Patience

As the year progresses, the economic forecasts of Federal Reserve Banks and economists suggest the U.S. economy is experiencing a significant downshift in growth.

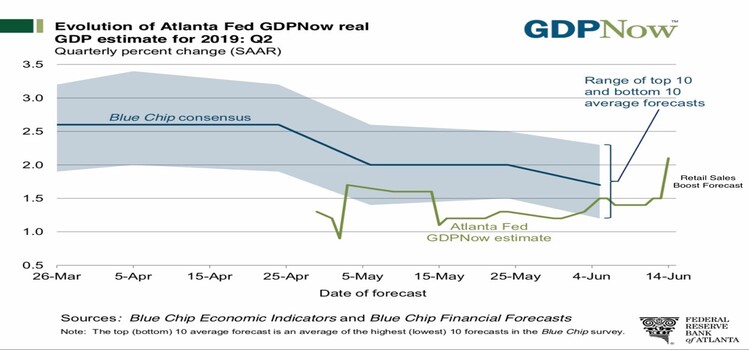

In an example of a more enlightening forecast, the Federal Reserve Bank of Atlanta’s GDPNow forecast suggests that economic growth in Q2 could be as low as 1.5%. It is important to note these negative estimates came out before the May retail sales figures reported on Friday, improving to 2.1%. [i]

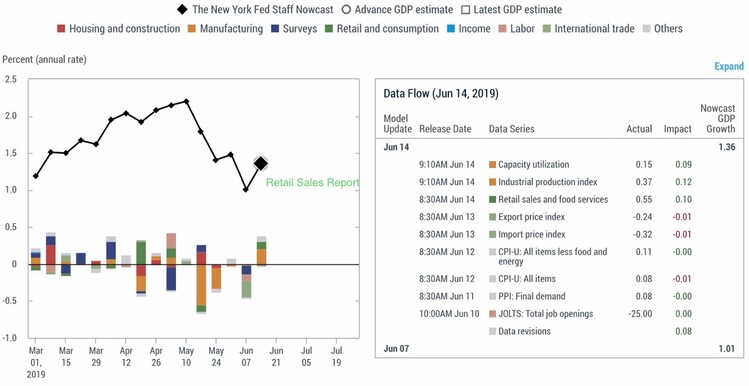

But despite the strong retail sales growth, Federal Reserve Bank of New York estimates the U.S. economy will grow a meager 1.36% in Q2. [ii]

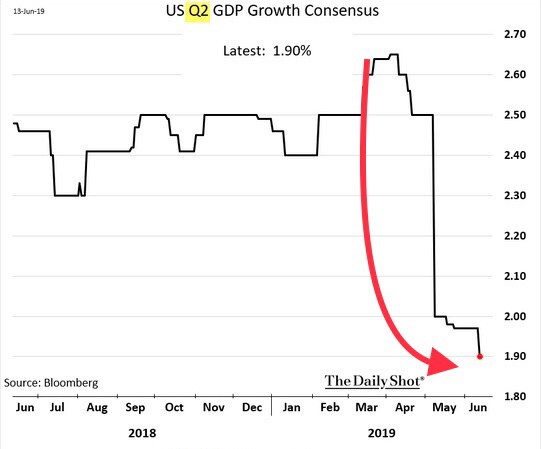

Bolstering the more promising outlooks, Bloomberg's economist survey concluded the economy could see growth of only 1.9% in Q2. This would represent a large downshift from the impressive growth facilitated by the tax cuts in 2018. [iii]

The one bright spot, and it’s no small matter, is the strong retail sales report in May. Actually, the May report was a modest 0.05% growth but the April revision went from a decline of 0.02% to an increase of 0.03%. Despite this being a modest growth in retail sales, when compared to the declining retail sales in five of the last 10 months, May's growth comes as very welcomed news; the upward shift in recent months has instilled hope of continued progress. [vi]

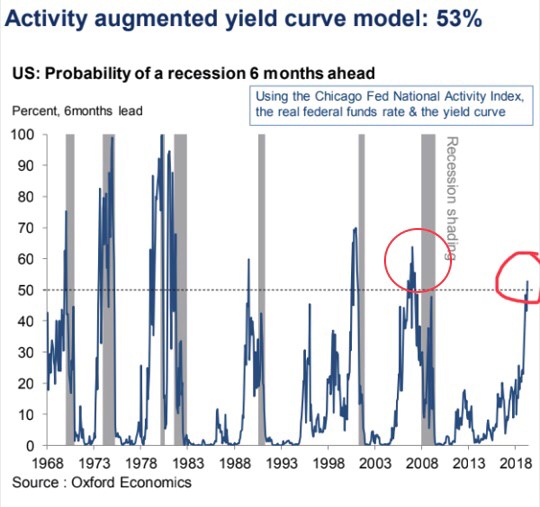

Nonetheless, the risk of a U.S. recession hitting in the next six months has risen substantially in 2019. Concerningly, the U.S. hasn't seen a risk of recession this high since before the financial crisis in 2008. [iv]

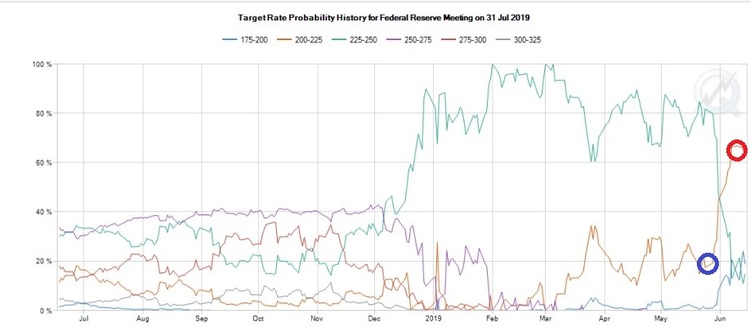

In light of these pessimistic estimates, the Federal Reserve will most likely soften their language surrounding interest rates during rate-setting meetings this week. Thus, their language in reference to a more "patient" strategy will be censored, with estimates suggesting there is around an 85% chance we get a rate cut in July (demonstrated by the increase from the blue circle to the red). [v]

Considering this, I believe the Fed has lost its patience with trade-related weakness in the economy, as well as downshifting inflation. As a result, rate cuts might help consumers spend more and support equity prices until we get back into an earnings growth mode later in the year.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Resources:

i. https://www.economy.com/dismal/indicators/releases/usa_retail/United-States-Retail-Sales

ii. https://www.frbatlanta.org//media/documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf

iii. https://blogs.wsj.com/dailyshot/2019/05/21/the-daily-shot-economists-downgrade-u-s-gdp-growth-estimates/

iv. https://fred.stlouisfed.org/series/CFNAI#0

v. https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

vi. Bloomberg