One Foot on the Gas and One Foot on the Brake

It’s a difficult task as an investor to allocate capital when we are in the midst of so much interest rate uncertainty. The formula is pretty straight forward for equity investors. We want a premium return over the risk-free rate (10-year Treasury). Everyone might want something different in excess, but we all suffer the same when we don’t know where the terminal point is on the 10-year Treasury.

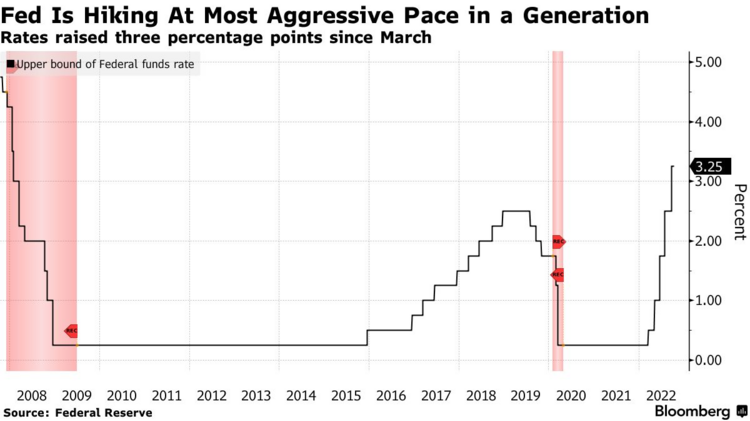

Currently, the Fed has its foot firmly on the economic brake by raising interest rates at a rapid pace. 1

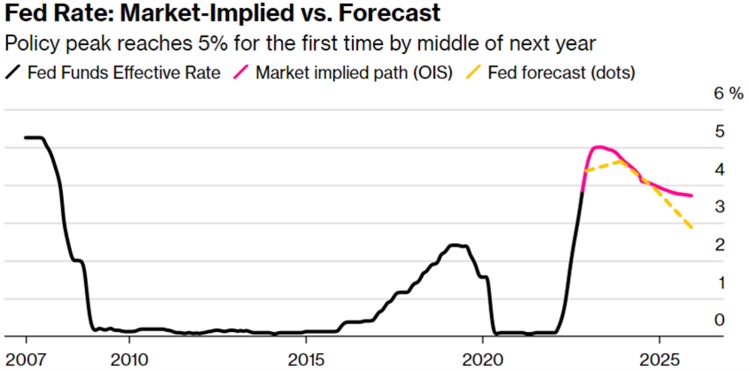

Further, investors are expecting the Fed Funds rate to peak out at around 5%.

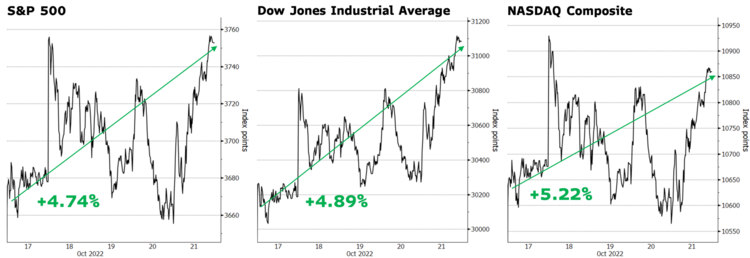

It’s hard to reconcile last week’s strong market rally with so much ongoing uncertainty. 3

Additionally, the fact is that the U.S. Government (along with many others around the world) still has its foot on the economic growth gas pedal with fiscal policy. No, there is not a major giveaway to consumers, other than the proposed student loan forgiveness program that is anticipated to generate up to $240 billion of stimulus.

