Picking The Loser

It’s becoming abundantly clear to me that the Federal Reserve might just have to pick the economic loser in this interest rate cycle. Picking winners and losers is dangerous business when it comes to public policy but that’s the game. When it comes to the Fed picking winners and losers, it can be disastrous.

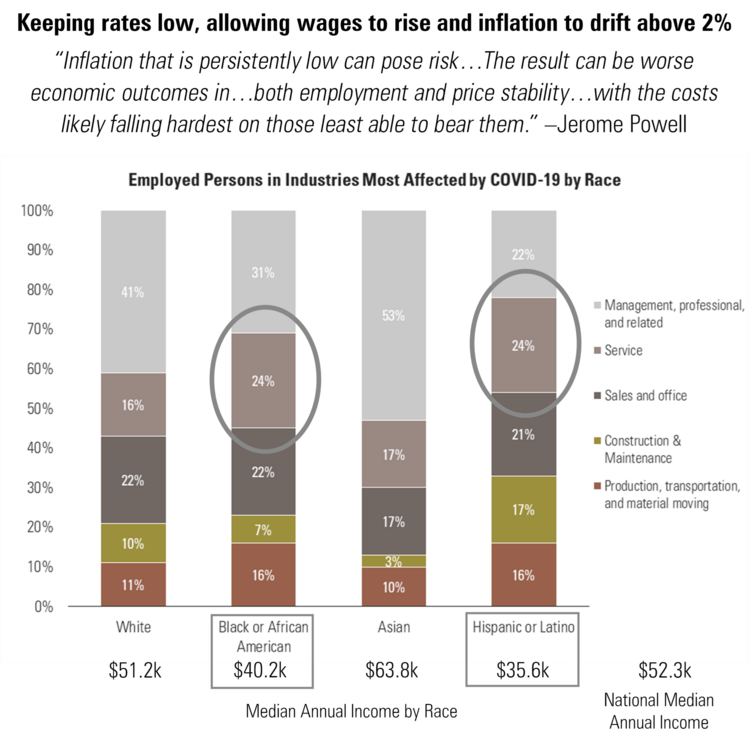

Let me take you back to Covid and the George Floyd moment (May 2020). We all should recall the video of the police brutality that took place in Minnesota against George Floyd. The national outrage was palpable and widespread. Many institutions wanted to express their outrage and declare a purge of systematic racism. The Federal Reserve was no exception and had the power to do something to lift wages, especially for minorities including African Americans.

On August 27, 2020, Fed Chair Jerome Powell made the following statement. This is from our Q4 2020 Look Ahead. 1

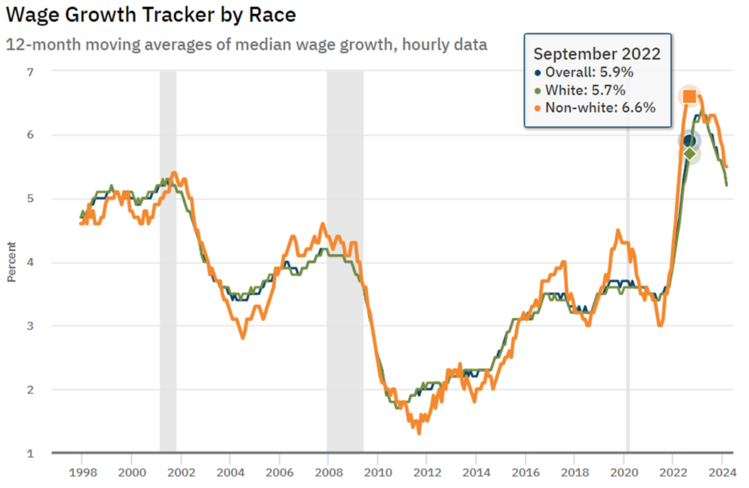

Mission accomplished. By keeping interest rates much lower for longer the Fed was able to manufacture a lift in wages across the board and especially for minorities. 2

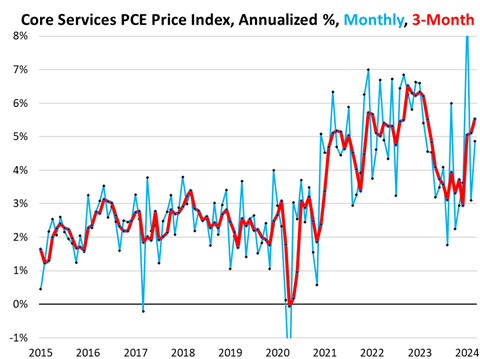

With lower interest rates for longer, we had much more price and wage inflation in the services sector and those are the industries non-whites have large exposure to. 3

That’s history. Whether intentional or reactionary, the Fed was able to lift non-white wages by keeping interest rates lower for longer.

