Pivot Point

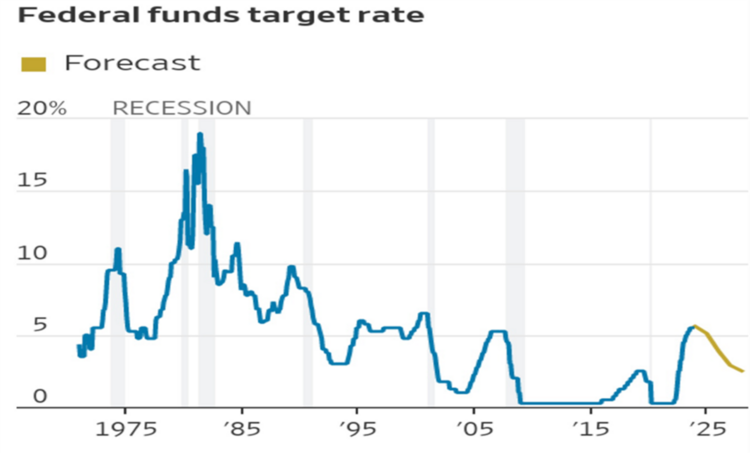

In a consequential week of economic reports, the Federal Reserve signaled an end to the rate hike cycle we’ve been in for over a year.

While Fed Chair Powell didn’t explicitly say rate cuts were guaranteed, the nuance was pretty clear.

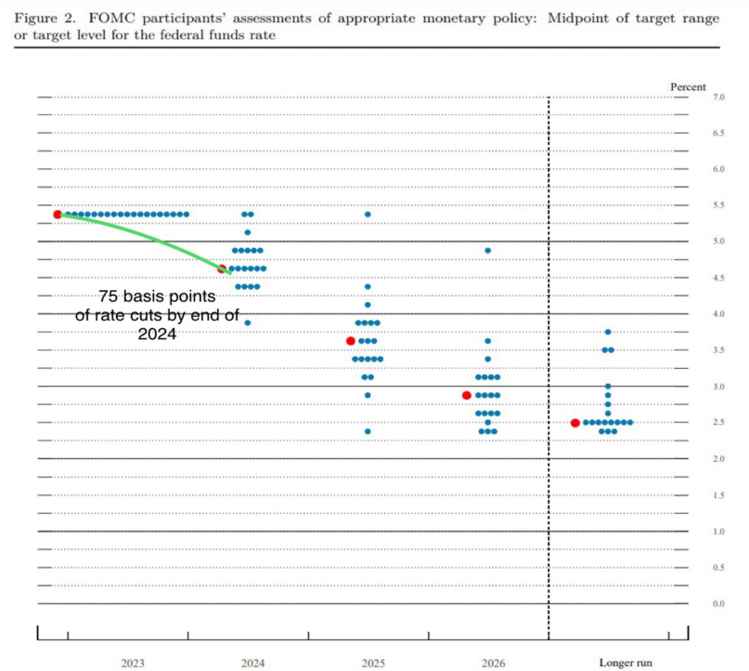

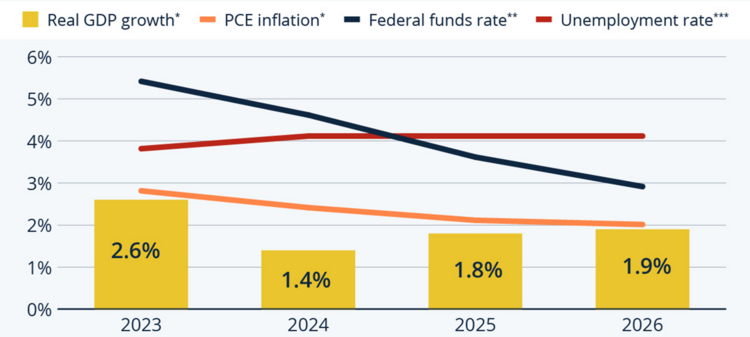

According to the those that participate in setting interest rate policy, the consensus says the end is upon us. Here are their projections for the coming years. You can see policy makers are anticipating 75bp of rate cuts next year. 1

The Chair Powell commented on the dot plot (above), saying: 2

“… we believe that we are likely at or near the peak rate for this cycle. Participants didn’t write down additional hikes that we believe are likely, so that’s what we wrote down. But participants also didn’t want to take the possibility of further hikes off the table.”

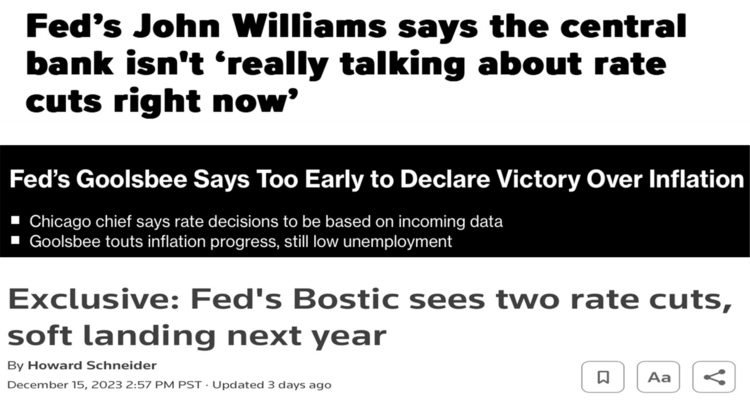

Based upon recent headlines, the dot plot does not reflect the disparity amongst voting members.

