One Step Forward, Two Steps Back

As expected last Wednesday, the Fed removed the word “patient” from its interest rate policy statement, moving us one step closer to potential interest rate increases, perhaps as soon as the Fed’s June meeting. However, the Fed will still be cautious and consider the merits of a rate increase on a meeting-by-meeting basis. While speaking about normalizing interest rates, Fed Chair Janet Yellen stated,

“Just because we removed the word ‘patient’ doesn’t mean we are going to be impatient.”[i]

The Fed effectively took two (or more?) steps back as it highlighted several concerns about the U.S. economy and lowered its estimates for annual GDP and the year-end interest rate level. This led the market to rally, as it interpreted these cautions as a sign that a rate hike may not materialize until at least September and would be smaller than previously expected.[ii]

The Fed’s economic concerns included topics we’ve discussed previously: employment, the strong dollar, and declining inflation.

In addition, economic growth in 2015 Q1 has slowed to about half the pace of the 3.75% annualized growth rate reported in the second half of 2014.[iii] One cause is a decline in U.S. exports due in part to the strong dollar, which makes U.S. goods more expensive in foreign markets.[iv]

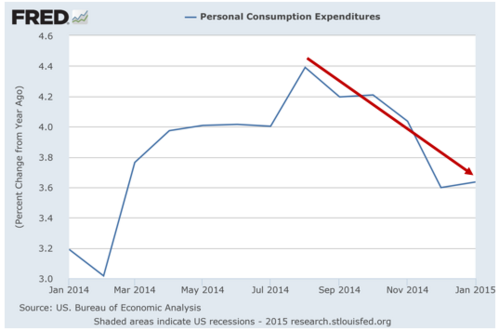

Here at home, the Fed noted weaker than expected consumer spending despite the benefits of low energy prices, low interest rates, and improved employment. The growth rate for personal consumption has been falling since last August.[v]

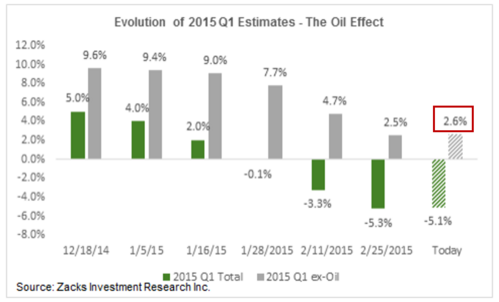

The sharp decline in Q1 earnings growth estimates reflect the slowdown in the economy and the impact of the strong dollar. Even excluding the Energy sector, whose earnings have been negatively impacted by low oil prices, the Q1 earnings growth estimate for the rest of the S&P 500 is at just 2.6%.[vi]

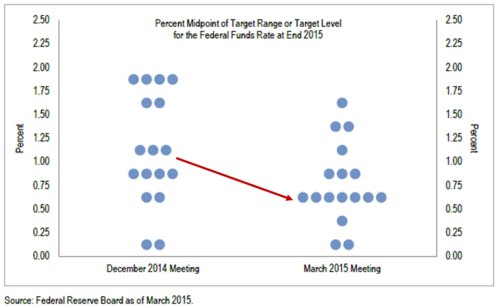

Based on the weak data, the Fed reduced its 2015 GDP growth expectations by 30 basis points to a range of 2.3% to 2.7%.[vii] In addition, the median year-end 2015 interest rate projection from the Fed Board Members declined from around 1% to 0.5%.[viii] The Fed Funds Rate is currently at 0.12%.[ix]

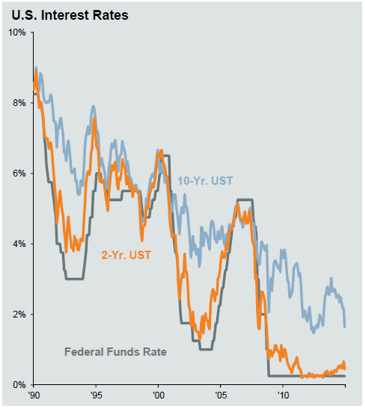

While the Fed removed the last technical hurdle to an interest rate increase by changing the language of its policy statement, it does not want to risk stalling the economy by raising rates too soon. Until there’s a change in the current economic growth and inflation trends, a significant change in interest rates is doubtful. The upshot for investors is that interest rates appear likely to stay low longer than expected.

Even when the Fed Funds Rate is eventually increased, JP Morgan noted that longer-term rates are less sensitive to Fed tightening than short-term rates.[x]

The negative rates in Europe will also drive demand for U.S. Treasuries from foreign investors and help to keep U.S. interest rates down.

Based on the current economic data and the Fed’s positioning, we are:

- Targeting duration of around 5 years for fixed income, perhaps moving a little higher if economic data continues to show weakness.

- Overweight countries that benefit from the stronger U.S. dollar through exports.

- Tilting to U.S. small-cap stocks that are more domestically oriented versus U.S. large-cap’s that are dependent on exports.

- Keeping an eye on large multinationals for the impacts of currency and consumer spending on corporate earnings as the Q1 reporting season begins in April.

- Monitoring for a weakening dollar that could push us back into a stronger tilt to U.S. large-caps.

- Watching for signs of stronger consumer spending and GDP growth.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Jeff Paul, Senior Investment Analyst – Phillips & Company

Tim Phillips, CEO – Phillips & Company (Editor)

References

[i] Lee, D. (Mar 18, 2015). Fed moves toward raising interest rates – but the when is unclear. LA Times.

[ii] Google Finance. (Mar 20, 2015). S&P 500.

[iii] Lee, D. (Mar 18, 2015).

[iv] TradingEconomics.com. (Mar 20, 2015). United States Exports.

[v] Federal Reserve Economic Data. (Mar 20, 2015). Personal Consumption Expenditures.

[vi] Mian, S. (Mar 19, 2015). Zacks Earnings Trends: 3 Things to Know About Q1 Earnings Season. Zacks.

[vii] Lee, D. (Mar 18, 2015).

[viii] Goldman Sachs. (Mar 23, 2015). Market Monitor.

[ix] Federal Reserve Bank of New York. (Mar 20, 2015). Federal Funds Data.

[x] Kelly, D. (Mar 18, 2015). The Investment Implications of Fed Tightening. JPMorgan Asset Management.