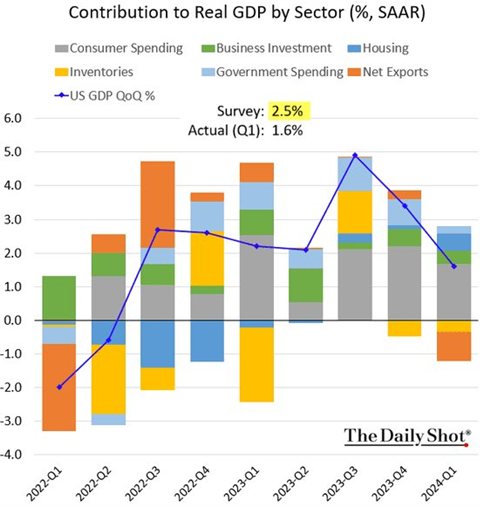

The Fed is now fighting the result of their “lower for longer” interest rate social engineering project with “higher for longer” interest rates. Persistent inflation is going to force the Fed to pick an economic loser from their “higher for longer” interest rate regime. The loser could be the investor class like many of us. It could come in the form of job losses and that would certainly impact those in the service sector.

Although consumers have not cut discretionary spending on services at this point, they will with higher-for-longer rates. 4

Or it could come in the form of a housing recession. While housing supply has been constrained for the last several years those trends look to be changing – especially for new homes. The supply of new homes is the highest it’s been since the Great Financial Crisis. 5

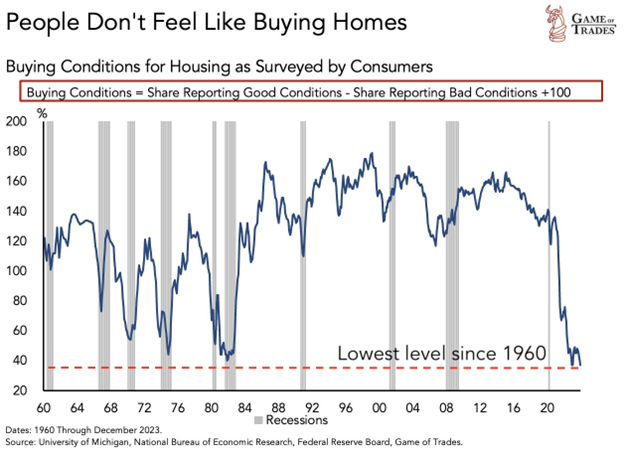

Further, the overall mood of the consumer is also at extremely low levels when it comes to their desire to buy homes. Certainly, driven by higher-for-longer interest rates. 6

To their credit, the homebuilding industry has found new and innovative ways to deal with higher-for-longer rates, supply chain constraints, and lead times. I am not convinced homeownership trends are going to break easily.

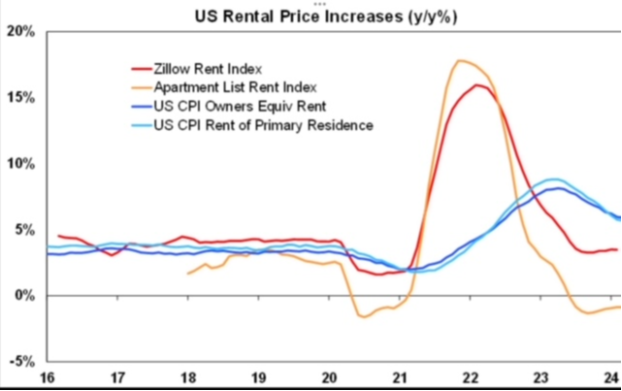

So, who do I think the loser will be in this interest rate cycle? The Fed is going to lose. They are going to cut rates even with sustained inflation over 2% especially when they know their housing inflation index is flawed. When you strip out housing from the index you get inflation below 2%. 3

The Fed is going to lose either their credibility or its flawed measurement of housing inflation. When the Fed chose to get into the winners and losers business, they already lost.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm

- https://www.atlantafed.org/chcs/wage-growth-tracker

- https://wolfstreet.com/2024/04/26/feds-wait-and-see-on-rate-cuts-further-supported-by-extra-hot-core-services-pce-inflation-hot-core-pce-inflation/

- https://thedailyshot.com/2024/04/26/the-us-downside-gdp-surprise-masks-robust-underlying-growth/

- https://fred.stlouisfed.org/graph/?g=1lix1

- https://x.com/GameofTrades_/status/1773757582009929915