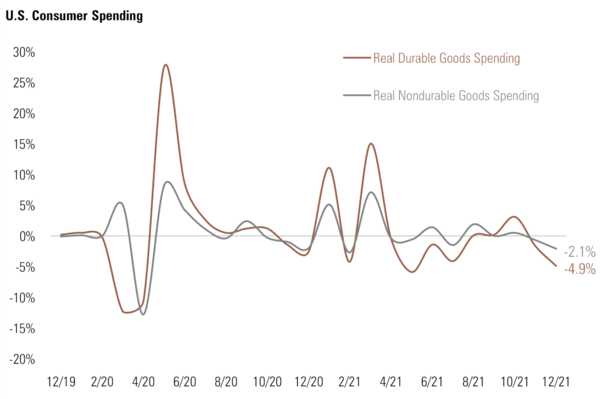

While the consumer did contribute the remaining growth to Q4 GDP, there are clear signs of weakening. From our friends at Moody’s, “Nominal U.S. consumer spending fell 0.6% in December. Real consumption was down 1%, the second consecutive monthly decline. Real durable goods spending was down 4.9% in December with sizable declines in motor vehicles/parts and furnishings/durable household equipment. Real nondurable goods spending also declined in December, falling 2.1%.” 2

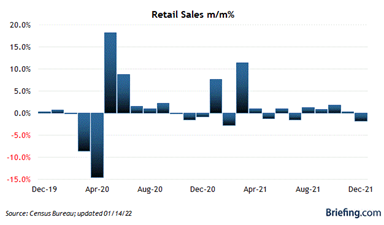

Further, retail sales in December came in much weaker than expectations, posting the first decline since July 2021. 3

Hold that thought and let’s pivot to the most recent comments by Fed Chair Powell.

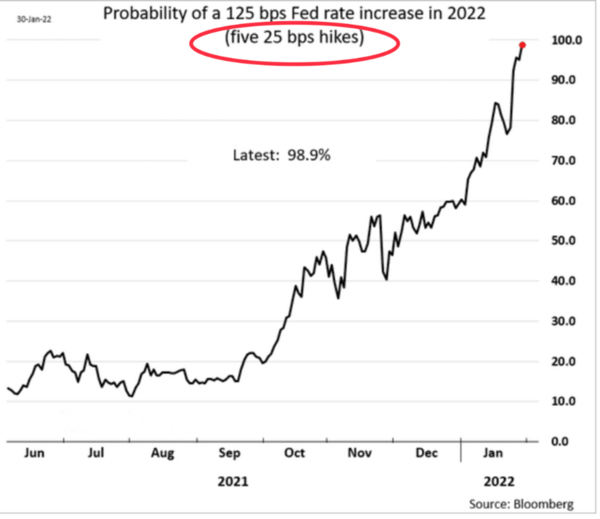

Powell clearly signaled that the taper was continuing and interest rate hikes were likely going to commence in March. In fact, the market has priced in five rate hikes in 2022. 4

Powell said the economy was much stronger now than in 2015 when the central bank last embarked on a rate rising cycle, noting soaring inflation that was “well above” the Fed’s 2 percent target and a robust labor market.

“These differences are likely to have important implications for the appropriate pace of policy adjustment,” he said.

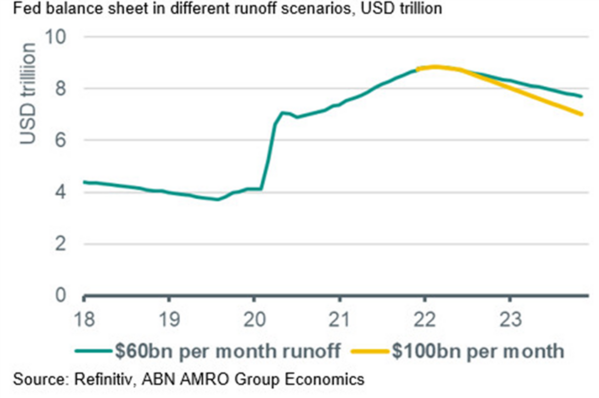

Further, the runoff of the massive Federal Reserve balance sheet will also commence this year. This is simply allowing the bonds the Fed holds to mature while not repurchasing more bonds. 5

Curiously, Chairman Powell added an interesting statement when asked about the path forward for interest rates. He stated, “And I stress again that we'll be humble and nimble. We're going to have to navigate cross-currents and actually two-sided risks now.”