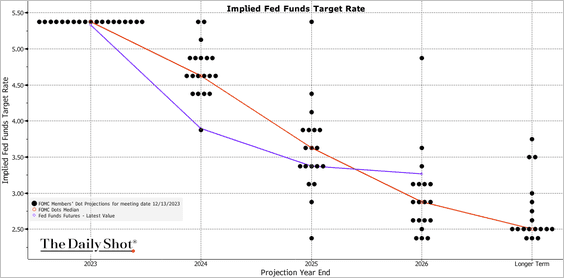

Interestingly, market participants showed some different cards when futures markets priced in much deeper cuts to rates coming. Fed Funds Futures (purple line) suggest the rate will end 2024 at 4.75%, much lower than those setting the policy rate (red line). 3

It’s entirely possible investors understand the history of rate cuts and know when the Fed cuts rates it’s not a gradual process. 3

It’s also possible investors are speculating on a much harder landing that will require more rate cuts compared to what the Fed expects. The Fed’s expectations are for continued modest GDP growth, softening inflation, and only a modest increase in unemployment. 4

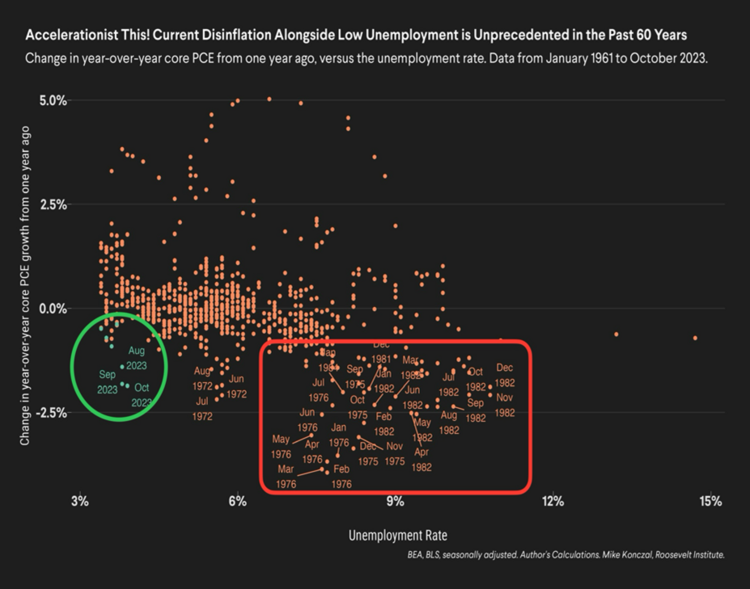

To get to six rate cuts in 2024 vs. the Fed’s targeted three (assuming 25bp per rate cut) would require a much more dour forecast than what the Fed is calling for. Again, it’s not typical to see rate cuts without much higher unemployment. 5

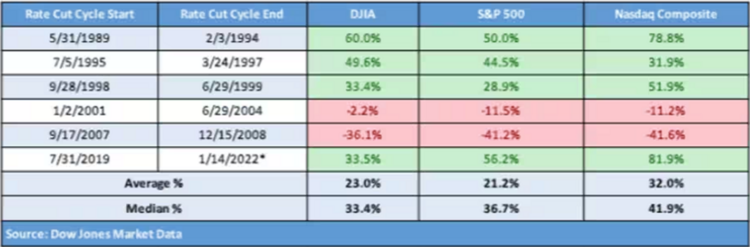

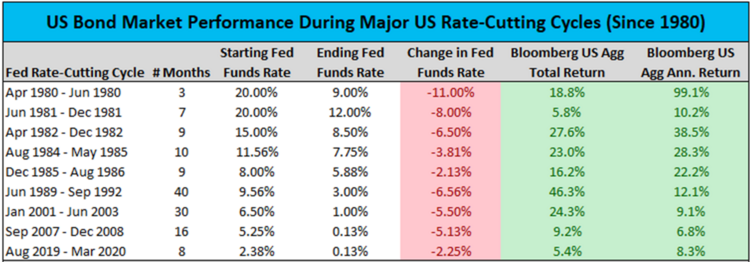

While there will be ongoing tension between what the Fed and investors expect, rate cuts can be great for investors. Let’s not lose sight of that part of the pivot.

Equity Returns During Rate Cut Periods6

Fixed Income Returns During Rate Cut Periods 7

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20231213.pdf

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20231213.pdf

- https://thedailyshot.com/

- https://www.statista.com/chart/31437/fed-projections-of-inflation-interest-rates-gdp-growth-and-unemployment

- https://twitter.com/mtkonczal/status/1730221086304850207

- https://www.cmegroup.com/openmarkets/finance/2022/A-Historical-Look-at-Equities-During-Rising-Rate-Environments.html

- https://x.com/charliebilello/status/1720801398969754006?s=20