Perpetual Money

As the U.S. economy creeps towards a round of rate cuts, I think it’s important to take a step back and look at what is going to happen to all the money on the sidelines.

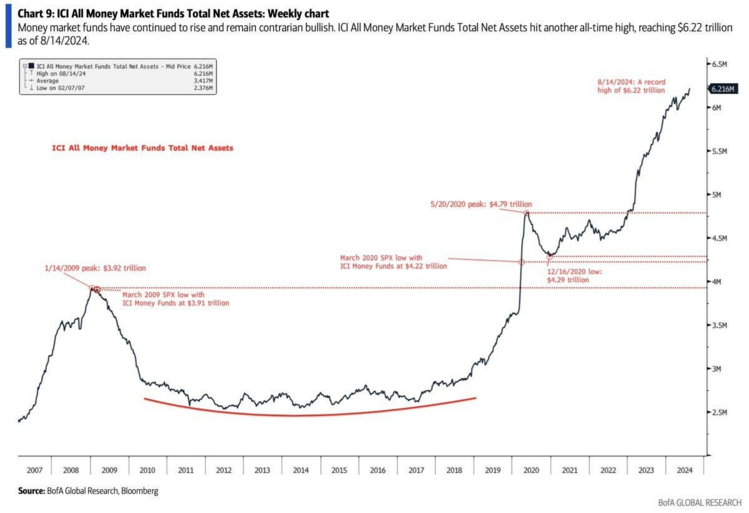

Right now, money markets are sitting on a record $6 trillion. 1

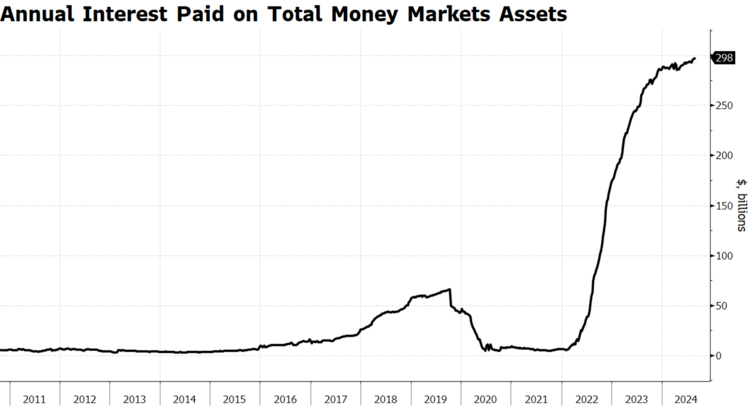

The allure of higher yields on cash has prompted investors to stockpile resources in these interest-bearing accounts. Recently, they've been offering about 5% on average – that translates to a whopping $298 billion in annual interest. Keep in mind, most money market accounts hold a substantial portion in U.S. Treasuries. 2

If savers went out and spent that amount of cash, they would inject another 1.1% of GDP growth into the economy. Let’s not mention what would happen if they poured that into U.S. equities (which is not likely) as these assets are probably assigned less risk.

The common refrain is when interest rates get cut, that $6+ trillion will see a rotation. But not so fast. I believe it hinges on where the Fed ultimately lands. Looking at the bowl-shaped trend in money markets balances between 2010 and 2019 in the chart above, we were hovering at or near zero interest rates.