Applying humility, in my opinion, is allowing lots of room to be wrong, to not know, or to be fallible.

While the Fed must press hard on rate increases and shrinking the balance sheet, they are incredibly skilled at creating room to adjust policy.

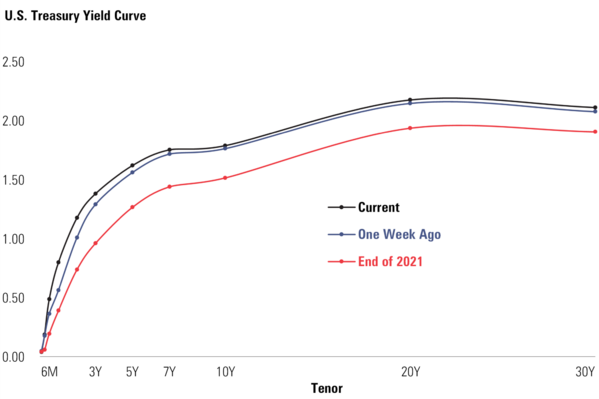

Perhaps that’s why the yield curve flattened last week even considering the loud drumbeat of rising rates. There is clearly weakness in the data and the consumer is showing some strain. 6

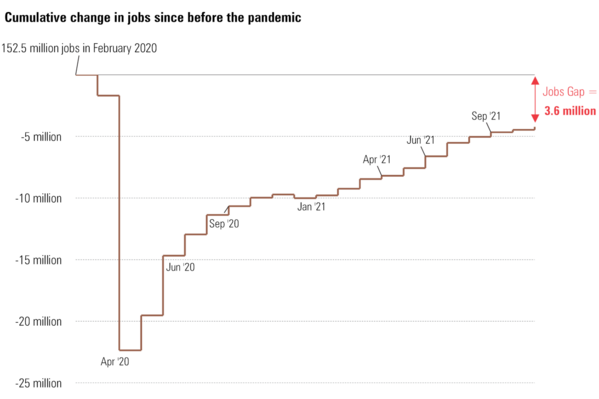

How many millions of U.S. workers are out of work related to Covid? It’s over 3.5 million. 7

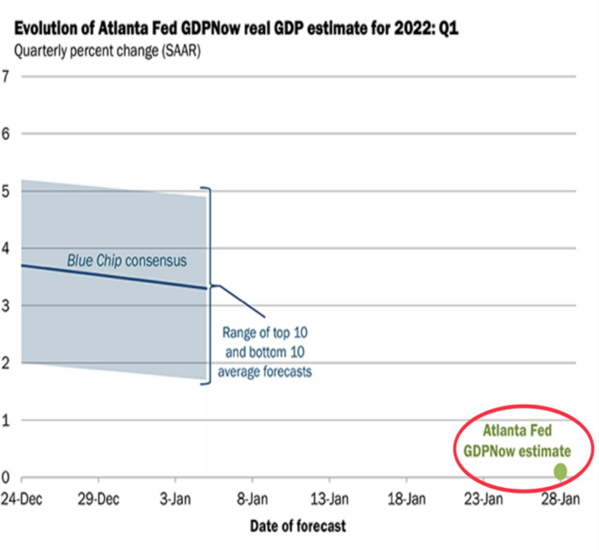

So, while the Fed is curbing growth by lifting rates and suspending bond purchases all in an effort to cool the economy, it’s quite possible the economy is cooling itself. Even the Atlanta Federal Reserve suggests Q1 2022 GDP growth will be almost flat, with the possibility that the economy could shrink in Q1 2022. 8

It’s my view the Fed has finally got ahead of the rate increase curve and we might see a lot of humility this year with fewer than five rate increases that markets are anticipating. All of that could be good for U.S. equities, notwithstanding the pain we need to go through with more volatility.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://www.bea.gov/data/gdp/gross-domestic-product

2. https://www.bea.gov/data/consumer-spending

3. https://www.census.gov/newsroom/press-releases/2022/annual-retail-trade-survey.html

4. https://dailyshotbrief.com/

5. https://www.abnamro.com/research/en/our-research/brace-for-a-march-fed-lift-off

6. https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

7. https://www.bls.gov/news.release/empsit.nr0.htm

8. https://www.atlantafed.org/cqer/research/gdpnow