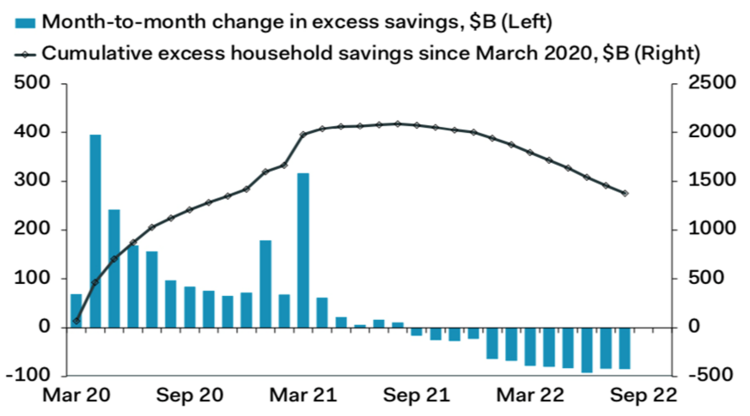

The foot on the gas pedal I am talking about is the residual impact of the over $5 trillion in fiscal stimulus that is still weaving its way through the U.S. Consumer. 4

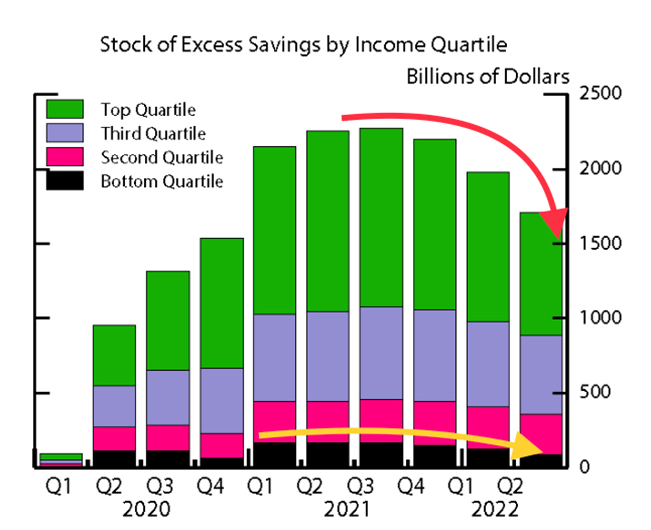

All of that excess is currently sitting in savings accounts and is approximately $3.25 trillion or 12.9% of GDP. 4

The consumer has been spending down their precautionary savings, but it’s clear there is a long way to go before they hit rock bottom. 5

Understanding who has the stockpile of cash matters a lot. A recent Fed paper discusses those breakdowns. It’s pretty clear the bottom income quartiles are spending down, but the upper 50% of income earners is still sitting on a stockpile of cash.

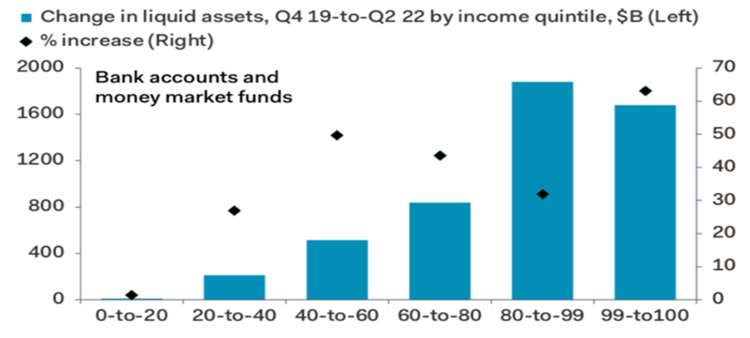

Breaking down the income to quintiles provides an even better granular look at who’s hoarding the bulk of the cash. It’s certainly not the bottom two quintiles. Not surprisingly, they have spent down their savings. Perhaps to pay down debt, pay for inflated food, gas, and rent, or buy better toys.

The upper two quintiles (and the 1%) would appear to be holding the largest amount of cash. Collectively they have about $4.4 trillion in reserves. 4

The core of the inflation debate may not be just supply chain issues, which are abating, but the supply of cash. It’s likely going to take the third quartile six months to return to normal levels at the current spending trajectory.