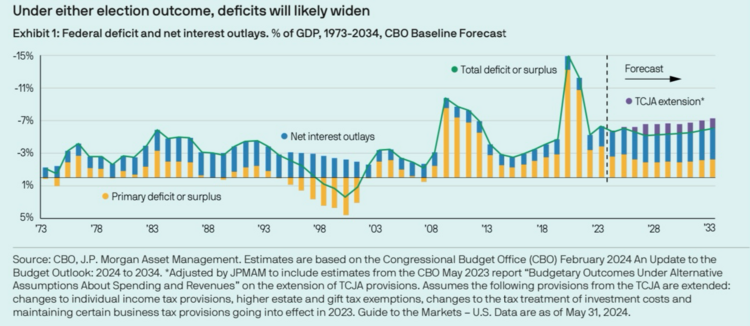

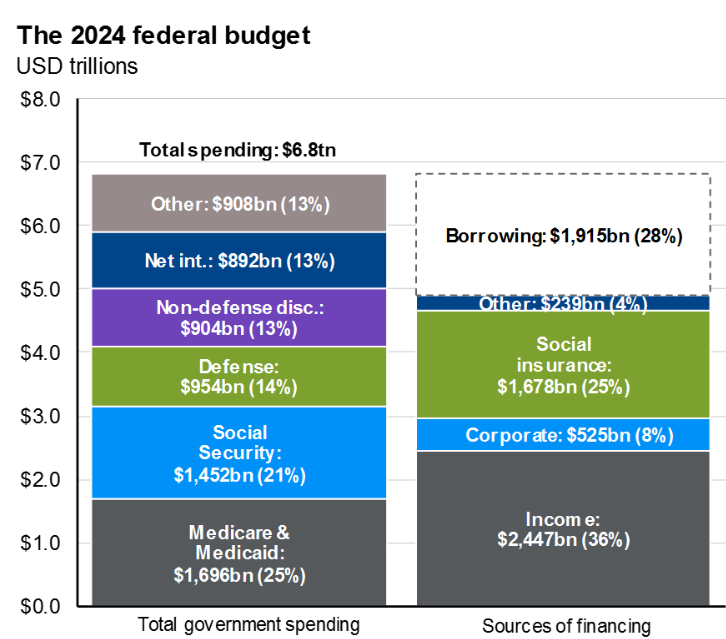

I don’t think that’s in the cards without a crisis. This is primarily due to the simple fact that in any likely election scenario, we're looking at expanded federal spending and widening deficits. 3

The blue bar in the chart above indicates that interest outlays (what the U.S. government must pay in interest) will continue to surge. We've just surpassed the $1 trillion mark in interest payments. 4

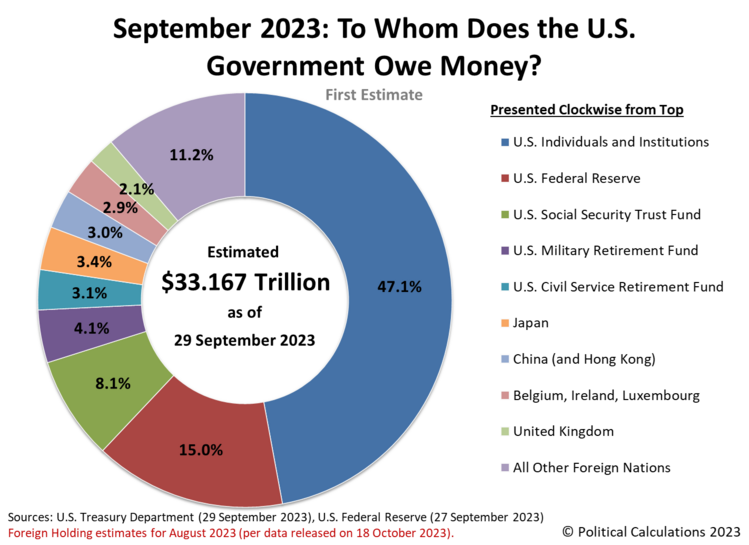

So who is receiving those interest payments? 47% are going to U.S.-based holders, both individual and institutional. That’s something like $470 billion. 9.3% are going to Japan, China, and Belgium which is a buyer for various nations that do not want to be known (aka China). In fact, 22% of our entire debt is held by foreign nations. 5

Let’s take this one step further. Given that federal budget deficits are projected to widen by a staggering $2+ trillion annually, market rates will need to be sufficiently attractive to draw in buyers.

It’s anyone’s guess where rates are going to land, especially if the Federal Reserve is willing to be a buyer of last resort for our fiscal deficits. 3

I suspect a Fed Funds rate of 4%. My math is simple. To effectively manage inflation and maintain full employment, you need a rate that addresses both wage growth and worker productivity. With wage growth at 2% and productivity growth at 2%, a 4% Fed Funds rate emerges as a logical target.

If the Fed Funds rate settles at 4%, we can expect money market rates to hover near that level, still generating about $250 billion in interest payments circulating through the economy. 2

For savers, this scenario means a substantial pool of cash available for both consumption and investments. The perpetual cash machine appears well-positioned to continue generating a steady stream of dollars.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/MikeZaccardi/status/1826560809935233405

- Bloomberg

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-themes/us-elections/

- https://www.visualcapitalist.com/u-s-debt-interest-payments-reach-1-trillion/

- https://politicalcalculations.blogspot.com/2023/11/september-2023-snapshot-of-who-owns-us.html

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.