Our Immediate Future

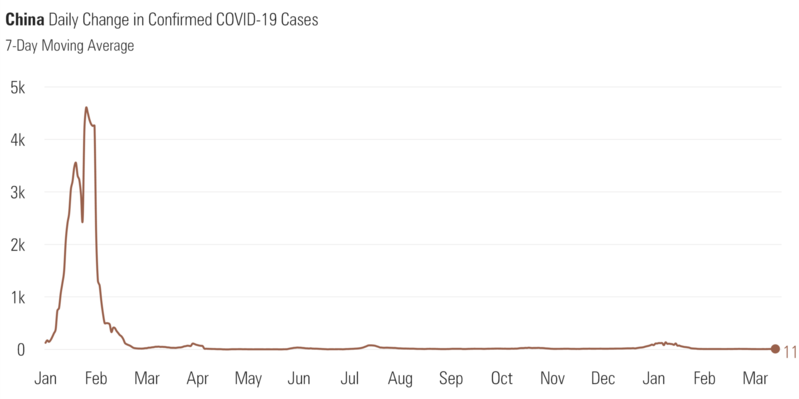

Since February 2020, China has been leading the way in the recovery from COVID-19 and economic re-opening. New confirmed cases of COVID-19 in Mainland China have been near zero since the beginning of February. [i]

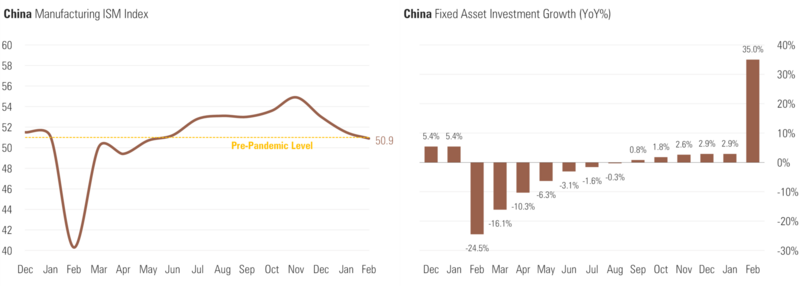

China has achieved a post-pandemic recovery in most areas, including manufacturing and fixed asset investment (capital spending). [ii] [iii]

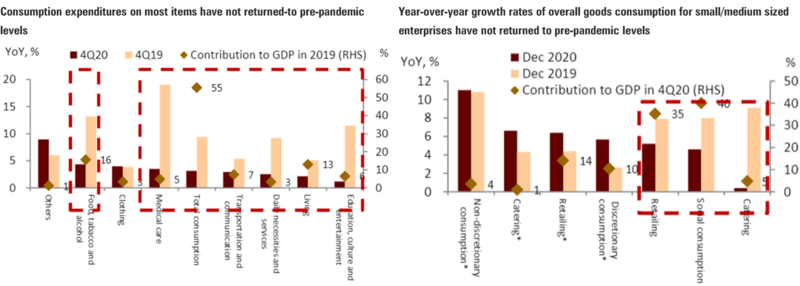

A couple of major laggards in the recovery have been the services sector and small/medium-sized business (SMEs). [iv]

The People’s Bank of China has indicated they will be cautious about adding additional stimulus into the economy but, remain supportive. [v]

“As the economy resumes growth, we will make proper adjustments in policy but in a moderate way…Some temporary policies will be phased out, but we will introduce new structural policies like tax and fee cuts to offset the impact.”

China’s premier, Li Keqiang, March 1st

That “return to normal” statement has led market participants to take profits and create a correction in Chinese equity markets. [vi]

China has been out in front of COVID for more than a year, opening up their economy and perhaps giving us a glimpse into our future as we look forward to a more organically-grown economy versus one being injected with monetary and fiscal steroids. As for our immediate future, a modest pullback in the U.S. equity market might also be in store, similar to China’s lead.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/coronavirus

ii. https://www.caixinglobal.com/index/

iii. https://tradingeconomics.com/china/fixed-asset-investment

iv. https://research.cicc.com/

v. https://www.wsj.com/articles/china-becomes-first-major-economy-to-start-withdrawing-pandemic-stimulus-efforts-11615730401

vi. https://www.bloomberg.com/markets/regions/asia-pacific