Oil Again?

I know we have opined on the price of oil for the last couple of weeks and perhaps the topic is getting a bit tired. However, when the price of any asset class drops as precipitously as oil has, the topic merits continued examination.

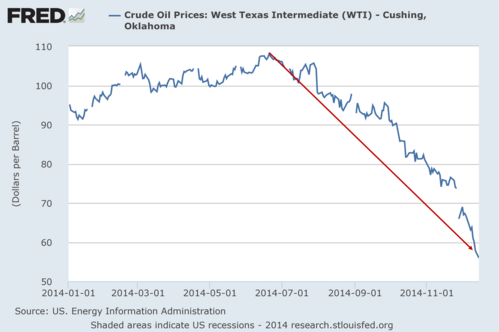

Those joyfully absorbed in the holidays perhaps haven’t realized the price of oil has dropped over 47% since June 20,2014.[i,ii]

I received an interesting chart from a well-respected CIO (Chief Investment Officer) this week, which put a bit of concern into my thinking.[iii]

On the face of this chart, one would surmise that the price of West Texas Intermediate Crude (WTI) is highly correlated to the S&P 500 and the divergence since mid-2012 merits a large correction within the S&P 500. Fortunately, we have other data that suggests this is not necessarily the case.

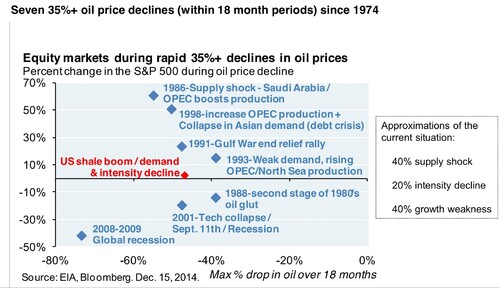

Our friends at JP Morgan presented an interesting perspective this week during an informative conference call I attended. When they examined past major drops in oil prices since 1974, 5 of the 8 episodes led to higher equity prices not lower.[iv]

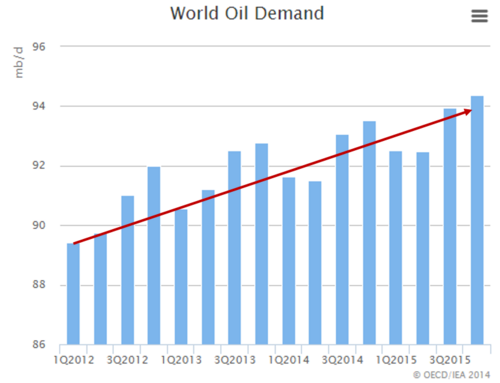

It really just depends on the circumstances associated with the drop. In the current case, it may be more of a supply shock than a precursor to a significant global slowdown. The International Energy Agency has reduced its outlook for 2015 global oil demand growth, but it is still projected to grow by 900,000 barrels per day and 2015 total demand is estimated above 2014 levels.[v]

What's comforting about the drop in oil is much of the price decline will find an equilibrium level. Here's why:

We know gas prices have dropped and that will motivate people to drive more, take trips, and buy larger cars. All of that is good for our economy.

Airlines will certainly benefit from lower jet fuel prices, driving lower fares and making trips more affordable for travelers. Perhaps this will be an impetus to buy more aircraft too. All of this is certainly good for our economy.

Manufacturers need oil for various parts of their process from inputs to energy for operating facilities. Energy savings will certainly benefit this cohort, which could lower prices to consumers and more importantly offset our rising dollar. This could help our manufactured goods to compete overseas in spite of a strong dollar.

During my visit to Houston and Dallas a few weeks ago to explore energy investments, it was abundantly clear to me that the largest oil and gas producers were ready to benefit from more competitive service contracts from their vendors. As oil prices dropped, so did the demand for vendor services, helping oil companies to lower their extraction costs.

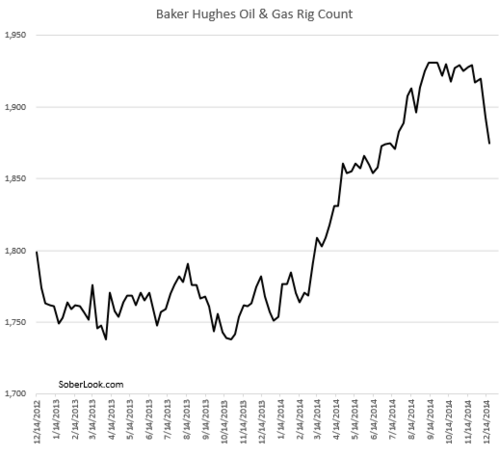

Further, if need be, energy companies can "lay down" rigs and shrink supply, which is exactly what's happening right now.[vi]

You get the point. Like other ecosystems, the energy sector has a self-correcting system that can help stabilize its pricing and profits.

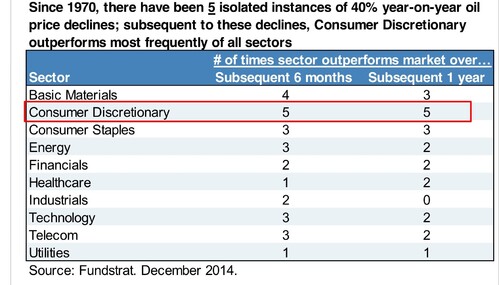

Further, there are some very strong indications from other areas of our economy based upon lower oil prices. Again from our friends at JP Morgan, sectors such as Basic Materials and Consumer Discretionary can benefit from the decline in oil prices.[vii]

One thing to note during this rapid decline in prices is the impact on high yield bonds. Currently energy debt comprises about 18% of all high yield bond issuance.[viii] The follow-on effect of a large drop in oil prices (shown in red) has caused investors to panic as it relates to energy debt and as a bystander, high yield debt in general (shown in blue).[ix]

While I don't think anyone, especially me, can predict macro events, I am quite comfortable in suggesting that panicky investors generally overreact and sell, which creates a buying opportunity for others.

That's certainly been the case with MLPs (Master Limited Partnerships) to some extent, which is a position we have maintained in most of our allocations. While MLPs benefit from volume of oil not pricing, they too have been hit fairly hard. We expect rational thinking to return to the market. Unfortunately, markets and participants can act irrationally much longer than I have ever expected. We will certainly be examining this sector very closely for opportunities to add to our current allocations in the coming quarter.

On behalf of the entire Phillips & Company team, we want to wish you a very happy holiday and a healthy and prosperous 2015. We are grateful for your gift of trust and confidence and don't take that precious gift lightly.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Federal Reserve Economic Data. (Dec 22, 2014). Crude Oil Prices (WTI).

[ii] Oil-Price.net. (Dec 22, 2014). WTI Crude Oil.

[iii] ZeroHedge.com.

[iv] Cembalest, M. and Pil, A. (Dec 16, 2014). The Shifting Landscape of Global Oil Markets and Implications for Financial Markets. JP Morgan. p 15.

[v] IEA. (Dec 12, 2014). World Oil Demand.

[vi] Soberlook.com. (Dec 19, 2014). Baker Hughes Oil & Gas Rig Count.

[vii] Cembalest, M. and Pil, A. (Dec 16, 2014). The Shifting Landscape of Global Oil Markets and Implications for Financial Markets. JP Morgan. p 16.

[viii] Fox, M. (Dec 3, 2014). Huge Opportunity in high-yield bond market: Pro. CNBC.

[ix] Hanlon, S. (Dec 16, 2014). Oil’s Price Decline Weighs On High Yield Debt. Forbes.com.