That will likely keep inflation a little higher than the Fed wants, but they are fighting with their own partner’s fiscal policy behavior: The U.S. Government.

As it relates to the upper quartile or quintile and the 1%, much of that savings will likely never find its way into traditional consumption patterns. In most cases this money will not be inflationary to the real economy, but likely flow back into stocks, bonds, and real estate. That’s approximately $780 billion that could reinflate equities according to the chart above.

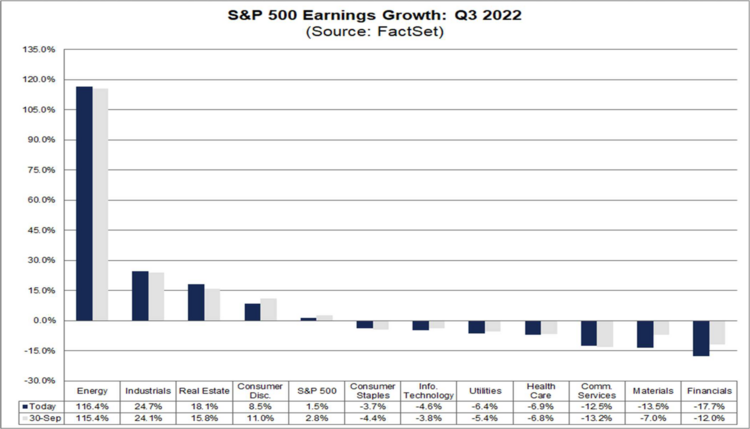

It’s possible that’s exactly what drove the rally last week; upper quartile money finding a home in the form of U.S. equities. While it could be corporate earnings, the fact is there is plenty of top quartile cash not wanting to miss out on returns – especially if they believe an end is near to the rate increase cycle. 6

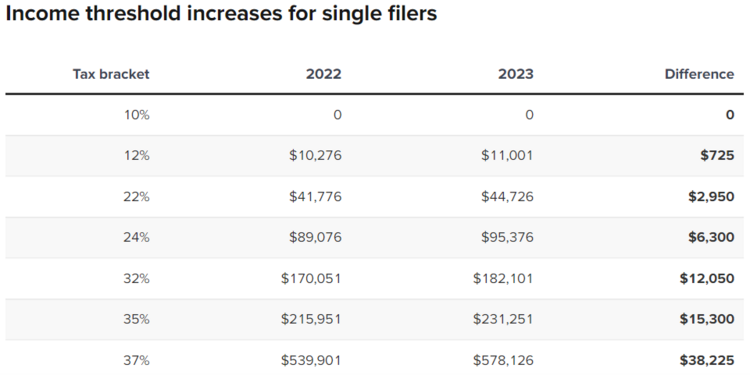

So how long will the Fed keep their foot on the brake and the consumer keep their foot on the gas? A lot depends on the middle-income cohorts’ spending patterns. A lot also depends on any more fiscal stimulus that can find its way into the economy. Student loan relief is one and the inflation-adjusted tax brackets are another. That’s right, you might get a tax cut as income brackets are set to increase substantially next year; conversely you might pay less tax on the same income. 7

It’s my view that there will likely be little chance the Fed can return to the 2% target inflation rate any time soon. However, the target might look more like 4% if they don’t want to devastate the economy. The Fed will have to blink.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/news/articles/2022-10-14/fed-s-george-warns-of-risks-of-moving-too-fast-on-rate-hikes

- https://www.bloomberg.com/news/articles/2022-10-20/fed-swaps-briefly-price-in-5-peak-for-policy-rate-in-2023

- Bloomberg

- https://www.pantheonmacro.com/

- https://www.federalreserve.gov/econres/notes/feds-notes/excess-savings-during-the-covid-19-pandemic-20221021.html

- https://insight.factset.com/topic/earnings

- https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023